Over the past three years, Japan's stock market has responded very positively to the government's efforts to kick-start its long moribund economy. Thanks to aggressive monetary easing, which started in 2013, the Japanese yen has fallen about 30% against the U.S. dollar. A weaker yen has been a boon for Japanese exporters, who have since been reporting stronger earnings growth. And as these export-oriented electronics and consumer firms continue to rally on improving earnings, financial firms have been able to reap higher profits from a stock market boom. Over the past three years, the Nikkei 225 benchmark has returned a cumulative 120% (in yen), significantly outperforming the gains of 60% and 19%, respectively, for the S&P 500 and the S&P/TSX Composite Index over the same time period.

Investors in Japanese equities have benefitted from these trends over the past few years, but a weakening currency is certainly not a sustainable solution for longer-term corporate earnings growth. Looking forward, the government is trying to address some long-standing issues that have weighed on the country's growth potential--namely, corporate Japan's indifference to returns and building shareholder value. Japan's returns on equity have historically been about half that of the S&P 500 for a few key reasons. First, Japanese firms tend to hold an excess of rainy-day cash, an asset that generates almost no returns. Second, Japanese firms have a legacy of crossholdings, under which weak companies are kept afloat by their parent company. These practices are well entrenched in corporate Japan and are supported by an insular and staid corporate governance environment where directors have cozy relationships with their management teams and are loathe to push for change.

The Japanese government has launched a number of initiatives to try to bring Japan's corporate governance practices to be more in line with global standards. In 2014, the government unveiled its Stewardship Code, a set of guidelines for how institutional investors can more effectively engage with company management to focus on medium- and long-term growth. The following year, the government addressed the issue on the corporate side with the launch of the Corporate Governance Code, which pushes for better transparency and more independent board members.

To highlight companies doing right by shareholders, a new equity benchmark of "good" companies was created in 2014. This benchmark, the Nikkei 400 Index, screens for 400 companies that have the highest returns on equity and operating profits and that also employ shareholder-friendly practices, such as having external directors. Index constituents are weighted by float-adjusted market capitalization, but any holding accounting for more than 1.5% at the annual rebalance will be trimmed back to a 1.5% weighting.

To help give this index some influence over corporate Japan, the government has encouraged the Government Pension Investment Fund, the world's largest pension program, to invest in companies included in the Nikkei 400 Index rather than the Nikkei 225 or the TOPIX, the more common benchmarks for Japanese equities. In Japan, about 20 index funds tracking the Nikkei 400 launched in 2014, and, since then, those funds have gathered almost US$6 billion in assets. In theory, the "good" companies of the Nikkei 400 Index would exhibit better long-term performance, making a Nikkei 400 exchange-traded fund an attractive investment choice for Japanese equity exposure.

Fund options

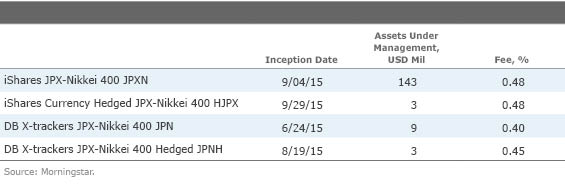

There are four U.S.-traded ETFs that track the Nikkei 400--two are not currency-hedged and two are currency-hedged. Currency-hedged ETFs use currency forwards to remove the impact of the yen's movement versus the U.S. dollar on fund returns. During periods when the yen is falling against the U.S. dollar, the currency-hedged ETF will outperform its currency-unhedged counterpart, and vice-versa. Of course, for Canadian investors both the hedged and unhedged versions of these products present currency risk if the invested funds are ultimately to be converted to Canadian dollars.

The fund sponsors of these Nikkei 400 ETFs are iShares and Deutsche Bank. The two Deutsche Bank ETFs each hold the entire portfolio of Nikkei 400 constituents, with the currency-hedged ETF, Deutsche X-trackers Japan JPX Nikkei 400 Hedged Equity (JPNH), using currency forwards to hedge the yen exposure. The unhedged iShares fund, iShares JPX-Nikkei 400 (JPXN), also holds the 400 index constituents; however, the currency-hedged ETF, iShares Currency Hedged JPX-Nikkei 400 (HJPX), holds shares of JPXN (instead of index constituents) and currency forwards to hedge the yen exposure. This difference in fund construction between the currency-hedged iShares and Deutsche Bank ETFs can result in small performance differences over the short term, as shares of JPXN are trading during U.S. market hours and the constituents of the Nikkei 400 are not. But over the long term, the small differences in returns between the currency-hedged Deutsche Bank ETF and iShares ETF should be negligible. JPXN began tracking the Nikkei 400 last month, and previously tracked a different index, so historical data for this fund does not reflect the performance of the Nikkei 400.

Actually, the trailing three- and five-year performance of the Nikkei 400 Index has been 100% correlated to that of the MSCI Japan Index, the market-cap-weighted benchmark for ![]() iShares MSCI Japan (EWJ), the largest Japan equity fund listed in the U.S. The constituents of the two indexes are almost the same, but, because of the Nikkei 400 Index's 1.5% cap on individual securities, there are small differences in sector tilts. On the other hand, the Nikkei 400 and the Nikkei 225 indexes have had a 97% correlation over the past three and five years, and the reason for the slightly lower correlation is because the Nikkei 225 is a price-weighted index, so sector weightings are less similar for the two indexes.

iShares MSCI Japan (EWJ), the largest Japan equity fund listed in the U.S. The constituents of the two indexes are almost the same, but, because of the Nikkei 400 Index's 1.5% cap on individual securities, there are small differences in sector tilts. On the other hand, the Nikkei 400 and the Nikkei 225 indexes have had a 97% correlation over the past three and five years, and the reason for the slightly lower correlation is because the Nikkei 225 is a price-weighted index, so sector weightings are less similar for the two indexes.

A greater emphasis on returns and better corporate governance will be a slow, gradual process, especially in a place like Japan. While the Nikkei 400 Index will ostensibly identify the "good" companies, by omission, it will also shame the "bad" companies. Sony (SNE) is notably absent from the Nikkei 400 Index, as it posted losses in five of the past six years. And when Toshiba disclosed its multibillion-dollar accounting scandal, it was subsequently removed from the index. If the Nikkei 400 Index helps encourage good, as well as bad, companies to put shareholders first, then, in the long run, all investors should benefit.