Debt is a necessary evil for many Canadian millennials – especially if they want a degree or home. Everyone wants to be debt free as soon as possible. But sooner is not always better. Under the right conditions, investing is a faster way to build wealth than paying off debt.

“It all depends on the person. If somebody really hates debt, then by all means, pay off that debt first,” says Alim Dhanji, a Certified Financial Planner (CFP) with Assante Financial Management in Vancouver. “If your debt is costing you five per cent, then your guaranteed rate of return is five per cent. You can’t get a guaranteed rate of return in the stock market.”

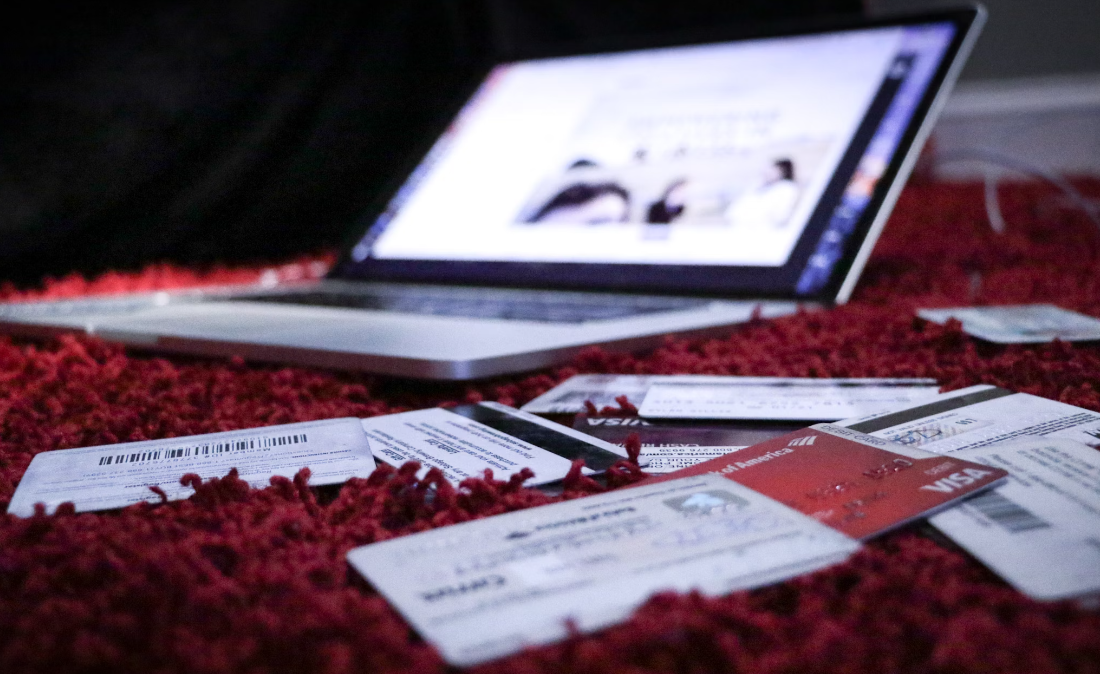

People with high-interest debt will benefit from paying off their debt first, according to Liz Schieck, a CFP at the New School of Finance in Toronto. “If there is consumer or credit card debt, that is the top priority. The interest rate is really high, it impacts your cash flow and your ability to save. The impact on your credit score can also be significant,” she says.

Paying off credit card debt will improve your cash flow because your monthly minimum payments will go down, Schieck adds, and “if you pay it off and something unexpected comes up, then that credit is accessible [again].”

It is worth considering investing when the interest rate on a loan is low and cash flow is manageable. The next step is determining personal risk tolerance and time horizon. Sun Life’s risk profile questionnaire and Vanguard’s investor questionnaire are free online tools that can help investors evaluate their comfort with risk.

Make a mortgage happen

“A mortgage is a very large debt that is going to be paid over a very long time,” says Cindy Marques, an Advocis board member and Toronto-based independent CFP. At the same time, she comments, “If you’re going to wait 30 years before you even start saving, you’re missing out on a lot of potential investment growth.”

It is possible for homeowners to earn higher returns on their investments than the rates they pay on their debt. While this spread can be attractive, a mortgage is a significant obligation and there are a number of factors to consider in deciding whether to invest before the mortgage is paid off.

Some homeowners aim to buy a second property to build equity – but they need enough cash to make the purchase. If this is the goal and, “You focus all your energy on [paying down your first mortgage], it’s going to take you forever to save up for that down payment,” says Marques.

Schieck says the safest route for millennials affected by the gig economy may be to prioritize paying down a mortgage. According to her, full-time stable jobs with benefits are on the decline, while freelance contracts with no guarantee of renewal are on the rise.

“Often, people are worried about the longevity of their career and their earnings,” Schieck adds. Without a reliable income, “It might be better to pay down the mortgage or any other obligations as quickly as possible so that they have the financial flexibility if they earn less in the future.”

“When I pay down my mortgage I have a line of credit that I’m able to use for investment,” says Dhanji. “My mortgage rate is close to around three per cent or so. I [expect to] generate five to seven per cent over the long run in a well-diversified portfolio. For me, that makes sense.”

Pay the minimum on student loans

If people can easily afford their student debt and it is their only debt, it’s fine to start investing, says Schieck. “Student loans, particularly government [ones], are generally closed. They’re usually the lowest priority of debt to pay off because interest rates tend to be lower and when you pay the loan off, you don’t get any access to that credit again.”

According to Schieck, “It’s much scarier to put money down on a student loan [because] you can’t have access to that credit again. It feels very permanent.”

When it comes to student loans, Dhanji says, it often seems like there is not a big enough spread in the market. Graduates pay about 5.5 per cent on their loans (as of Sept. 2019). Perhaps they can get five to seven per cent from an investment portfolio, he says. “I usually lean towards paying off debt for a few years and then [investing].”

Investing is the better choice for millennials looking to move out faster, says Marques. If you pay off your loans first, then your credit will be inaccessible. Investing first will free up capital to make a down payment and cover related costs.

Focus on financial flexibility

Millennials should be working towards their long-term financial goals but often they are uncertain about how to allocate funds, says Schieck.

When she asks clients what their goals are, they frequently mention owning property one day – if that’s possible in the Toronto market – or going back to school, or saving for retirement. Then again, “a lot of the time I get ‘I don’t know.’ ”

Schieck adds that when there’s uncertainty about what savings are for, the best answer may be to pay down debt and use a tax-free savings account, or TFSA. She says she makes a plan that offers the most flexibility. “I say all the time: financial flexibility is a financial goal.”