Rather than simply following the returns of an underlying index, a third of Canada's 947 exchange-traded funds (ETFs) forge their own path and take an active path to produce coveted alpha.

Actively managed ETFs have continued to gain popularity in Canada making up roughly one-quarter of the ETF market by assets under management. Justifiably so, as they provide easy access to professional management and can be a great choice for self-directed investors.

So how do I choose?

The first consideration above all else is to consider the asset class for which you want to be exposed to. Morningstar leverages a Canadian standardized classification system that is meant to help investors understand the underlying holdings within a fund. Examples of classifications include Canadian Equity, Global Fixed Income, Canadian Dividend Income and Equity and Money Market. All funds must be assigned to a category, and categories are reviewed quarterly.

Stars

The Morningstar rating overall, known to most as the “Star” rating, is a backward-looking assessment of risk-adjusted return against similar funds. Ratings range from one to five stars, where funds receiving five stars have outperformed their peers historically. The star rating is a great starting point to understand which funds have historically performed the best within a category.

Medals

The Morningstar Quantitative Rating, or the “Medalist” rating – a forward-looking assessment of funds’ prospective ability to outperform similar funds after fees, based on five factors: people (the quality of management team), process (the effectiveness and consistency of the investment process), parent (organizational structure and talent retention), performance, and price (fees). Ratings include gold, silver, bronze, neutral and negative. As a group, gold medal funds outperformed silver medals (which outperformed bronze medals) twelve months after receiving the rating over the 2019 calendar year.

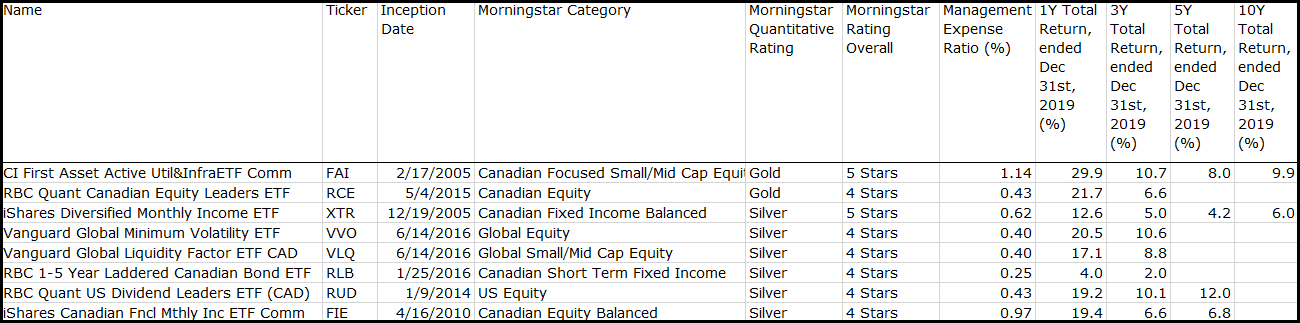

To qualify, the fund must be rated four or five stars and must have a medalist rating of Silver or Gold.

What we found

We used Morningstar Direct to pull the relevant information on the funds from the screen, inclusive of their trailing returns, management expense ratios, category membership, and inception dates. The funds appear in no particular order. It is worthwhile to note that although each fund is well-rated, investors are urged to pay attention to the category to which the fund belongs, which is an indication of the types of holdings in the fund and whether those holding types fit appropriately into your asset allocation and risk tolerance.

.jpg)