This article originally appeared in the April/May 2014 issue of Morningstar magazine.

"Smart beta," "alternative beta," "enhanced indexes," "quantamental indexes"--at this point, the list of monikers describing the fast-growing middle of the active-to-passive spectrum extends long enough to put it just a few syllables shy of making a lunar landing. It's an arena that has further blurred the lines between active and passive management (see Exhibit 1), and one which is at the leading edge of the most recent wave of product proliferation within the global exchange-traded products (ETP) landscape.

What Morningstar is deeming strategic beta is a broad and rapidly growing category of benchmarks and the investment products that track them. The common thread among them is that they seek to either improve their return profile or alter their risk profile relative to more-traditional market benchmarks. In the case of equity products, which account for the overwhelming majority of assets in this arena, the result is typically one or more factor tilts relative to standard market indexes.

As new products have continued to roll off asset managers' assembly lines, their sales and marketing departments have been working tirelessly to position these new models within an increasingly competitive field. The result has been a ratcheting up of the level of complexity of the indexes that form the raw stuff of these benchmark-based investment products and, in some cases, a growing disparity between how they are pitched by their sponsors and the actual investment results they produce. Investors are faced with a complex task as they navigate this landscape, and Morningstar is working to provide the compass they need to do so.

A brief historical detour

The proverb "There is nothing new under the sun" applies to this "new" corner of the asset-management arena. Academics distilled investment returns into their component factors decades ago. And others, most notably the eponymous founder of Barr Rosenberg Associates, had recombined these basic drivers of investment returns into investable products. In fact, Rosenberg's "bionic betas" landed him on the cover of the May 1978 issue of Institutional Investor magazine.

So why is this time different? First, there have been major advances in information and investment technology since the mid-1970s that have given asset managers the horsepower necessary to efficiently manage more-complex index strategies, to repackage them into the newest generation of strategy-delivery vessels (such as ETPs), and to deliver them at a low cost to investors. The past four decades have also been marked by steady secular growth in index investing. Since the first index fund was launched in 1975, the portion of U.S. mutual fund and ETP assets accounted for by index-tracking products has grown from nothing to nearly 30% today. All told, the investment world of today is far more ready for these sorts of strategies than it was 40 years ago.

What's in a name?

The need to define this space, to measure it and to police it has grown and will continue to grow with time. At Morningstar, we are positioning ourselves to meet these needs, all with the goal of helping investors make better-informed investment decisions. For our part, we have decided to tag this realm with the label strategic beta. Why strategic beta? First and foremost, we are eager to do away with the positive connotations that may be inferred by the "smart" in smart beta. Not all of the strategies included in this arena are smart, per se. The term strategic is meant to draw attention to the fact that the benchmark indexes underlying the ETFs, mutual funds and other investment products in this space are designed with a strategic objective in mind. These objectives primarily include attempting to improve performance relative to a traditional market-capitalization-weighted index or altering the level of risk relative to a standard benchmark.

As for the beta in the name, it is not meant to imply beta in the strictest, most academic sense of the term (a measure of a security or portfolio's sensitivity to movements in the broader market). Instead, it is to highlight the fact that this is a group of index-linked investments, all of which have the goal of achieving a beta equal to 1 as measured against their benchmark indexes. Strategic beta may not roll off the tongue as easily as smart beta, but we believe it is a more accurate descriptor.

A motley crew

In delineating the boundaries of the strategic beta space, we have tried to be as inclusive as possible, including products that may have a variety of different processes but yield fairly similar end products, and all of which deviate in some meaningful way from their traditional broad-based index peers.

Also, it is important to note that our definition differs from some others' in that we include products tied to benchmarks that first screen candidates for a variety of attributes (value, growth and dividend characteristics, for example) and subsequently weight the eligible securities by their market capitalization (Vanguard U.S. Dividend Appreciation VGG, for example). Others have adopted a more narrow definition that excludes any products based on benchmarks whose constituents are market-cap-weighted.

Our resulting universe includes a diverse range of products, spanning from the iShares MSCI All Country World Minimum Volatility ETF XMW to the YieldShares High Income ETF YYY. The common elements among them:

- They are index-based investments.

- They track non-traditional benchmarks that have an active element to their methodology, which typically aims to either improve returns or alter the index's risk profile relative to a standard benchmark.

- Many of their benchmarks have short track records and were designed for the sole purpose of serving as the basis of an investment product.

- Their expense ratios tend to be lower relative to actively managed funds.

- Their expense ratios are often substantially higher relative to products tracking "bulk beta" benchmarks like the S&P/TSX 60 or the S&P 500.

Better returns, less risk?

Having defined the strategic beta space in very broad terms, Morningstar makes a second cut of the universe, tagging products on the basis of the overarching strategic objective of their underlying benchmark. These objectives fall into three buckets: return-oriented strategies, risk-oriented strategies, and a catch-all "other" classification.

Return-oriented strategies look to improve returns relative to a standard benchmark. Value- and growth-based benchmarks are prime examples of return-oriented strategies. Other return-oriented strategies seek to isolate a specific source of return. Dividend-screened or weighted indexes, such as those followed by iShares Canadian Select Dividend Index XDV and SPDR S&P Dividend ETF SDY, are the chief examples of this type of return-oriented strategy.

Meanwhile, risk-oriented strategies look to either reduce or increase the level of risk relative to a standard benchmark. Low-volatility and high-beta strategies are the most common examples of risk-oriented strategies.

Lastly, "other" encompasses a wide variety of strategies, ranging from non-traditional commodity benchmarks to multi-asset indexes. This second cut allows investors to classify strategic beta instruments along very broad lines.

The devil is in the details

The third and final cut involves classifying products with similar strategic objectives at a more granular level. Here we group products tracking dividend-screened or weighted, value, low/minimum volatility/variance, non-traditional commodity and a variety of other benchmarks together. This is intended to facilitate more-precise comparisons between products with very similar underlying methodologies. Exhibit 2 outlines our strategic beta taxonomy in full detail.

A look at the numbers

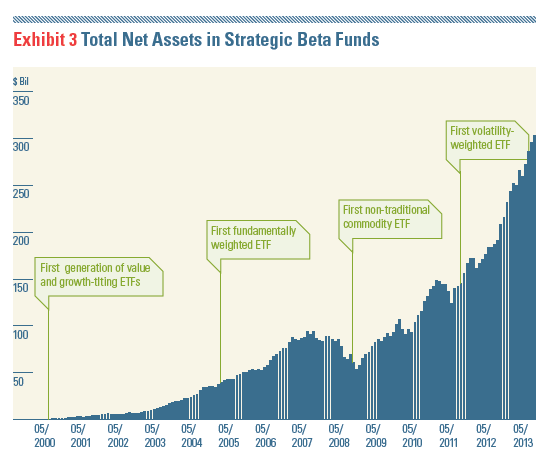

Overlaying our taxonomy on the U.S. ETP market yields some interesting results. First, this universe has seen tremendous growth over the past decade. (See Exhibit 3.) The rate of growth has only accelerated in the past five years. At the end of 2013, Morningstar counted 342 strategic-beta ETPs in the United States. These products had collective assets under management of US$291 billion, representing nearly 18% of total ETP assets. Assets grew 59% in 2013 alone; net new cash inflows accounted for more than 34 percentage points of that figure, and asset appreciation accounted for the remaining 25 percentage points. Also, this is a category that has been punching above its weight. While strategic beta ETPs accounted for 18% of total industry assets as of year-end 2013, they garnered 35% of total net cash inflows into all ETPs for the year.

Exhibit 4 shows the breakdown of strategic beta ETP assets and their share of flows for 2013 along the lines of the secondary strategy attributes outlined above. ETPs offering access to dividend-screened or weighted strategies are the largest class of strategic beta ETPs. It should come as little surprise in the context of what has been a yield-starved market environment that dividend strategies have grown to account for nearly one third of assets in this space.

It is also important to note that more than 45% of assets in strategic beta ETPs are tied to what we would deem to be the first generation of such benchmarks -- those that tilt or otherwise seek to isolate stocks with value and growth characteristics.

There are also some notable up-and-comers in the space. Fundamentally weighted strategies have been gaining traction as many of the ETPs tracking them now have track records of three-plus years, a fact that has bolstered some investors' confidence in their merit. Low volatility/variance ETPs have also attracted substantial investor interest as investors that are still feeling the sting of the 2008 downdraft in global financial markets adopt these strategies as a way to smooth their stock returns a bit.

What's next?

What comes next in the land of strategic beta is more complexity. The latest wave of new products hitting the market is of the multifactor variety, combining a range of factor tilts or exposures into one fund. During the writing of this article, JPMorgan Chase JPM filed with U.S. authorities to launch a suite of ETFs tracking multifactor equity benchmarks. These products are peeking over the fence that stands at the border between active and passive -- mimicking active strategies in a rules-based, transparent, tax-efficient and low-cost manner.

This layering of complexity adds to the due-diligence burden for investors. Investors' due-diligence processes for these funds need to be every bit as rigorous as those they would undertake in scrutinizing active managers. Morningstar believes that its taxonomy is an important first step in the direction toward helping investors to better understand the strategic beta universe.