Cannabis companies are poised to see sales grow by nearly nine times through 2030 as legalisation gains popularity and distribution widens, according to Morningstar’s latest research.

The US recreational, US medicinal, Canadian, and global medicinal export markets have penetrated just 8 per cent, 21 per cent, 11 per cent and 19 per cent of their estimated markets respectively. We believe this large, underserved market will provide top-line growth and fixed-cost leverage for cannabis companies, supporting a “green rush” through at least the next decade.

These findings are among the key takeaways detailed in our Basic Materials Observer on cannabis market growth. The full report provides a playbook for investors seeking exposure to different cannabis trends, as well as market-size forecasts and regulatory outlooks for major cannabis markets.

Here we explore some of our findings about the current state and future expectations of the cannabis industry in the US, Canada, and international markets.

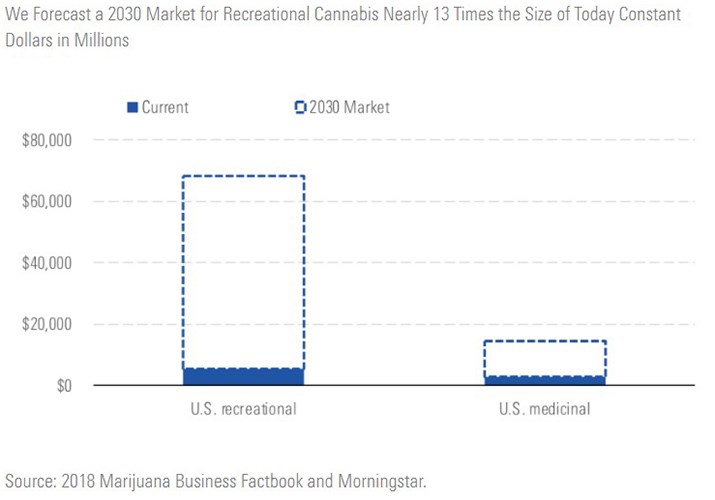

US cannabis market outlook: massive growth in recreational and medical markets

The recreational cannabis market is larger than the medical market both at its current size and long-term estimate. The current market estimate of the legal recreational market is about $5.4 billion, primarily dominated by the western US, where recreational legalisation is more common and distribution more developed. As shown on the chart below, we estimate the market will become nearly 13 times larger by 2030, at roughly $68 billion in constant dollars (representing about 25 per cent average annual growth).

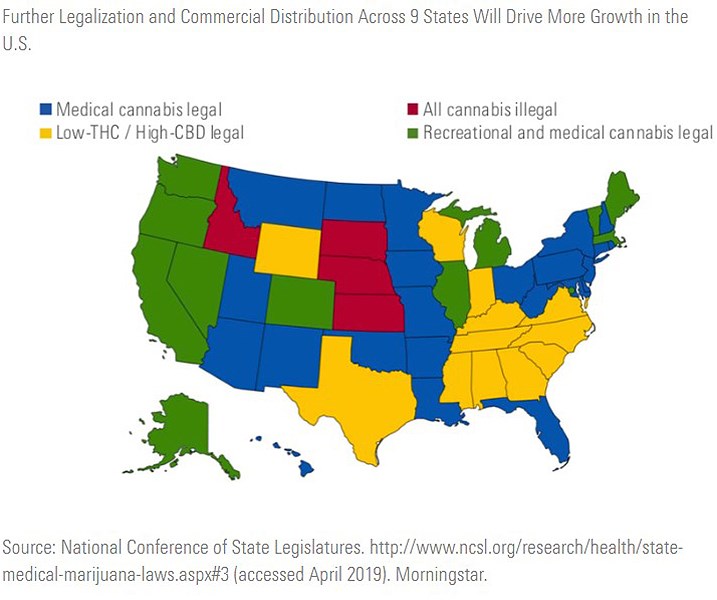

Legalisation is expected to expand at both the state and federal levels. Laws differ greatly from state to state. As shown on the chart below, as of May 2019, 23 states have legalised medical cannabis, 12 states have legalised low-THC/high-CBD hemp or cannabis derivatives, and 11 states and Washington DC, have passed laws legalising both recreational and medical cannabis.

By 2030, we expect legalisation to take effect in nine more states. Six states are expected to legalise recreational cannabis (Connecticut, New Hampshire, New Jersey, New Mexico, New York, and Rhode Island). Three states have already passed legalisation (Michigan, Vermont, and Illinois), and implementation is ongoing. Commercial operations are expected to expand in the next decade as these programs are applied.

The federal government may be legally prevented from interfering in cannabis operations and consumers operating within a state’s laws. We contend that this is the most likely resolution to the federal and state legal discrepancy. This would mean states that legalise or have already legalised cannabis will not be inhibited from doing so. However, it would also mean states that have showed staunch opposition to legalisation would be able to continue to prohibit it.

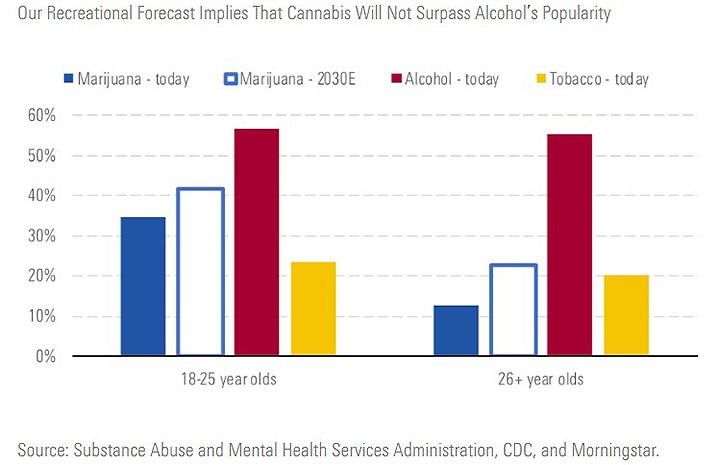

Robust recreational growth doesn’t rely on significant participation expansion. Our forecast (shown on the chart below) implies that cannabis won’t surpass alcohol in participation rates but may modestly exceed today’s participation rates for tobacco. In other words, tremendous market growth doesn’t need to come from converting nonconsumers, just from converting existing black-market customers to the legal market.

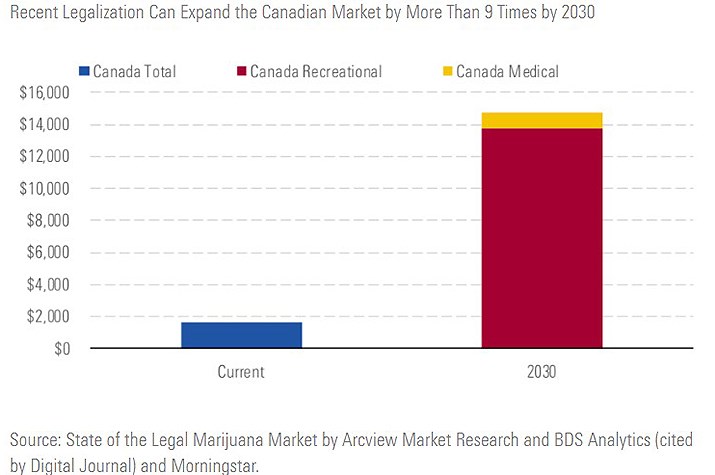

Canadian cannabis market outlook: forecasted to be nine times larger by 2030

Unlike the confusing US cannabis laws, Canada’s laws are very clear: Recreational cannabis was legalised in June 2018 when Canada’s House of Commons and the Senate approved Bill C-45 (the Cannabis Act). The law took effect in October 2018, making Canada the second country after Uruguay to fully legalise cannabis for adult use.

Canada’s current market penetration is at just 12 per cent of the market, shown below. This leaves a significant runway for growth and underpins our forecast that cannabis sales will grow nearly 20 per cent per year on average.

International cannabis market outlook: medical growth expected, but competitors emerging

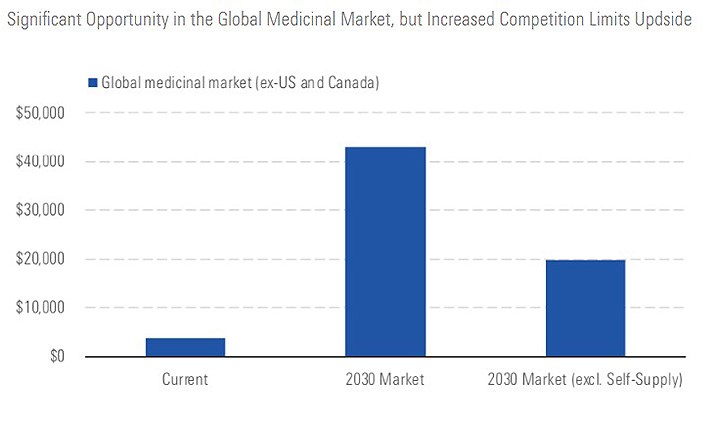

Increasing interest in medical cannabis may create further demand. Internationally, a growing number of countries have recognized the benefits of medical cannabis and are expanding access. This widening legalisation is expected to create further demand. Still, the global market (excluding the US and Canada) remains severely underpenetrated, leaving room for it to expand to more than 11 times its current size.

We forecast total-market potential of nearly $43 billion by 2030 with the addressable market at $20 billion. This forecast is a substantial increase from the current global medicinal cannabis market (excluding the US and Canada), which we size at roughly $3.7 billion based on estimates ranging from $3.5 billion to $11 billion from Coherent Market Insights and Research and Markets, as shown on the chart below. More than half of the market potential over the next decade lies in countries that will expand their own cannabis production, limiting the opportunity for exporters.