Oil prices have gone negative this week for the first time in history. But what does this phenomenon mean and is a cue for investors to buy the black stuff?

Crude oil prices were more than US$100 a barrel as recently as August 2014. But a double whammy of a global fall in demand because of the Covid-19 lockdown and an oversupply of the commodity by oil cartel Opec has seen prices nosedive.

The dramatic move is enough to make many investors conclude that now is an ideal time to buy oil. The simplest way for investors to do this is to buy an oil exchange-traded commodity. ETCs are similar to an exchange traded fund, or ETF, but do not meet the diversification requirements need for fund status because they are only exposed to one thing.

The United States Oil Fund (USO) is one of the most well-known oil-based ETCs, and offers a cautionary tale to prospective investors as its managers scrambled to change its structure, multiple times in the recent weeks, amidst plummeting oil prices.

Before you hit the buy button, there are some important things to consider:

How Do ETCs Track Oil?

It is at times like this that the proverbial devil lurking in the detail comes out to play. The first thing to understand about oil ETCs is that they don’t track the spot price of oil. Unlike most gold ETCs, these vehicles don’t buy and sell the physical commodity. This is because oil is costly to store and transport. Instead, they invest in highly liquid futures contracts (a type of derivative) which have their own pricing dynamic.

To maintain a steady exposure to the price of oil, these ETCs invest in futures contacts promising to purchase physical oil at a set point in the future. Just before the contract expires and it is obliged to physically take ownership of the oil, the ETC sells that contract and replaces it with an equivalent contact with a longer date to expiry. This cycle is repeated at predefined intervals throughout the year.

Do You Contango?

The current glut of oil has filled up global oil storage facilities. As they near capacity, fewer investors are willing to take physical delivery of the commodity, so buyers for the contracts closest to expiry have dried up.

Many investors left holding these contracts have no wish or ability to receive physical delivery of barrels of oil and are willing to pay others who can, to take these contracts off their hands. This has pushed the price of futures closest to maturity into negative territory – it means the investors that hold these contracts are effectively paying someone else to take the oil off their hands.

The global oversupply is expected to be temporary, which is why contracts for delivery later in the year are trading at a much higher price.

This leaves a rule-based ETC facing serious ‘rolling’ costs, as it pays to offload short-term contracts and buys much pricier longer-term contracts. This results in an extreme case of what is known in commodities jargon as contango.

Contango Erodes Returns

In this case, even if the oil spot price is rising, the contango losses caused by repeatedly selling cheap contracts and buying expensive ones can more than offset gains, resulting in net losses to the ETC investor. In fact, the relatively high storage costs of oil mean that the crude market is in contango more often than not, creating a significant headwind for long-term investors.

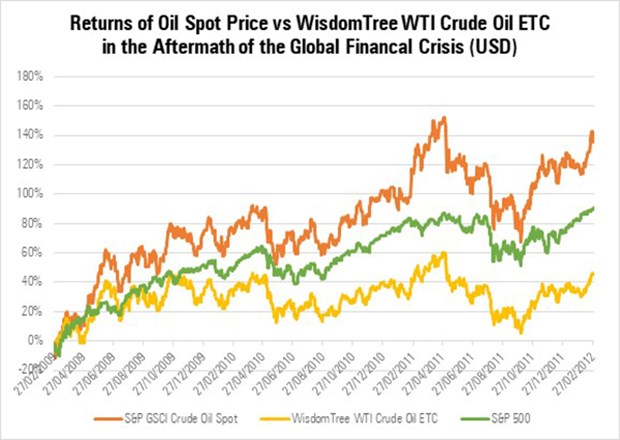

The graph below shows the performance of the most popular crude oil ETC in Europe versus the spot price of oil as markets recovered following the global financial crisis of 2007/08.

The comparisons in performance are stark. In the three years of recovery following the crash, in dollar terms, the spot price of oil rebounded an impressive 138%. Over the same period, the WisdomTree WTI Crude Oil ETC rose just 45%. This large disparity in performance can primarily be attributed to the return sapping impact of rolling futures contracts under contango.

Buying cheap oil using an ETC may seem tempting, but the complexities and idiosyncrasies of the crude futures markets mean that you can lose money even if oil prices rise. For most investors, this this approach is best left to specialists.

Investing in the low carbon economy

Learn about the companies best positioned to survive and thrive