John Youn: A lot of folks are wondering what online advice is. So, what we've done at Questrade, as a financial technology company, mostly on the technology side, is to bring traditional advice to the online forum. And that means, [as a] market disrupter, being able to compress the administrative part but give the traditional asset management advice to individual investors.

[With] robo-advice or online advice, what an investor would do is seek out those providers, one of them being us, as Questrade Wealth Management. And they would fill out an online questionnaire – a risk tolerance questionnaire is what we call it. And it really comes down to the suitability of that individual client for a specific asset mix of a portfolio. So, again, what the clients' needs are in risk and requirement is what we [determine] with the online risk tolerance questionnaire.

If somebody has a risk budget of the maximum return, but has a timeline of, say, three years or the very short term, typically it will get rejected from that online questionnaire. The suitability is reviewed by a portfolio manager – a human portfolio manager, believe it or not – and that individual would be . . . contacted with that conflict, and either it's resolved or it's rejected.

Often people don't realize there is a human individual that you can contact on online advice [platforms]. And what we at Questrade have put together is, again, technology upfront and then the traditional asset manager or a portfolio manager behind the scenes. And that particular team has a track record of sub-advice and, additionally, we oversee it with our portfolio managers based on their performance and outlook and make sure that they are on target.

Most investors have a tough time accessing advice. So what we've done is streamline with technology, again, the administrative component, which is the suitability requirement and asset mix. But if they do want to speak to a live individual and have questions, we have portfolio managers on staff that are able to answer any questions. We have customer service agents that will answer administrative questions as well. But, certainly, with the performance of their individual portfolios, they have a human contact that they can always go to.

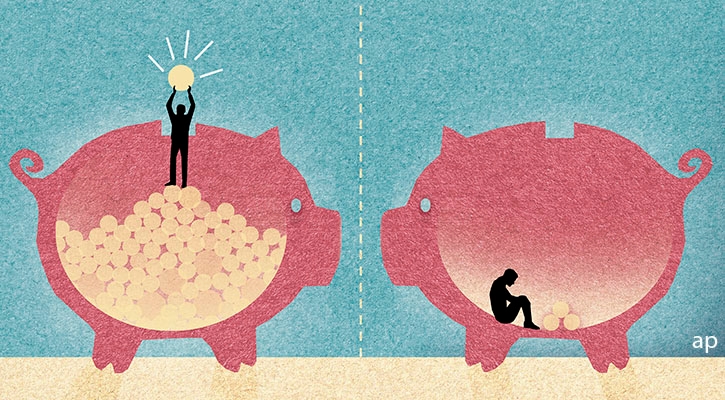

There are cost savings. And if you look at traditional mutual funds, you're ranging in Canada anywhere from 2% and north of that to about 2.5% depending on the portfolio. And that's just an investment component without the advice. In some cases, you're still looking at, with full service advice, north of 1.5%. So when you look at the Canadian online advice column, you are looking at a fee as low as 30 basis points, or 30% of 1%, and it could go almost as high as 70 or 75. But at the end of the day, [there are] dramatic cost savings relative to traditional full-service or even mutual funds as an alternative.

There are very few things in the market that we could control. Performance certainly is very difficult to control in this sort of market. But if you look at any sort of statistics, if you can save yourself 1% over a 30-year period of time or a 20-year period of time, any length of time, you are doing yourself a lot of benefit because that goes into the performance of your portfolio. So, you can make a dramatic difference at the time of retirement when you can save yourself 1% or 0.5% on an annual basis. I know it doesn't look like much, but look at your mortgage. We often try to save ourselves 0.5%, if that, on a traditional mortgage. So, think about it that way. If you can save yourself 1% or 0.5%, you are doing yourself a world of good in [terms of] performance of your own portfolio.