Note: This article is part of Morningstar Canada's Emerging Markets Week Special Report

Emerging market economies continue to grow, despite facing heightened geopolitical and economic uncertainty. Perhaps to combat this uncertainty, their banks stock up gold reserves.

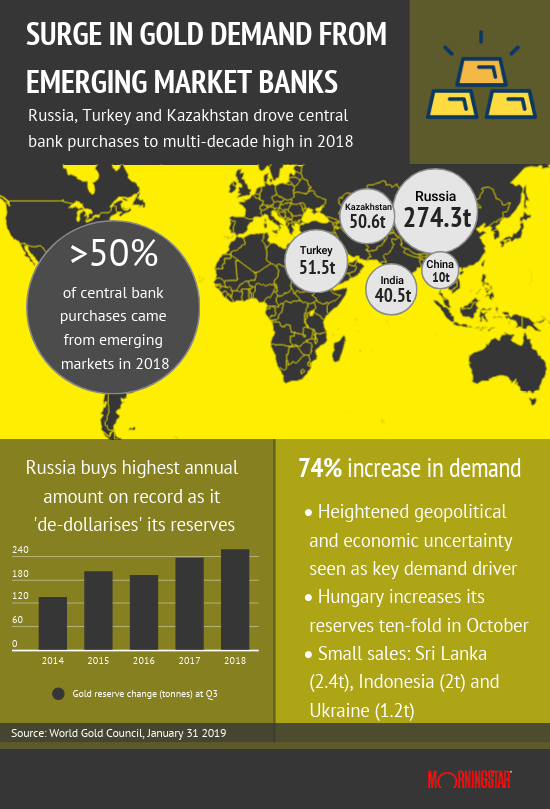

Russian gold reserves rocketed up by 274.3 tonnes in 2018, according to the World Gold Council, the highest annual net purchase on record, and with Kazakhstan, Turkey and India took up more than half of total global purchases.

A recent survey from the World Gold Council found that 76% of central banks see gold as a safe haven asset, with nearly one fifth indicating that they intend to make a purchase in the next 12 months.

Other than for its use as a strategic asset, gold jewelry is an important cultural custom in emerging markets, says Kristoffer Inton, equity analyst at Morningstar, who adds that there could be more opportunities as incomes growth could lead to more gold purchases.

Emerging market jewelry demand has been an important driver for the price of gold, says George Milling-Stanley, Vice President and Head of Gold Strategy at State Street Global Advisors, making up at least half of the overall demand for the metal. He sees demand today surging well from China, India and Thailand.

.jpg)