This article is part of our Earth Week special report

Although the concept of responsible investing is not new, it has certainly made its way to the limelight over the last number of years, capped off by a substantial inflow of funds into these products in the US and coupled with a record high number of sustainable product launches. In Canada, there have been 64 new sustainable fund launches in the last five years, including 11 new products launched so far this year. Many Canadian financial institutions are also signatories of the United Nations Principles of Responsible Investing which shows commitment to incorporating environmental, social and governance (ESG) issues into the investment analysis and decision-making process.

The COVID-19 pandemic showed investors that the choice between investing sustainably and performance are not mutually exclusive. In the US, the majority of sustainable investments outperformed their peers through the deep drawdown seen over Q1, a trend that we’ve also seen amongst Canadian fund managers.

Morningstar defines sustainable investments in three ways:

(1) ESG Funds - funds that use ESG considerations when picking companies or are actively engaging with company management around these areas

(2) Impact Funds - investment strategies that seek to make a measurable impact alongside financial return on issues like gender & diversity, community development, etc., or

(3) Environmental Sector Funds - funds that invest in environmentally oriented industries, such as renewable energy or water.

To understand which of these identifications are appropriate for a fund, Morningstar looks directly to the regulatory filings from the fund manufacturer inclusive of their prospectus and related documents. All three of the above classifications are considered sustainable investments by Morningstar.

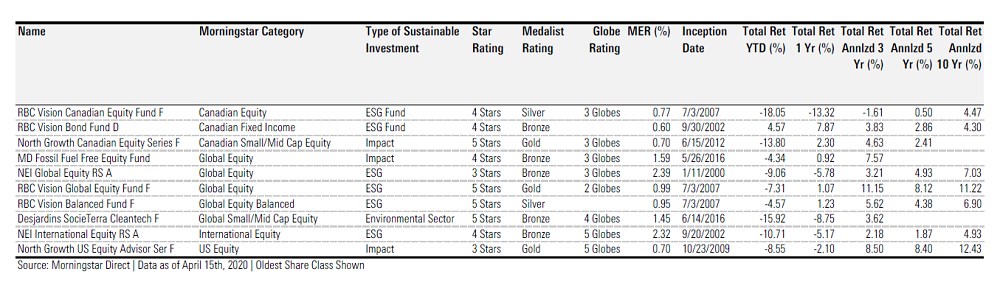

This framework applies to both mutual funds and ETFs. In Canada, Morningstar has identified 105 such funds. Of these funds, here are some that have had a three-star or better performance and have a medalist rating of Bronze, Silver or Gold:

For a higher-resolution image of the table above, click here.

As always, it is imperative to pay attention to the category to which the fund belongs as an indication of the fund’s underlying holdings. Companies in the global equity category will have a very different risk/return profile than that of a Canadian fixed income fund. The star ratings above are measuring the funds’ risk adjusted returns against their own peer groups.

Readers will also notice in the table the Morningstar Globe rating, which is an assessment of the aggregate ESG risk rating of the funds’ underlying equity holdings provided by our partners at Sustainalytics. The ESG risk rating measures the degree to which a company's economic value may be at risk driven by ESG issues.

It's important to mention that many sustainable funds have shorter histories and may not have an associated star rating just yet, since Morningstar requires 36 months of history before assigning a star rating. This does not mean that they won’t turn out to be great performers over the long run.

This article does not constitute financial advice. It is recommended to speak with a financial advisor or investment professional before investing in any of the funds listed here.

Are you getting the right returns?

Get our free equity indexes to benchmark your portfolio here