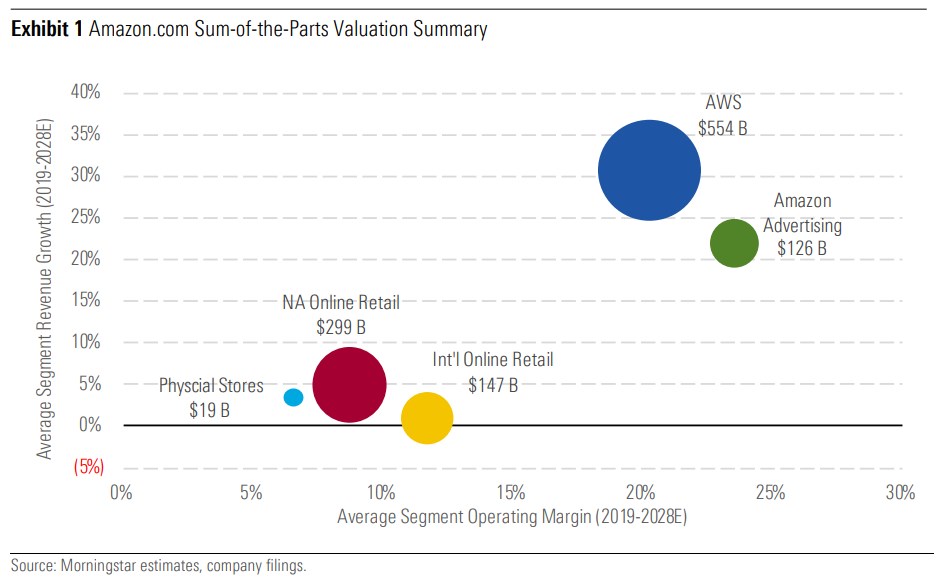

With Amazon's business model evolving the past several years and questions about breaking up large technology companies likely to persist through the 2020 election cycle (and probably longer), we believe it's appropriate to revisit the longer-term assumptions behind our discounted cash flow analysis and introduce a sum-of-the-parts valuation for each of Amazon's key business units. While we don't see a breakup of the company as imminent, we believe this exercise can help investors gain greater confidence in an Amazon investment, which remains our top pick in online retail.

Our analysis suggests that Amazon Web Services and Amazon Advertising are not receiving the credit they deserve from the market, and we still identify multiple paths to margin expansion for the company's online and physical retail segments in the years to come, even against an uncertain global economic backdrop.

1. AWS and Amazon Advertising

With estimated stand-alone valuations of US$550 billion and US$125 billion, respectively, AWS and Amazon Advertising are the most misunderstood and underappreciated pieces of the Amazon valuation puzzle, in our view. While most investors would agree that these segments are important longer-term margin contributors, we believe the sheer magnitude of cash flow generation is difficult for some to grasp. We see AWS as Amazon's most important cash flow contributor over the next decade, with advertising beginning to take the mantle roughly a decade out. We believe both segments offer more significant margin expansion opportunities than the market is giving them credit for, with AWS riding its differentiated and mission-critical services to low to mid-30s operating margins and Amazon Advertising growing from high teens to mid-20s operating margins over the next decade.

2. Online retail still has room to grow

As Amazon's North America operations continue to transition from Prime member acquisition to engagement while becoming a more accommodating third-party marketplace, margin expansion is still possible even after factoring in oneday shipping initiatives. We expect North America online retail segment margins to reach 5.5% by 2028 (compared with 4.5% in 2018, excluding advertising). We also expect Amazon's international online retail segment margins to turn positive in 2021 as more established markets like Europe and Japan benefit from the Prime membership flywheel and investment activity in markets like India and Australia winds down. In our view, Amazon's online retail businesses are worth $450 billion on a collective basis.

3. Physical stores are important feeders

Physical stores represent a small percentage of Amazon's future valuation on a stand-alone basis—roughly US$20 billion—but are highly complementary to other business segments. We believe Whole Foods and Amazon's other retail formats—many of which have yet to be announced—help to bring Prime memberships into the physical world and unlock new subscription monetization opportunities. They also help to attract new third-party vendors and offer a differentiated source of customer data.

4. Big data breakup not in near future

Despite increased calls from politicians to more heavily regulate or even separate large U.S. technology firms, we don't expect regulatory pressure or other factors to lead to an Amazon breakup in the near future, especially considering the lengthy investigation and appeal process that would accompany such proposals. We believe the company has little interest in breaking apart, given the complementary nature of its various business units, and would only consider a separation as a last resort, even if the market were willing to assign a higher valuation to segments like AWS or Amazon Advertising on a stand-alone basis.

5. Pricing power means recession resistance

Our analysis shows that e-commerce companies react more like defensive retailers during periods of economic softness, with consumers still relying heavily on marketplaces like Amazon because of competitive pricing and the convenience of expedited shipping. While we currently forecast only a moderation in global consumption trends during 2020, we still believe Amazon is well positioned to outgrow most of its peers over the next several years. We also believe AWS and Amazon Advertising should help to insulate the company during the next cyclical downturn and reinforce the company's vastly different business mix compared with the 2008-09 recession.

The sum-of-the-parts

Our fair value estimate of US$2,300 per share balances emergent sources of growth such as advertising, new subscription services, international retail, and Alexa (and the future licensing opportunities it presents) with Prime one-day shipping, video and audio content, and other technology investments.

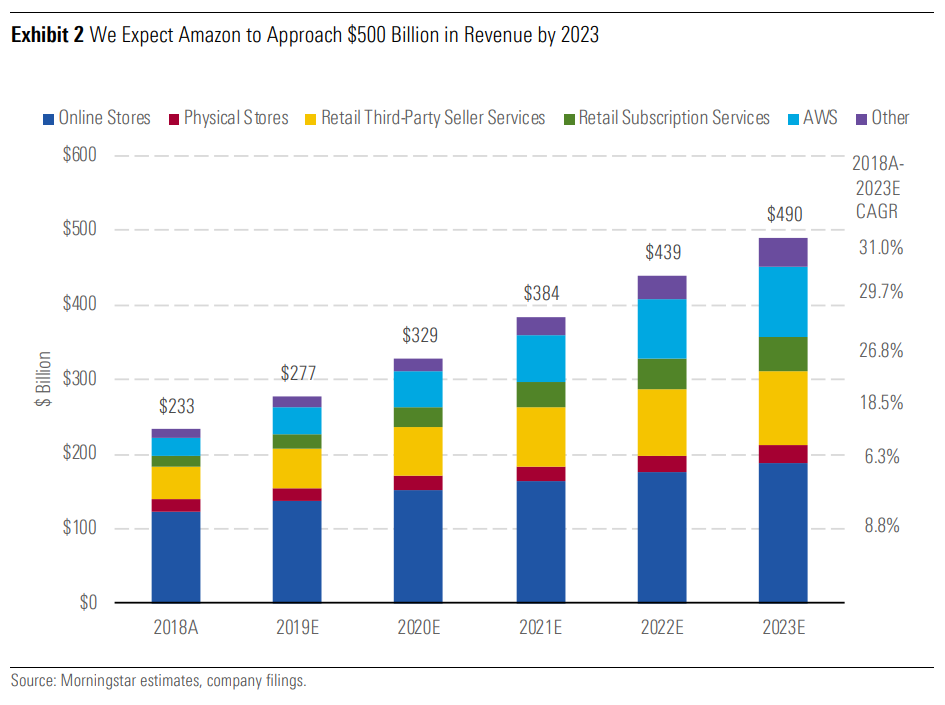

Our model assumes average annual revenue growth of approximately 16% for the five years ending 2023—including almost 19% in 2019—due to the contribution from physical retail formats, greater engagement among Amazon Prime members, increased third-party sales from its suppliers, digital content sales, international expansion, and nascent growth channels like Amazon Advertising and technology licensing. With respect to Amazon's sales mix, we forecast online retail revenue to grow 9% annually over the next five years, below our forecast of low-double-digit global industry revenue growth over the same period, but partly a byproduct of Amazon's ongoing shift to a third-party marketplace. On the basis of gross merchandise volume (GMV, which represents the total amount of Amazon and thirdparty products and services sold on Amazon's marketplaces), we anticipate midteens growth over the next five years. Our model forecasts that smaller segments like physical stores, third-party seller services, subscription services, AWS, and advertising will grow 6% (on a pro forma basis), 19%, 27%, 30%, and 31%, respectively, over the same period.

We forecast that gross margins will reach 43% over the next five years, compared with 40.2% in 2018. Amazon's growing clout with suppliers and advertisers, the higher proportion of third-party units in the sales mix, AWS' increased presence, and new advertising service offerings should allow for higher gross margins. We also forecast operating margin expansion through increasing expense leverage (particularly in the marketing and general and administrative expense line items), contribution from AWS, and accelerating third-party unit sales.

The bottom line

We continue to believe that Amazon is uniquely positioned to remain a disruptive force in online retail, cloud services, and advertising services, giving it multiple paths to cash flow generation and insulating it from a cyclical downturn. There are risks to the investment story, including mounting regulatory concerns in the U.S. and several international markets, calls for a separation of the company, increased competition from Walmart, Target, and others, and the risk of consumer fatigue and operational complexity as the company continues to grow. However, we believe recent membership/subscription revenue per Prime member and third-party seller service trends reinforce the network effect underlying our wide moat rating, and our deep dive into each business unit offers a closer look at the many ways Amazon can monetize its business in the future.

This article is an excerpt from the Morningstar Consumer Observer report, "Answering the trillion-dollar question: How do you value Amazon heading into 2020?"