The US stock market has provided four out-of-body experiences during the past half century:

-

The 1973-74 bear market

-

Black Monday

-

The New Era's rise and fall

-

The 2008 financial crisis

In each instance, the markets took over the broadcast news. It's not normal for investments to own the headlines. They are customarily treated as ancillary dispatches, along with the traffic, sports, and weather, rather than as items that affect the entire nation. But on occasion, stocks force their way to the forefront. When that happens, everybody cares how the Dow Jones finishes on the day.

Oh, did we ever on 19 October 1987! That was the most shattering stock-market performance of my lifetime. At the time, I owned no stocks, nor did I expect ever to do so. (I was not born into an investing family.) Nonetheless, I spent that day searching for a radio, listening in horror to what seemed to be a national collapse.

Federal Reserve chief Alan Greenspan was caught unaware. He knew that the markets had started badly, then boarded a plane. When his flight landed, he asked how the Dow had fared. The answer was "Down 508" - the largest one-day percentage drop in the index's history. Greenspan was pleased. He interpreted that response as meaning "Down 5.08."

Receiving breaking news on the radio, with a senior federal official flying in silence. Technology has certainly changed. However, the investment issues that underlie Black Monday persist.

It's only academic

So much for the stock market's alleged efficiency. Try as one might - and some did - there was no explaining why a stock index that was worth 2,246 points on Friday afternoon should trade at 1,738 points one business day later.

The intervening economic news had not been unusually bad. Tensions were high in the Persian Gulf, and the dollar's weakness sparked concern, but those were ordinary, ongoing dangers. There was no way to square the stock market's behavior with the economic fundamentals.

As this Wall Streeter explains, "The crash of 1987 was largely a trading event, not a fundamental or economic one." The market's mechanisms jammed. Such a problem falls outside the academic purview, as the efficient-market hypothesis doesn't trouble itself with trading issues. Once market participants have established their prices, they seamlessly buy and sell at their desired levels.

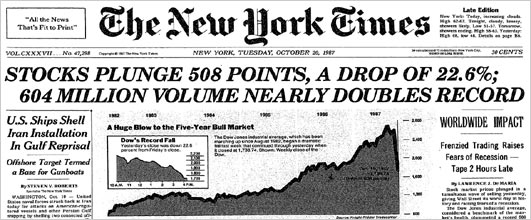

How the New York Times reported the crash on 20 October 1987. Source: jpkoning.blogspot.com

There was nothing seamless about Black Monday's trading. Sell orders overwhelmed market makers. Plummeting quotes spooked potential buyers. Stock-index prices dropped below those of the underlying securities, which encouraged stockholders to sell their merchandise and buy the cheaper index future. Such actions did provide some support for the index futures, but they further damaged the stocks themselves.

In short, the day was a mess. It illustrates that although the efficient-market hypothesis is a fine approximation of the truth, an approximation is not the truth. Exceptions exist, and sometimes they are very meaningful. More broadly, academic insights should be consumed with a helping of salt. They typically carry both stated and unstated assumptions.

Upshot: With academic findings, trust but verify.

When chaos reigns

The causes of the trading failure were widely debated. Most researchers faulted the newfangled technique of portfolio insurance, which (apparently) caused the decoupling of stock-index prices with those of the underlying securities.

However, as index and securities don't confess, the evidence was circumstantial, and it was acknowledged that Black Monday's glitches were too large and numerous to be explained by portfolio insurance alone. Other factors were also at work.

The exact details are unimportant today. What matters is the recognition that change can create instability. Inevitably, the stock market's traits evolve. Its participant base transforms (in recent decades, from individuals to institutions, and from active management to passive management), the investment techniques adapt, and the trading platforms incorporate new technology. The effect of these items cannot be understood in isolation. They affect each other in a fashion that is extremely difficult to predict.

Of course, people try. Researchers often argue that exchange-traded funds destabilise the stock exchanges. Perhaps, but I don't place much faith in forecasts that attempt to pinpoint the specific agents. The task is overly ambitious. The larger point, for me, is that stocks are sometimes beset by chaos. It arrives in stealth, wreaks its (sometimes enormous) damage, then departs. That is no fun for anybody.

However, such disorder has an advantage, in that it makes stocks relatively less attractive than bonds, thereby increasing the potential return for equities. The pain increases the pleasure. (This column gets no racier than that.)

Upshot: The system is not entirely stable.

The charts giveth, and the charts taketh away

A fortunate few made a bundle of money on Black Monday by shorting stocks. The most fortunate - and fewest - were those who were not regularly bearish (if they had been, they would have suffered through the previous years' bull market) but who somehow anticipated the oncoming disaster. Upon such a success were entire investment careers built.

Those who accomplished such a feat generally did so through technical analysis. As the northern autumn of 1987 began, some noticed similarities between the stock performances of 1929 and those of 1987. Lay one chart against another, adjusting for the difference in raw prices so that the scale was similar, and the second year seemed to echo the first year's pattern. Get out!

In Black Monday's aftermath, many others studied the 1929 charts - which demonstrated that after a sucker's rally, stocks would decline again. The number of bears grew. In early 1988, however, equities rose off the floor, turning a modest profit for that year, and appreciating 30% the following year. The lesson of 1929 fizzled.

(For another false alarm, see here.)

Upshot: Technical analysis works like a broken clock, rather than like clockwork.

Tail of the dog

Ultimately, the biggest stock-market decline in modern US history meant pretty much nothing. A few people panicked, which led to the occasional layoff, among them yours truly. (A fine termination it was. I was released in December 1987 from an 18-person go-nowhere company, and hired two months later at this 18-person company. Lucky does indeed beat good.) But for the most part, the economy hummed along.

Which ultimately restored stock prices. Faith in the market's stability had been severely shaken, but gradually those fears were overcome by basic math. As companies continued to grow their earnings and dividends, and inflation remained reasonably low, stocks became the offer that investors couldn't refuse. True, the headlines were dour, and pundits continued to suggest that the economy might suffer the stock market's fate, but a bargain is a bargain. Buyers returned.

To an extent, this same pattern repeated at the conclusion of the New Era. From 2000 through 2002, technology stocks declined almost 80 per cent. However, while there certainly were flameouts in Silicon Valley, the technology industry itself held up fairly well. Stocks bad, corporate results reasonably good. The US didn't escape recession entirely, but the economic damage was far lighter than the stock-market damage.

Upshot: Stock-market crashes might sometimes forecast a recession (2008), and they might coincide with one (1973-74), but they don't cause recessions. The tail does not wag the dog.