Despite worries about global growth and ongoing U.S.-China trade tensions, equity markets are moving upwards, and veteran stock-picker Hilda Applbaum remains upbeat and focused on bottom-up stock selection.

Delicate growth

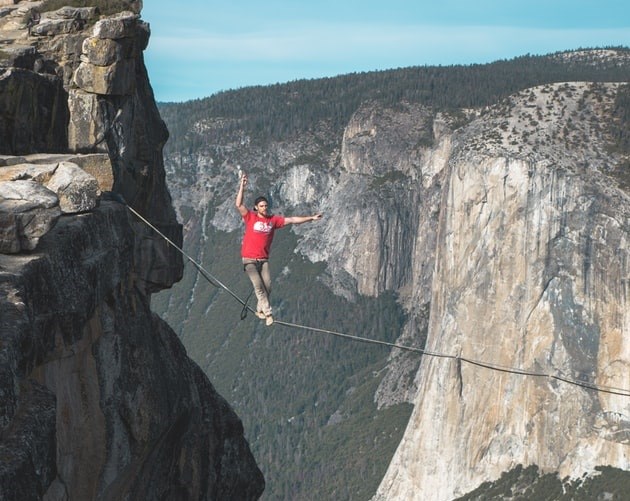

“We’ve all heard the expression ‘bull markets don’t die of old age,’ but I would suggest that bull markets probably become a little more fragile,” says Applbaum, a San Francisco-based portfolio manager at Capital Group Companies and lead manager of the 5-star rated $1.2 billion Capital Group Global Balanced Fund. “That has a lot to do with the fact that valuations start to get stretched. I do see a reasonable runway for the equity markets. But the analogy I would use is that it feels like we’re walking a tightrope. There is a safe path to get us from here to the end, without falling. But it takes much less of a wind or bad news or a disappointment to make you topple off that tightrope, than if you were on more solid ground.”

A 32-year industry veteran and a native of New York who joined Capital Group in 1995 after several years as an economist, Applbaum does not see any reasons why equity market cannot continue to do fairly well. We can safely get good returns, she says, albeit less strong than we have experienced this past year. “If you think markets return 8-10% on average and you get an exceptional year, then the chances are likely that the following year may be less generous in terms of returns. But they continue to be positive,”says Applbaum.

Trade tensions and musical chairs

The possibility of trade tensions spreading beyond the U.S.-China conflict to other countries is a concern, Applbaum admits. But there are also political uncertainties looming on the horizon with a number of elections in 2020, including those in Taiwan, Indonesia, Venezuela, and of course the U.S. “With elections come the potential for new leaders and some disruption. I don’t have any one great concern. But there is uncertainty in the world, whether it is market-related or country-related or whether there are political tensions or wars. Yet there is no one thing that I believe can single-handedly derail continued economic growth.”

From a strategic viewpoint, Applbaum admits the team has become a little more conservative, as they have raised the cash portion to 9% of the fund, and the bond and stock portions have declined somewhat.

Applbaum emphasizes that from an equity standpoint, her six-person team’s finding opportunities through a bottom-up orientation. “While we may be a little more conservative in terms of our overall posturing in equities, we are very enthusiastically finding companies to invest in for the long term,” says Applbaum. “It’s important to highlight that we have a cadre of 50 equity analysts who do bottom-up research, meet with company management continuously, and know these companies over many years. They really get to know companies in great detail.”

Applbaum says the portfolio is managed by four balanced managers and two fixed income managers, with each manager looking after his or her particular sleeve. “Within each of the balanced sleeves we are making a bit of asset allocation decision, deciding on how much stocks, bonds and cash we own. That helps to inform the overall asset mix in the fund,” says Applbaum, adding that as the principal manager she has the final decision on how the fund is allocated. Beside herself on the equity side, there is Paul Flynn, Anirudh Samsi and Tomonori Tani, while Thomas Høgh and Robert Neithart are on the fixed income side.

Bond bets avoid negative rates and long durations

Within the bond portion that accounts for 34% of the fund, the managers are investing the bulk of the exposure in sovereign bonds in developed markets, with the U.S. accounting for the largest country weighting at 19% of the portfolio. “We think about it as a cash and bond allocation. But since we are now holding a little more cash and fewer bonds we are being a bit more cautious. Some of that has to do with the fact that some regions have negative interest rates,” says Applbaum, referring to countries such as Germany and Japan that make investors pay to hold their bonds rather than pay them interest. The managers are also cautious on duration since it is four years, versus six years for the benchmark Barclays Global Aggregate Bond Index. The fund has a running yield of 2%, after fees.

Within the 57% equity portion, technology is the largest sector at 19% of the total equity weighting, followed by 17% healthcare and 17.2% financial services. On a geographic basis, the U.S. accounts for 25% of the fund. There is also 20% in Europe and the U.K., and 7% emerging markets. “Whether it is Asia or the U.S., but less so Europe, technology has been the engine of global economic growth. It’s no surprise why it’s heavily represented.”

Taiwanese tech and European pharma

One of the top names in a portfolio with about 100 equity holdings is Taiwan Semiconductor Manufacturing Co. Ltd. (2330), the world’s largest manufacturer of integrated circuit boards. The name has been in the portfolio since the fund’s inception in August 2015. “It is lowly-valued and has a good dividend yield, and in a space that continues to grow as the world uses more semiconductors and circuits and the world becomes more connected,” says Applbaum. “They have the largest market share in the leading-edge technology and they stand to be a significant beneficiary from the move to 5G telephony. They are in a growth sector because we are using much more of what they make.” The stock is trading at about 18 times forward earnings and pays a 3.7% dividend yield.

Another favorite is AstraZeneca PLC (AZN), a British/Swedish pharmaceutical firm. “It’s been the beneficiary of a multi-year turnaround. We met with management to understand their pipeline and what went wrong [in the past] and why they had a dry spell in research and development for a number of years. And, most important, how they changed that,” says Applbaum. “That gave us insights into the change in philosophy in terms of their development pipeline. They now have premiere drugs in the oncology space that are only in the beginning stages and could pay benefits for a considerable time.” The stock, which pays a 2.9% dividend yield, is trading at 27 times 2019 earnings.

From a performance standpoint the fund has returned 10.32% year-to-date (October 31), versus 10.22% for the Global Neutral Balanced category. Over three years, however, it averaged 7.6%, compared to 4.94% for the category average.

Looking ahead, Applbaum is confident positive returns are sustainable, so long as one looks out five years to 10 years. “If you think of a market that is long in the tooth, you’d want a balanced portfolio of stocks and bonds,” says Applbaum, noting the fund has also benefited from low volatility. “And you’d want a fund with a fairly conservative bent and someone with a proven track record. Clearly, we shape the asset mix a bit, but we have to have a minimum 45% in equities. That’s prudent for someone trying to build their capital at any stage of their life.”