As much discussion as there is on the distinctions between ETFs and mutual funds, the two investments share more similarities than differences.

Yes, ETFs tend to be less expensive, more transparent and more tax efficient than conventional mutual funds. And because they trade on stock exchanges, investors can buy and sell them throughout the day, use leverage and sell them short -- advantages that benefit short-term traders and speculators more than long-term investors.

Despite the differences in how ETFs and mutual funds trade, the end product is the same. Both provide exposure to a diversified basket of stocks, bonds and occasionally, hard assets and derivatives. ETFs mostly track passive benchmarks while mutual funds largely pursue active strategies, but the line between passive and active has increasingly blurred. So-called "smart beta" or "strategic beta" (Morningstar prefers the latter term) make active bets against the market, just like most mutual funds. It's worth noting both vehicles are governed by the same regulatory requirements, so investors experience equal levels of legal protection.

While investors should pay close attention to factors relevant to ETFs alone, such as premiums, discounts and liquidity, they should view these investments through the same analytical lens as mutual funds. Morningstar's approach asks the same questions of both vehicles; we evaluate the quality of the people, process, performance, parent and price -- our five pillars of manager research -- regardless of whether the fund trades on an exchange (like an ETF) or sells once-daily (like mutual funds). We seek to understand what factors may drive future performance and identify sources of potential competitive advantages in each research pillar. (For more on Morningstar's approach to fund research, click here).

Regardless of the investment vehicle, investors should know what they own. Here are the five main questions they should be able to answer when considering an ETF.

Who runs the fund and what resources are at their disposal?

For the most widely held ETFs, which track passive market benchmarks, the quality of the people shouldn't be a key driver in investors' decision-making. This isn't to say that it doesn't matter who runs purely passive ETFs. It takes some trading know-how to keep the fund's returns aligned with the benchmark. More-active strategies may require more than trading expertise. These tend to employ rules-based approaches entailing little to no human intervention, but someone has to design the rules first.

For example, RBC's head of quantitative investing Bill Tillford adapted his team's quant-based portfolio management tools to create the firm's suite of dividend-oriented ETFs last year. Tillford has leveraged his vast experience -- he has focused on integrating quantitative and fundamental analysis for the better part of his nearly 30-year career -- to create thoughtful quantitative models. These ETFs' prospects are dependent on Tillford's ability to adapt his models to changing markets.

What is the strategy and how does it translate into the portfolio?

It may seem odd to think of passive benchmarks having strategies, but they do. Take Vanguard FTSE Canadian High Dividend Yield VDY and iShares Core S&P/TSX Composite High Dividend Index XEI, for instance. Both target Canadian firms with relatively high dividend yields, yet the funds represent this universe very differently. The iShares fund delivers a much higher yield thanks to its sizable stake in income-rich real-estate investment trusts, which make up more than 17% of the portfolio. By contrast, Vanguard's FTSE index excludes REITs and relies heavily on big Canadian banks for its yield. Such banks comprise the better part of its 55% financials stake. (Only 12% of the iShares ETF is invested in non-REIT financials.) The Vanguard ETF delivers a smaller yield -- its holdings average a 4.6% 12-month yield relative to the iShares fund's 6.1% -- but its portfolio is focused on larger-caps and its holdings tend to be more profitable and less leveraged than those of its competitor. The iShares fund generates more income but its smaller-cap, lower-quality portfolio will likely lead to higher volatility.

Strategic beta approaches also feature significant tilts as a result of their strategies. Definitions of strategic beta differ, but these approaches weight holdings differently than a market-cap-weighted portfolio or place added weight on certain factors, such as value, momentum, beta and quality, that academic researchers have associated with above-average risk-adjusted returns.

Powershares FTSE RAFI Canadian Fundamental PXC weights holdings based on fundamental factors such as book value, sales, cash flow and dividends rather than market cap. RAFI indexes, conceived by well-known researcher Rob Arnott, deliberately give stocks with lower valuations heavier weight than the market-cap portfolio. In general, RAFI indexes have been successful, though their value leanings mean they are unlikely to fare well when growth stocks rule the roost.

Other strategic beta approaches introduce other biases into portfolios. ETFs like iShares MSCI Canada Minimum Volatility XMV and Powershares S&P/TSX Composite Low Volatility TLV weight stocks based on volatility metrics like standard deviation. Low-volatility strategies tend to favour relatively stable sectors like utilities, telecom and consumer staples. Here again, though, is another example of how different indexes can draw upon the same factor with much different results. While the MSCI benchmark's sector weightings look more like those of the broad Canadian market, the S&P/TSX bogy is heavily concentrated in financials, with a giant 64% stake in the sector, versus 38% for the MSCI index. The latter's more market-like complexion means its 18% energy stake dwarfs the 4% weighting in the S&P/TSX benchmark.

How has the fund performed?

The question here, especially for ETFs tracking broad market-cap-weighted indexes, isn't so much whether performance has been good, but whether the results match expectations. The falling Canadian dollar and tanking oil prices meant ETFs that track the S&P/TSX Composite didn't perform anywhere as strongly as those tied to the S&P 500, which represents U.S. large caps. The TSX-linked ETFs still did their jobs, though, by providing investors exposure to Canadian large-cap stocks.

How the funds and the indexes they track have performed in different markets can frame your expectations. In topsy-turvy years like 2011 and 2014, for example, low-volatility ETFs fared especially well; were they to rally in red-hot markets, like 2009's, it could be a sign they're taking on more risks than you expect.

Well-run ETFs minimize tracking error -- the difference between the fund's returns and the index's. Because ETFs charge fees, it's tough to match an index's returns, but it should come close once fees are taken into account. Not all funds will manage tracking error equally well. BMO, Vanguard, iShares and Horizons all offer S&P 500 Index funds, and despite nearly identical MERs (which range from 0.15% to 0.17%), returns can vary noticeably. In 2014, for instance, Horizons S&P 500 HXS and Vanguard S&P 500 ETF VFV performed fairly comparably, lagging the index by 0.45% and 0.49% respectively, while iShares Core S&P 500 XUS trailed by 0.84%.

How much does the fund cost?

Because costs take a bite out of your returns, cheaper is better. That's especially the case for the lion's share of ETF assets, which are essentially commodity products tracking purely passive benchmarks. When competing ETFs track the same or similar index, the cheaper one will probably come out ahead. BMO Aggregate Bond ZAG and iShares Canadian Universe Bond XBB will provide the same pre-expense returns, provided they track their benchmarks equally well. But with a 0.23% MER, the BMO offering is 10 basis points cheaper than the iShares offering, improving its prospects over its rival.

Not surprisingly, more-active ETFs come with higher price tags. For instance, Powershares' Canadian RAFI-based ETF charges a 0.51% MER -- five times what Vanguard charges for pure Canadian market exposure with Vanguard FTSE Canada VCE. The added costs may be worth investors' while, but the Powershares offering will have a higher fee hurdle to overcome.

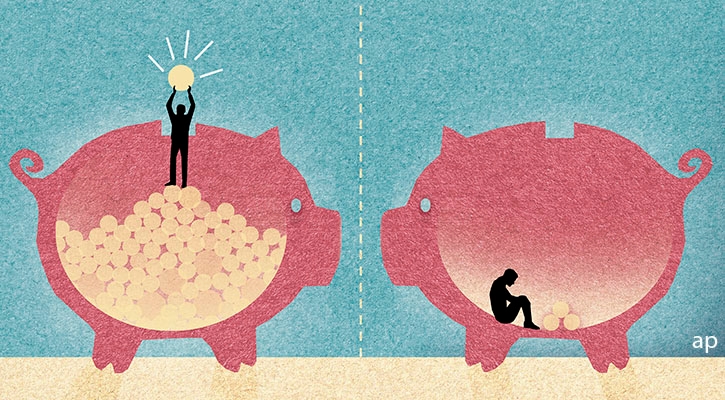

Of course, ETFs don't just compete against other ETFs. They compete against mutual funds, too. In this framework, the comparison generally weighs in favour of ETFs. The aforementioned Powershares RAFI ETF may be expensive relative to pure passive alternatives, but it's less than half the 1.1% MER charged by the average core domestic equity fund sold in the fee-only or DIY channels. Even within the same fund provider, ETFs can give the mutual fund competitors a run for their money. That's the case with RBC Quant Canadian Dividend Leaders RCD, which levies a 0.44% MER, about half of that of actively managed, Neutral-rated RBC Canadian Dividend, whose F series weighs in at 0.94% annually.

To be sure, there are costs not included in the MER that investors should also consider. Because ETFs trade like stocks, you'll have to pay a commission to buy and sell shares. For those who invest small amounts regularly or trade a lot, the commission costs could end up mitigating ETFs' cost advantages. What's more, ETFs have costs of their own, in terms of commissions, bid-ask spreads and market impact costs. Other costs could add to tracking error on top of the MER, including sampling error, securities lending and trading costs.

Is the fund provider a good steward?

It should go without saying, but investors should prefer to partner with fund providers who have their best interests at heart. Morningstar has an extensive process to assess whether fund companies put stewardship ahead of salesmanship in its Stewardship Grade. To state our process succinctly, we consider whether firms' corporate cultures foster investment excellence, whether their managers' financial interests are aligned with those of fundholders, whether their fees are competitive, and whether they've gotten into regulatory trouble.

Some of these factors aren't as relevant to ETF investors. Whether the manager of your S&P/TSX 60 Index ETF invests heavily in the fund doesn't matter so much. And passive investors may not care a lot about the investment culture of the firm, so long as its resources are adequate to manage its ETFs with minimal tracking error and other ownership costs.

Yet the quality of a corporate culture matters even in passive investing. Vanguard, for example, avoids gimmicky product launches, instead favouring those with long-term merit which investors can use well. In general, I'd wager its ETF line-up is more likely to serve fundholders better than one from a marketing machine more focused on creating products that sell regardless of the investment merits.

Given how important fees are to the ETF investor experience, investors should favour ETF providers with a history of offering cheap ETFs that get cheaper. In recent years, firms like Vanguard, iShares and BMO have been on a race to the bottom on expenses -- a fee war that's been to the benefit of fundholders. Higher-cost providers may be less likely to be as competitive, making their line-ups less attractive on price.