Jack Ma's decision to step away from wide-moat ![]() Alibaba's (BABA) executive chairman role in 2019 and the company's board of directors will not impact our positive long-term bias for two reasons. First, we believe recent results demonstrate that Alibaba has a deep management bench, including current CEO Daniel Zhang (who will transition into the chairman role in 2019 and played a central role in the development of the Singles Day shopping event, building the Tmall platform from a regional to global B2C platform, and deploying several of Alibaba's "New Retail" strategies) and executive vice chairman Joe Tsai. Second, we believe Ma's involvement with the Alibaba Partnership--a 36-member group of core company managers--will allow him to stay involved with certain strategic decisions.

Alibaba's (BABA) executive chairman role in 2019 and the company's board of directors will not impact our positive long-term bias for two reasons. First, we believe recent results demonstrate that Alibaba has a deep management bench, including current CEO Daniel Zhang (who will transition into the chairman role in 2019 and played a central role in the development of the Singles Day shopping event, building the Tmall platform from a regional to global B2C platform, and deploying several of Alibaba's "New Retail" strategies) and executive vice chairman Joe Tsai. Second, we believe Ma's involvement with the Alibaba Partnership--a 36-member group of core company managers--will allow him to stay involved with certain strategic decisions.

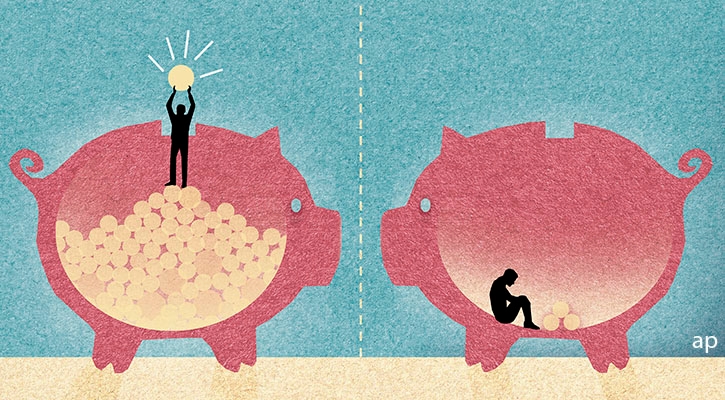

We remain comfortable with our US$240 fair value estimate and believe Alibaba is one of the more undervalued investment stories in the consumer category. We believe that negative trade war headlines have been masking steps to increase engagement among its existing user base and incubate new potential avenues of growth. Our fair value estimate assumes a revenue CAGR of almost 37% for fiscal 2019-23, including 61% growth in fiscal 2019 (consistent with management's 2019 revenue growth target of 60%, or 50% excluding acquisitions). We expect adjusted EBITDA margins to contract to the high-20s the next few years (versus 42% in fiscal 2018) due to technology, logistics, product development, and marketing investments as well as the impact of acquired businesses. However, we expect margins to inflect as investments wind down and nascent businesses scale, bringing our fiscal 2028 adjusted EBITDA margins back to the low- to mid-30s.

Despite our confidence in management's ability to execute following upcoming management changes, we will maintain our Poor equity stewardship rating due to questions about partnership voting rights, variable interest entity (VIE) structure, and convoluted ownership structure.

| Morningstar Premium Members gain exclusive access to our full analyst reports, including fair value estimates, bull and bear breakdowns, and risk analyses. Not a Premium Member? Get this and other reports immediately when you try Morningstar Premium free for 14 days. |