That electric car that silently cruised by you in the traffic this morning may still be a relatively novel sight on suburban roads but over the coming decade the wider automotive landscape is set for change.

In just five years’ time, battery-operated electric cars will compete with conventional cars on both price and performance. Fears over limited driving range and onerous charging times will diminish, and the electric vehicle – or EV – will no longer be seen as a cleaner but inferior rival to the internal combustion engine (ICE).

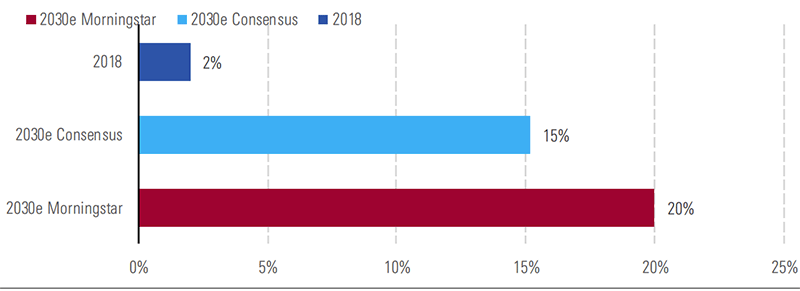

And widespread adoption of EVs will follow, according to Morningstar equity analyst Seth Goldstein, who is also chair of Morningstar’s electric vehicle committee. “By 2030, battery electric vehicles will account for one out of every five cars sold,” Goldstein says.

In the first of this two-part series, we will identify three industries that have the potential to benefit from EV adoption. In the next article, we will share stocks tips for the electric vehicle revolution.

EVs accounted for just 2 per cent of global auto sales in 2018, but signs of growth are there. And the “wildcard” in Goldstein’s eyes is charging infrastructure. In other words, when will the EV plug-in equipment be as easy to access as the humble petrol station?

In China, Europe and some parts of the US, this is already happening. “We forecast the second half of the next decade will see rapid EV adoption,” Goldstein says. “The 2020s will also be the decade of the hybrid, as these partially electric vehicles will reach 30 per cent of new auto sales by 2030. Indeed, by 2030, half of all new cars sold will be EV or hybrid.”

Battery electric vehicle share of global auto sales in 2018 and forecasts for 2030

Source: Morningstar, various forecasts, International Energy Agency, US EPA, EU ACEA, China People's Daily

How to play increased EV adoption

Many industries will be affected by increased electric vehicle adoption between now and 2030. Product lines and demand will evolve throughout the auto supply chain and ancillary industries. Here is a summary of views from Goldstein around the industries that he believes have the potential to benefit.

Auto suppliers

Suppliers to electrified powertrain vehicle programs have more potential benefit for investors than the mass-market automakers. Suppliers' technologies include engine components that increase fuel efficiency, the electronics that control propulsion systems (ICE, Hybrid, EV), battery power optimization, electric drive motors, and torque transfer devices that send power to the wheels.

The mix of powertrain that automakers produce will be managed to meet government clean air standards and optimize asset utilisation while providing consumers with competitive pricing. We expect industry adoption of hybrid-powertrain to drive battery and electric motor demand to higher volumes that enable better economies-of-scale while maintaining ICE volumes to maximize utilisation.

Lithium

Lithium is one of the best ways to invest in electric vehicle and hybrid adoption as it is the required energy storage component in all transportation batteries. The need for lithium to power electric vehicles and hybrids exists regardless of battery chemistry or auto brand.

Lithium demand will quadruple over the next decade as electric vehicle adoption increases. This will create the need for a similar increase in supply, incentivizing higher-cost supply to come online and increasing long-term prices.

Ultimately, lithium producers' returns will be driven by their position on the cost curve. We like low-cost lithium producers who are already operating, as brownfield capacity expansions are cheaper and carry less execution risk.

Utilities

By definition, electric distribution utilities will be the "fuel" providers for EVs. In addition, utilities are already among the initial investors in charging and other infrastructure to support EVs.

We expect utilities will continue to be key investors in the supporting infrastructure for many years. The potential for electricity demand growth is minimal, but we expect it can help partially offset the substantial headwinds from energy efficiency.

Additionally, US utilities are seeking regulated returns for EV infrastructure investment, which provides earnings growth for investors.

.jpg)