Judging by conversations with seniors in their 70s, life can be as busy, or busier, than life in their working years. As one 72-year old retired teacher said recently, “I am so busy, I’m going to have to give something up!”

For many, this decade in retirement offers time for desires like travel, quality time with growing family and friends, and the pursuit of hobbies that were hard to fit in before.

Yet, time aside, the ability to enjoy this decade in retirement is a result of financial considerations, says John (Jay) Nash, senior vice-president, investment advisor and portfolio manager with Nash Family Wealth Management at National Bank Financial Wealth Management in London, Ontario.

“As you’re entering your 70s, you know what you have in savings, what is your intended lifestyle, and your longevity, based on family history. From that, you know your required cashflow to meet that lifestyle,” Nash says. Apart from that, you have an idea for residual wealth – charitable giving or gifts to children. “Those are the initial key considerations, because each one is going to play into what’s important from an investment point of view,” he says, noting that an individual’s asset allocation is no longer truly age-based.

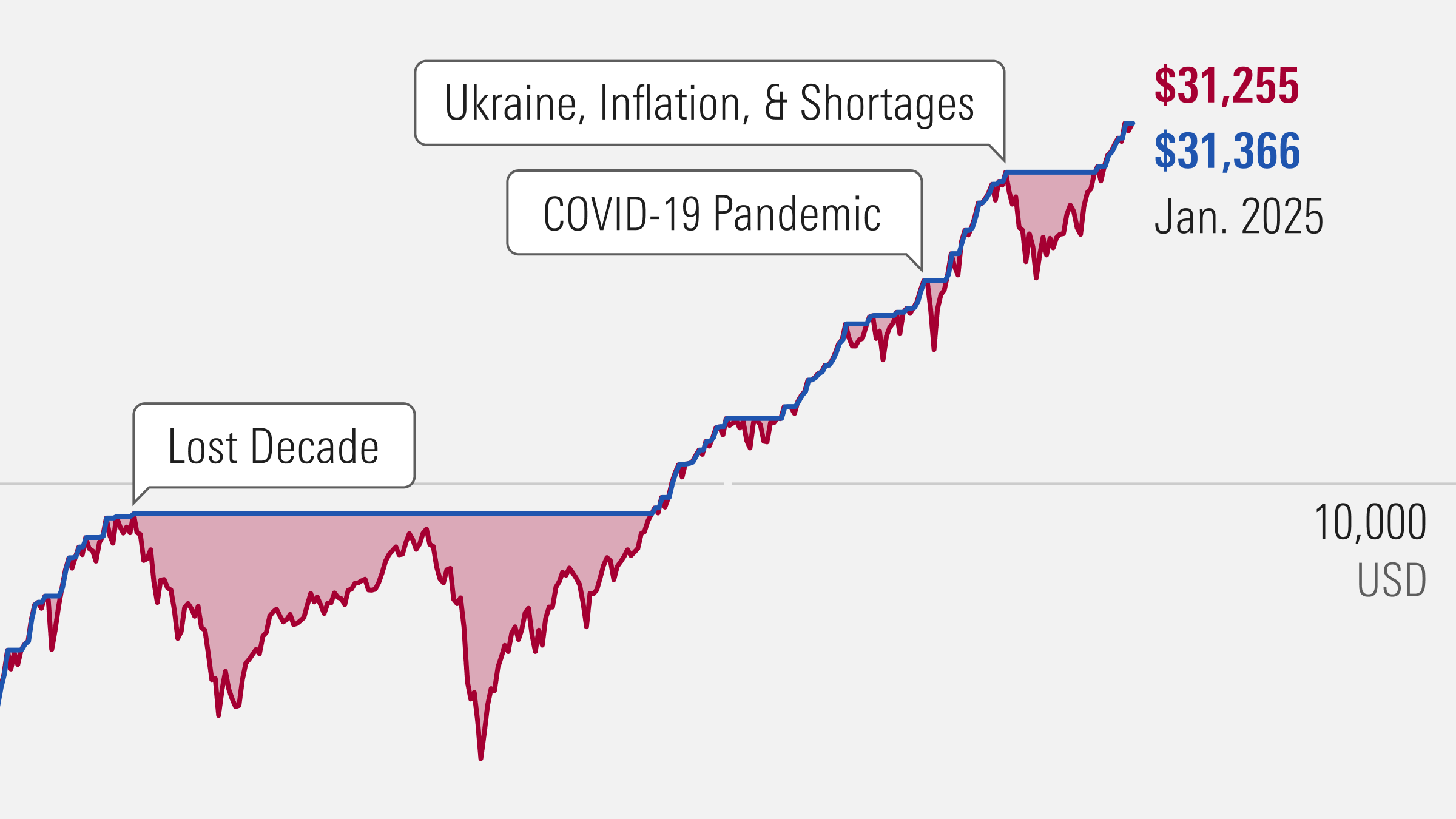

“The average female life expectancy is about 84.5 years. If you’re in your early 70s, looking out over the next 25-plus years, that’s a long time.” And there’s no point in history where equities have been down over that length of time, he adds.

Based on his two decades of experience, most people’s investment planning is still based on getting a 4% or 5% annual return but “sadly” some people use higher numbers. According to Nash, the expectation of 4% or 5% generally is fine as long as you have an equity weighting. But the downside of an equity weighting is volatility in the short run. The question of how much to hold in equities is one of the harder ones to answer, says Nash. From a risk perspective, “large-cap equities tend to be very appropriate but speculating in small caps is not. During market downturns, at least you have a much higher probability that those valuations will return.”

Paul Duxbury, an advice-only financial planner and consulting actuary at Duxbury & Associates in Cambridge, Ontario, suggests a 50% investment split in fixed income and 50% in dividend-paying equity funds for many clients in their 70s.

“With fixed income returns at around 3%, and a dividend-income funds earning dividends of 4% after fees, you’ve got returns of around 3.5% from the 50/50 investment split,” Duxbury says.

He recently met with a couple over 71 who were looking for investment advice for their modest-income lifestyle. Between the two of them, they have about $150,000 in RRIFs, with a minimum withdrawal payment of $8,100 a year and additional income from CPP and OAS payments.

With preservation of capital in mind, Duxbury suggested that they could use $50,000 of their RRIF to by an annuity and there would be $100,000 left in the RRIF. Then they could invest more aggressively with the remainder when they’ve converted one third of their RRIF into fixed income cash flow in the form of an annuity. “The remainder could be invested 75% in equities and 25% in fixed income,” says Duxbury. He also favours some ETF products for further diversification among the asset mix.

An annuity is an insurance product that he wishes more people would buy. “With an annuity,” says Duxbury, “you don’t have to allow for living beyond your life expectancy, and when it comes to investing in retirement, one of the biggest mistakes people make is that they way underestimate how long they’re going to live”.

From Nash’s experience, one of the most common mistakes with retirees in their 70s is to focus on the shorter term. He says that from a planning point of view, you really don’t want to take out more than 5% a year from investments.

Along with cash reserves, including TFSAs, he favours GICs, despite the rates of approximately 2.5% today. Yet the concept of owning a five-year GIC is very difficult for people when they first retire, he says. “But they give up a lot of risk-free return by doing that,” says Nash, “along with the comfort of having rolling GICs where they’re covered every year.” According to Nash, you want to make sure that one or two years of funds are held in cash or a short-term investment product.

In addition to cash to draw on during a market downturn, Duxbury favours dividend-paying equities. He says if you can truly ignore the market price and just focus on the dividends that you’re getting, it’s a lot less volatile. “But people see a piece of their investments go down,” says Duxbury, “and they get twisted instead of just focusing on the income, which doesn’t get hurt as much.”

Avoiding risk and market volatility is a key factor when investing in your 70s. As investors saw during the 2008 financial crisis, and more recently, the fourth quarter of 2018, a move in the market can be fairly dramatic. It can also have a significant impact on portfolios.

“The number one factor for anyone in their 70s,” says Nash, “is their ability to go through a market correction of say 20% or potentially more because they WILL see it happen.” Nash says the investment part of the portfolio is only about a third of the overall financial planning process. The second third is properly using investment accounts and managing wealth as it grows.

“I like to work with accountants and lawyers with my clients,” says Nash. “I don’t write wills and I don’t file taxes and each of these factors is critical to their success.” Seeking the advice of an accountant can result in significant savings for clients. According to Nash, a RRIF, for example, is a form of future tax liability to an estate, so planning on how to reduce that in the most tax-efficient way possible is part of the planning for investors in their 70s. “If there is only one individual,” says Nash, “and there’s any risk to their health, you need to give considerable thought to accelerating the RRIF payment, particularly if it is their intent to leave any of their wealth to their estate.”