Editor's note: Read the latest on how the coronavirus is rattling the markets and what you can do to navigate it.

For many Canadian households, the current pandemic isn’t just a health crisis, but a financial one as well. Unemployment claims are spiking, and while government support measures may help, many individuals will struggle to pay their bills. They’ll need to get their hands on some cash.

Canada recently announced its COVID-19 Economic Response Plan to try and stabilize the country’s economy. The plan includes short- and long-term income support measures, including changes to Employment Insurance eligibility, support while you may be caring for loved ones affected by COVID-19, and options for individuals that might not qualify for E.I., for up to 76 weeks.

With these developments in mind, let’s survey the options for individuals who still need additional funds. Although an individual's own circumstances will affect the attractiveness of these sources of financing, I've ranked them from the ones that are generally the most palatable (fewest strictures and costs, least disruption to long-term plan) to the least attractive (highest costs, most onerous taxation).

1. Your own cash reserves

The starting point for anyone in search of emergency cash should be the obvious: an emergency fund, specifically earmarked for times like these. Because emergency funds are meant to offer ready access to cash, they should be held outside of tax-sheltered wrappers and include highly liquid investments like bank savings accounts, money market accounts, and so on. If you’re working, your emergency fund would ideally hold a minimum of three to six months’ worth of living expenses; retirees should target one to two years’ worth of anticipated portfolio withdrawals.

2. Low-risk assets in non-registered accounts

Assuming you’ve depleted your emergency fund still need cash, your next step should be to take a look at other taxable holdings that you have: investments in brokerage accounts, outside of tax-sheltered vehicles. When identifying possible securities that you could sell to raise funds, focus on liquidity, tax consequences (capital gains/losses and income tax), and any commissions you’ll owe to sell.

In a best-case scenario, you’d have a short- or intermediate-term bond fund that you could sell. It’s reasonably liquid, if not quite like cash, and you’d already have paid taxes on most of your gains, in that income distributions are taxed as you receive them. But liquidating longer-term investments could make sense, too, especially if you’ve recently purchased them and could take a tax loss or you expect to be in a low tax bracket this year, meaning that any gains would be taxed at a low rate.

Also, although TFSAs are registered accounts, you can withdraw from them at any time and without a tax penalty. Whatever you withdraw will be added to your contribution limit next year. TFSA’s particularly useful if you’ve been (improperly) using them as a savings vehicle, rather than an investment vehicle. If you’ve been collecting cash and now you need it, feel free to use it.

3. Hardship withdrawals in registered, locked-in accounts

Just because your hard-earned money is in a ‘locked-in’ account, it doesn’t mean it’s off-limits if you’re in urgent need. Locked-in Retirement Accounts (LIRAs), Life Income Funds, or Locked-in Retirement Income Funds may not be legally drawn upon until a certain age, but they do have provisions that allow for special access in times of financial hardship.

Eligibility for special access to your funds depends on the province in which the account was created. An application for these types of withdrawals must be submitted to your financial institution, with reasons for withdrawals. For example, in Ontario, reasons include low expected income, payment of first and last months’ rent payment on a principal residence, arrears of rent or mortgage payments, and medical reasons.

4. Life insurance cash

Cash values that have built up in your whole life insurance or variable universal life insurance policy can be another decent source of emergency cash. You can withdraw money outright and have it deducted from your policy's face value--for example, if you withdrew $15,000 from a policy with a cash value of $50,000, your heirs would receive $35,000 when you die. Those withdrawals are tax-free, assuming they don’t exceed your cost basis (the amount you’ve put into the policy).

Another possibility, albeit a less attractive one, is to borrow from the cash value of your life insurance. You'll owe interest on the loan, payable to the insurance company. These rates can be reasonable but aren't always low, so it pays to check with your insurance agent to determine whether a loan is competitive with other sources of emergency funding. Also, be mindful that life insurance loans may come with additional costs--for example, the insurer may reduce the dividends being paid into your policy for as long as you have the loan. If you take a loan from your insurance policy's cash value, you will not owe taxes, but the interest you pay is not tax-deductible.

5. RRSP loan

The COVID-19 Economic Response Plan extended the tax filing deadline to June 1 if you need some time on your taxes owed. However, if you still need some relief when the time comes, and you have some contribution room left, you could consider an RRSP loan. This will allow you to reduce an immediate liability with money that you’re putting to work. RRSPs loans usually must be paid back within one year.

6. HELOC

Tapping your own assets is invariably a better way to scare up cash than borrowing from someone else. But if you find that you must take out a loan, using a home equity line of credit is one of the better ways to go about it. Essentially, you're borrowing against any equity you've built up in your house.

On the plus side, interest rates on HELOCs may be reasonable, particularly if you maintain a good credit rating, have a fair amount of equity in your home (which also makes it less likely that you'll default), and aren't taking out a huge loan.

On the downside, if you're not a perfect borrower, you could be asked to pay an unfavourably high interest rate or be denied the line of credit altogether. And if you end up borrowing more than you actually have in equity in the house, should you need to sell in a hurry, you'd have to cough up the difference. Finally, the interest on HELOCs is no longer tax-deductible unless the funds are used for home improvements, and in any case, many taxpayers benefit more from claiming the standard deduction than they do with itemized deductions.

7. Reverse Mortgage

A reverse mortgage allows homeowners older than age 55 (if you have a spouse, both of you must be at least 55 years old to be eligible) to receive a pool of assets that represents the equity in their homes. The homeowners don't have to repay the loan as long as they're in their homes, but when they do leave, the borrowed amount, plus interest, is deducted from the home's value. Qualifying for a reverse mortgage will depend on the location of your home, the type of home (detached, condo, townhouse), the appraised value and condition of the home, and the amount of equity you’ve accumulated in the home. Reverse mortgages rates can vary widely, so if such a loan appeals to you, you'll need to shop around and read the fine print; the loans can be costly and complicated.

8. Margin Loan

A margin account allows you to borrow against the value of the securities in your brokerage account. Margin accounts are used most frequently by traders who want to buy more securities, but the money you extract from your margin account can be used for anything.

This option would be most attractive for those who have assets but don't want to sell them because that would mean unloading them at a bad time (like right now) and/or incurring tax consequences. If you expect to be able to repay the money in short order and are trying to decide between taking a margin loan or selling securities to raise cash, the margin loan could be the better bet.

On the downside, interest rates aren't always attractive relative to other sources of financing. The bigger knock against margin loans--particularly for someone who's on a shaky financial footing to begin with--is that they're risky. The reason is that the securities in your account serve as your collateral, and the securities' value can fluctuate with the market. If your collateral drops below a certain level because of market declines, you're going to receive a "margin call." Essentially, that means your brokerage firm will require you to deposit more money or sell the securities to bring your collateral amount up to a certain percentage. If you don't have the cash at the ready, you can end up in an even bigger financial bind than you started with.

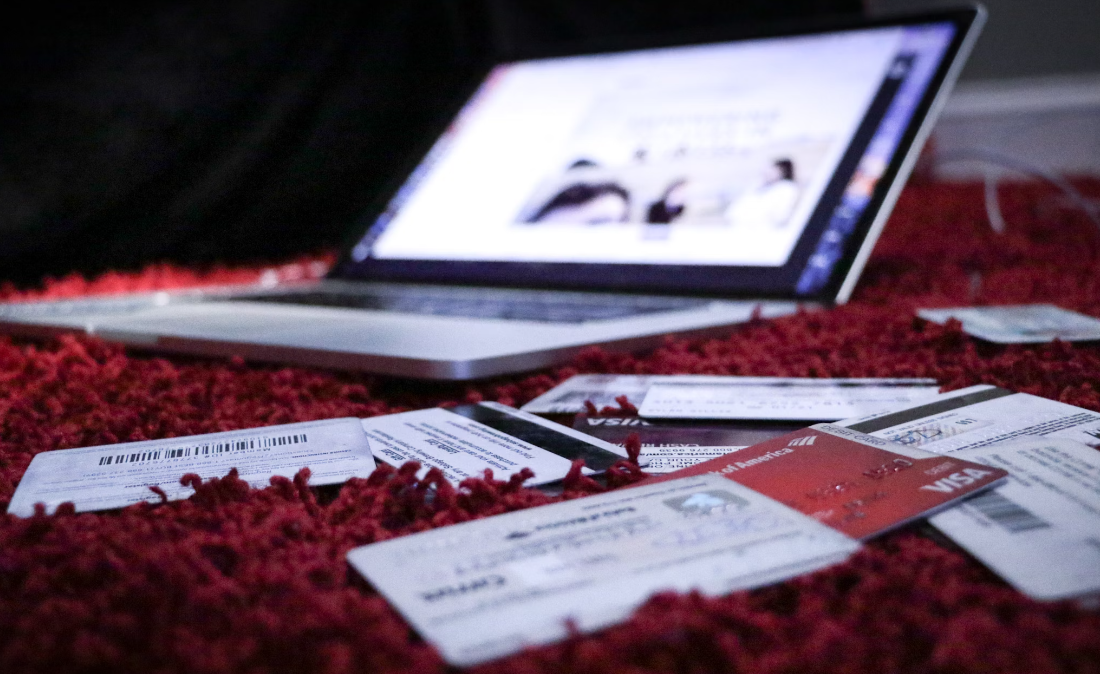

9. Credit Cards

This option is pretty straightforward and usually not a great idea for reasons that most consumers will understand. True, some consumers have been able to play credit cards like a fiddle, shifting balances among cards with ultralow teaser rates and incurring little in interest along the way. If that's you, more power to you. For the rest of the world, credit cards are the single easiest way to wreck your financial standing. Not only are interest rates high, but credit card companies have every incentive to keep you paying for as long as possible. Thus, the minimum payments they require don't make a dent in your loan's principal.