Editor's note: This week's three-part series on target-risk funds concludes today with manager research analyst Jeffrey Bunce assessing the historical performance of these popular fund-of-funds portfolios. The series, which began on Monday and continued on Wednesday, is based on a research paper released this month by Morningstar Canada's manager-research team.

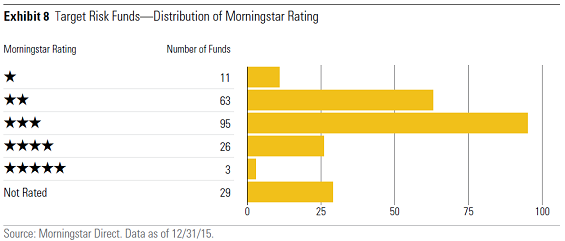

Most target-risk funds have been mediocre to weak performers relative to their asset-category peers. Very few achieve a Morningstar Rating of 4 or 5 stars, while a disproportionate number of funds score only 1 or 2 stars.

Our sample of 227 target-risk funds, sorted according to their Morningstar Ratings, shows that very few target-risk funds of funds excel in their categories. In fact, more than 74% of the funds are rated 3-stars or less, and only 13% are rated 4- or 5-star.

The remaining 13% of funds do not have a star rating since the Morningstar Rating methodology requires at least a three-year track record.

While it's to be expected that the 3-star rating is the most populated bucket, it's somewhat surprising to see a higher proportion of funds rated 1 or 2 stars compared with those rated 4 or 5 stars. (By definition, there will be fewer funds with 1- and 2-star ratings than 3-star in a category. But since the target-risk funds in our sample span multiple categories, the distribution by star rating could be skewed.)

Any number of factors could be tripping these funds up, but the following may be the most probable causes of mediocre performance:

- The target asset allocation of these funds may not line up with the majority of other funds in the same category, which could result in different risk-return profiles. However, this could be as much a benefit to some funds as a hindrance to others.

- Diversification may be playing a role. Target-risk funds are generally more diversified by asset class than the typical balanced fund in their category. While that may lead to improved risk-adjusted returns over the long term, it may not be evident in the time periods included in the Morningstar Rating.

- As examined in part two of this series, the management expense ratios of some of these target-risk funds are above the weighted average of their underlying holdings, creating a higher hurdle to overcome. All other things being equal, a higher ownership cost will result in lower returns.

- Lastly, mediocre performance of target-risk funds may stem from the underlying funds themselves. This could especially be the case for closed-architecture programs where a firm uses only its own funds. Like the jack-of-all-trades who masters none, the likelihood that a firm will have superior or best-in-class funds across all asset classes is low. So while a few target-risk funds are likely to produce above-average performance, it's also true that others are likely to produce below-average performance, potentially resulting in washed-out performance overall.

What's more, flows into target-risk funds have been less sensitive to past performance than stand-alone funds have been. Historically, 4- and 5-star stand-alone funds garner the greatest inflows, while those with 1- to 3-star ratings suffer outflows. By contrast, asset flows for target-risk funds seem impervious to poor performance since net flows were positive across all star ratings.

The use of target-risk funds as a managed solution appears to be more important than performance in driving net inflows. Furthermore, seven of the 10 largest target-risk providers have mostly or completely captive distribution channels that may enable them to sell on the basis of considerations other than performance.