Tax-free savings accounts have become very popular investment vehicles since their introduction in 2008. Indeed, 48% of Canadians, or almost one out of every two adults, have a TFSA, according to a recent survey completed for Bank of Montreal (BMO) by market research firm Pollara.

And yet not only are Canadians unfamiliar with the range of investment vehicles that can go into a TFSA -- only 11% correctly identified the six types of investments that are eligible for inclusion -- the vast majority prefer to be in cash or guaranteed investment certificates. The survey found that cash is the most common instrument held in TFSAs, at 57%, followed by 23% in GICs, 25% mutual funds, 14% stocks and 5% exchange-traded funds. (The figures add up to more than 100%, since some Canadians hold several asset classes).

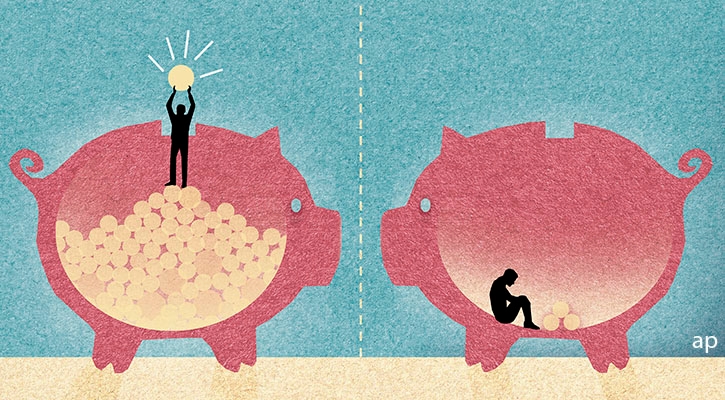

Isn't it time to be a little more aggressive with your TFSA? Unfortunately, a wide-spread misperception about the vehicle continues to prevail.

"People still believe that because it's called a tax-free savings account that they can only invest 'savings,' or hold cash," says Larry Moser, Ottawa-based regional sales manager, Bank of Montreal. "But it has improved and we're over the 50% barrier. People at least understand what a TFSA offers. Still, the percentage of people who can identify all investments that qualify is quite low."

Moser adds that only 19% of those surveyed know the limit for 2014 is $5,500, the same as last year and up from the original $5,000 that applied until 2012. On the bright side, TFSA holders plan to contribute $3,625 on average this year.

Jamie Golombek, Toronto-based managing director, tax and estate planning for CIBC Private Wealth Management, echoes Moser's comments. "The name is partly to blame. People think, 'Oh, this is a savings account.' That's where they put their money. So we're trying to change that image," says Golombek. "I look at it as a tax-free investment account. There is lots of flexibility."

While it's true that whatever qualifies for an RRSP also qualifies for the TFSA, there is one critical difference. "Once you take money out of an RRSP, that's it. To be able to put it back in, you need new RRSP contribution room," says Golombek. "With the TFSA, you can always put it back in at the start of the following year, assuming you have no unused room." If you have not opened a TFSA, you will be able to contribute up to $31,000, as of Jan. 1.

There is huge potential for gains within a TFSA -- suppose, for instance, you were fortunate to pick a stock such as Twitter Inc. TWTR, which recently was up 33% since its November launch. However, if your investment misfires, there is no deductibility for losses. "The problem with a loss inside a TFSA is that you can't use it," says Golombek. "My advice is to put a highly taxed investment inside a TFSA -- such as fixed income or foreign income, which is taxed at full rates."

Assuming you have a choice between a TFSA, RRSP or a non-registered account, Golombek says it may be more advantageous to shelter the fixed-income vehicles in registered accounts. Stocks that generate dividends and have the potential for capital appreciation are more suitable for a non-registered account. "That way, you can benefit from the dividend tax credit and pay tax only on 50% of the capital gain. The TFSA is ideally for stuff that is taxed the most."

If you are determined to invest in a speculative stock, it's critical that it fits in within your portfolio. "We recommend that you don't try to hit a home run and your portfolio is well diversified," says Golombek, "and that you follow a financial plan to achieve certain goals, such as funding retirement or buying a vacation home."

Still, Golombek admits that high-income earners might be more qualified to speculate. "If people are lucky enough to have 'fun' money, they often bet on speculative stocks. But it's not for the faint of heart," he cautions. "This certainly was not the intention for the TFSA."

But there is room for aggressive investing to some degree, says BMO's Moser. "For someone with moderate risk tolerance, there's no reason why he/she cannot invest more aggressively. It's the greatest investment vehicle since the creation of the RRSP."

This does not mean taking undue risks, adds Moser, and throwing all your money, or a good chunk of it, at penny stocks. "But a balanced portfolio that earns 5% compounded, based on historical returns, will be good for your retirement plans if you put money into a TFSA each year."

Take this example. If you start saving $5,500 at age 25, and continue for the next 40 years, your total contribution would be $220,000. Assuming the TFSA earns 1% a year in a savings account, your capital will grow to about $271,564. If that money was in a taxable account it would grow to $258,749, or $12,815 less.

Instead, if you build a portfolio with a mix of bonds, equity mutual funds and high-yielding dividend-paying stocks, you can achieve a blended return of about 5% a year. By age 65, you will have about $697,619 -- versus $527,160 in a taxable account. That's a saving of $170,549. If you can achieve a 6% compounded return, your capital will grow $902,262, all tax-free. By contrast, a taxable account would net you $638,683.

"If you are saving money for the long term, and have a solid pension, and no contribution room in your RRSP, this is a great vehicle to have extra savings for retirement," says Moser. "If you have a long-term time horizon, and use this vehicle for savings, I see no reason why you shouldn't be a little more aggressive."

Diversification is the key to the types of investments you should hold in a TFSA, agrees Arthur Azimian, a financial advisor at Edward Jones Investments, in Mississauga, Ont. "We believe in buying and owning good-quality investments and diversifying them." A combination of dividend-paying stocks and investment-grade bonds that have a degree of safety, he says, would be a good TFSA strategy.

If you are determined to speculate, adds Azimian, you have to ask yourself if you are prepared for the risk involved. "What if there is no gain? When you go super-aggressive and put everything into emerging markets, for instance, without diversification, what about the loss? You won't be able to use it."

It's often said in the investment industry that decisions should not be made on the basis of tax saved, but the merits of the investment. "Don't let the tax tail wag the investment dog. It makes a lot of sense," says Azimian.

As a guideline, Azimian urges investors to complete a thorough risk assessment, and then decide where each type of investment belongs in each account, whether registered or non-registered. "Because the TFSA is tax-free, it makes sense to be not too aggressive inside the account," says Azimian. "You want to make sure there is a higher degree of assurance, with less risk."

CIBC's Golombek agrees, and recommends getting professional advice to identify which investments are suitable and where they belong, and all within a personal investment plan. "Everyone's situation and risk appetite is different. And that's why everyone should get a written financial plan to achieve their goals."

Once that plan is in place, and you have decided which investments are suitable, the last step is determining where they belong, either in a TFSA or a non-registered account.

"It's not only about asset allocation and proper diversification," says Golombek. "It's also about asset location -- deciding which assets go where."