Editor's note: Read the latest on how the coronavirus is rattling the markets and what you can do to navigate it.

We think widespread availability of a coronavirus vaccine or curative treatment will probably be necessary to completely remove social distancing measures. In our base-case U.S. scenario, we expect states to wait for reassurance that the COVID-19 spread has flattened before beginning to reopen businesses, and we assume a 30% reduction in visits to nonessential businesses from baseline by the end of the year. This is a significant improvement from levels at the end of March (65% reduction) and should improve further in 2021 with the availability of a coronavirus vaccine. We assume that less than 10% of the U.S. population is infected by the end of 2020, with a 0.7% death rate, as improving levels of testing help control the spread of the disease.

- Remdesivir’s recent emergency use authorization in severely ill COVID-19 patients is a turning point, but efficacy to date does not look strong enough on its own to justify relaxing lockdowns. We project US$2 billion in peak sales in 2021, assuming an eventual U.S. price (after donated supplies) of around US$500 per treatment.

- Repurposed drugs could be the next wave of approvals. We expect IL-6 antibodies like Actemra and Kevzara could find a niche among the most severely ill patients by this summer, with data starting to read out on JAK inhibitors like Jakafi and Olumiant this summer, as well.

- Novel, targeted antibodies, led by Regeneron’s antibody cocktail, are likely to be effective but are behind this schedule; they could be available late this year for high-risk populations.

- While coronavirus vaccines have yet to produce clinical data, encouraging preclinical data, strong partnerships and funding, and rapid clinical progress all seem to indicate that use in high-risk populations could be possible by the end of 2020, with tens of millions of doses potentially available by that point. If just two of these vaccines succeed, we could have enough supply to protect high-risk populations in late 2020 and for broader vaccination as we enter 2021.

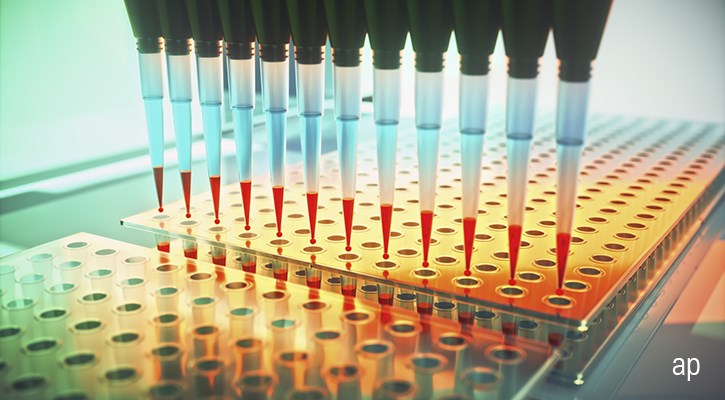

Considering the utter importance of diagnostic testing to help the U.S. begin resuming economic activity in a manner that minimizes the prospect of increases in infection, we remain concerned about national testing capacity meeting necessary levels both in terms of volume and accuracy. The United States was already behind the eight ball when SARS-CoV-2 infections began to rise in February and March. Once the Food and Drug Administration began to approve COVID-19 diagnostic tests under the Emergency Use Act in March, we began to see new tests roll out and capacity for diagnostic testing rise. At the start of May, the U.S. was above 300,000 tests per day, which gets us to roughly 2.1 million tests per week.

Nevertheless, this remains far lower than the 500,000 to more than 1 million tests per day that we see as the midrange of what epidemiologists and economists have projected is required to keep the COVID-19 infection from overwhelming our finite healthcare provider systems.

U.S. testing czar Adm. Brett Giroir says U.S. testing capabilities are in the right ballpark for reopening in May and that four types of testing are needed: surveillance (testing hundreds of thousands a month to get a radar view, even among asymptomatic), symptomatic (millions of tests per month to get a nearly 10% positive rate, meaning 10% of tests coming back positive), contact tracing (five people per confirmed case on average), and antibody testing. A 10% positive rate is the maximum recommended by the World Health Organization and a level the U.S. recently reached, based on daily data. Cumulative testing results as of May 7, with more than 8 million tests run, show an overall positive rate around 15%.

In addition, comparing U.S. testing rates to other countries gives some perspective. This comparison shows the slow start the U.S. made in ramping testing, and while there is a clear improvement over the past couple of months, the extent of the U.S. outbreak should justify even higher testing rates.

Another way of examining this is from the perspective of positive rates--the percentage of tests coming back positive. While the U.S. is making progress on positive rates, we have just barely reached the 10% threshold as a country, and some states are well above. South Korea was at 2% (roughly 10,000 positive tests out of 600,000), and we are higher than every other developed country outside the United Kingdom, which is at 30%.

Key obstacles to optimizing diagnostic testing capacity

Unlike the diagnostics lab industry in other countries, including Australia and the U.K., the U.S. remains a relatively fragmented and decentralized market. Even Quest and LabCorp--the two largest independent reference labs--have only captured an estimated 22% market share. Approximately half the diagnostic market is still controlled by the smaller, hospital-based labs. Considering that most of the competitive labs operate independently and that the federal government has failed to step in with leadership, it’s not surprising that we haven’t seen a coordinated effort to ramp up efficient use of capacity to handle the new COVID-19 tests. This is the overarching theme, and there are additional specific factors that are causing friction in efforts to scale up. There is no magic bullet to be found. Instead, the current situation is more akin to a rowboat that has sprung multiple leaks.

Tests That Are Largely Proprietary to the Equipment

The razor/razor blade model is standard for diagnostic equipment makers, with the proprietary consumables offering a high-margin stream of ongoing revenue once the main machine is installed. We suspect this proprietary test-to-equipment framework has been particularly cumbersome for Abbott (ABT), which introduced its COVID-19 diagnostic testing fairly early but had not seen its throughput of COVID-19 tests accelerate to the level expected. We think this is because Abbott’s roughly 175 m2000 machines scattered across the U.S. are in smaller labs. The m2000 is not widely installed at Quest’s network of labs, for example. Molecular diagnostic equipment at Quest is dominated by Roche and Hologic (HOLX). We suspect there may be a similar situation at LabCorp. If most of Abbott’s m2000 machines are not linked to a wider network, it won’t benefit from information flow that can identify and match available machine capacity to incoming tests.

Need for Trained Personnel

This is an issue on two fronts. First, there is a need trained medical professionals to obtain the specimen via nasal-pharyngeal swab. Capturing that nasal swab can be risky because it puts the medical professional close to the patient. Additionally, swabbing can make patients sneeze, which could further spread the virus if they’re infectious. Second, we also need trained technicians to run the diagnostic machines. The dearth of trained lab professionals has been a chronic problem in the industry, even before the COVID-19 pandemic.

Inadequate Supplies of Personal Protective Equipment for Medical Professionals

The well-documented PPE insufficiency has also hampered the ability of medical professionals to collect specimens from patients. If the saliva-based RT-PCR test offers comparable or superior specimen capture, shifting over could relieve some of the pressure on the healthcare workers, in terms of needing less training and PPE.

Inadequate Reagents and Other Supplies for Tests

On a preliminary basis, we have run across reports of healthcare providers running out of reagents, nasal swabs, and transport media supplies necessary to capture and preserve specimens. Increasing quantity of production will take time.

Restrictive Conditions on Testing for Patients

Severe test constraints in the early stages of the COVID-19 crisis in January and February meant that healthcare providers tried to limit the tests to symptomatic patients, those who were in contact with COVID-19 patients, and first responders. Now that more tests are available, providers can expand their guidelines for testing.

Lack of Centralized IT and Logistics Capabilities

We think this, perhaps, is the most significant factor in the near and mid-term that prevents us from turning our theoretical test capacity into reality. Getting the specimen from the healthcare provider to a lab with the appropriate equipment platform that has space in its overnight batches is difficult without a centralized information system. Both LabCorp and Quest have their own proprietary information systems that can provide insight into equipment platforms and testing capacity on a nightly basis across their own network of labs. However, roughly half the diagnostic industry in the U.S. is housed in hospital-based labs, and they are not looped into such a lab network. Same thing applies to the smaller, regional independent labs. As a result, there’s a fair amount of capacity in the system that is going unused. In the near and mid-term, we expect most of the usable capacity to come from LabCorp and Quest more efficiently using their existing equipment. This will be enhanced by the addition of Hologic’s newest COVID-19 diagnostic testing capabilities, run on its Panther machines, which are located in a range of small and midsize labs.

Point-of-care and at-home diagnostic testing unlikely to be short-run fix

We may see some new innovations to address the testing challenges. Quest management said the current administration has encouraged the firm to think creatively about how to bring on more capacity in different ways. The CARES Act also contains more than $1 billion dedicated to a competition to develop new diagnostics that can get around these pain points that have slowed COVID-19 diagnostic testing so far.

The first at-home tests are hampered by the need for a prescription and a US$119 out-of-pocket payment. The process of working with payers to collect the money would take time, as patients would then need to send insurance information to LabCorp for the lab to close the loop with the patient’s payer, collect payment, and send out the test. Getting at-home tests in the hands of noninsured Americans seems challenging.

Contact tracing offers incremental improvement in fighting outbreak

Contact tracing can help narrow the field of testing to be more precise, but U.S. health departments don’t seem well equipped using traditional methods. The Association of State and Territorial Health Officials recommends 100,000 U.S. contact tracers to get to a 1:1,000 individual/tracer ratio, using a three-tier response of lay contact tracers, disease investigator specialists (professionals) at the state level (currently only 2,200 DIS positions), and healthcare providers or epidemiologists at the CDC (a COVID-19 corps) to support the other two tiers. In Wuhan, China, aggressive contact tracing was done by 1,800 teams of epidemiologists, with at least five members on each team. Scaling up to a level like China’s would require one investigator per 1,200 individuals, or more than 300,000.

Technology could make this process easier and faster. Manual contact tracing (by disease detectives) may not be good enough to slow transmission, but instantaneous tracing (notifying exposed people the minute someone is diagnosed) could be, as used in South Korea and Singapore. Apps are being built to help with contact tracing, and proximity tracking could allow people to self-isolate if they get a notification that they have been near someone who is now confirmed to be infected. While apps in Asia have led to the disclosure of personal info, in the West, a system that uses Bluetooth signaling to record proximity could be less intrusive. In the U.S., many projects have been announced, like Covid Watch, CoEpi, and NextTrace, and the ability to piece all of their data together could become an issue unless we rally around one provider. Apple (AAPL) and Google (GOOG) announced that they are working together to facilitate contact tracing using Bluetooth functionality. To satisfy privacy concerns, rather than using GPS, their platform will focus on codes created when users are within proximity for a certain amount of time; if one is infected, the voluntary app (to be designed by healthcare agencies) could automatically warn close contacts that they may have been exposed. While they are first planning to unify their wireless protocols to allow others to build apps across platforms, we expect their own app could be more reliable than third-party apps. With any app, the idea is to limit the number of people who need to be tested in order to maintain containment of the virus. However, epidemiologists estimate that we would need to see 60% uptake of these apps for them to be effective, and so far, uptake is less than 20% for TraceTogether in Singapore and 40% for Iceland’s Rakning C-19.

Even in countries that have successfully used technology for contact tracing, concerns remain. South Korea passed amendments to its Contagious Disease Control and Prevention Act following its 2015 MERS outbreak to allow override of previous privacy laws during a serious infectious disease outbreak, which allowed disclosure of a wide range of personal information to the country’s federal, state, and local governments, including credit card transactions, location, transit history, and medical records. However, criticism of the level of data released to the public could lead to refinement of this strategy in the future, as significant amounts of this data were also released publicly, when aggregated data could have been enough.

Progress with treatments

Former FDA commissioner Scott Gottlieb sees a treatment as our best hope for returning to normal this year. We now have two regimens with emergency use authorizations, although safety issues with chloroquine (and recent studies casting more doubt on potential efficacy) put the focus squarely on Gilead’s (GILD) remdesivir.

Remdesivir’s efficacy so far is impressive and looks likely to reduce mortality rates from COVID-19 (although mortality data so far isn’t statistically significant, it shows a trend to a benefit). However, these improvements fall short of what we see as necessary for our former base-case scenario, which assumed that efficacy would be strong enough to allow wider relaxing of lockdown measures on its own.

Several other drug candidates are also moving through testing. Among anti-inflammatories, we expect IL-6 antibodies like Roche’s Actemra and Regeneron (REGN)/Sanofi’s (SNY) Kevzara could find a niche among the most severely ill patients by this summer, although initial data from Kevzara was disappointing (development is now focused on critically ill patients). Data could start to read out on JAK inhibitors like Incyte (INCY)/Novartis’ (NVS) Jakafi and Incyte/Lilly’s (LLY) Olumiant this summer, as well, although we have limited view on their potential efficacy. Targeted antibodies, led by Regeneron’s antibody cocktail, are among the most likely to succeed but are behind this schedule, and we don’t expect them to be available until late this year for high-risk populations. While convalescent serum and hyperimmune globulins from plasma firms could also be quite effective, scale is severely constrained; according to Adaptive Biotechnologies (ADPT), convalescent antibodies can treat only one or two patients for every donation from a recovered patient, and quality can vary.

Future trials will be more likely to focus on combinations with remdesivir, and a trial adding Olumiant to remdesivir (to enroll 1,000 patients) began May 8. Pfizer’s (PFE) protease inhibitor is also entering studies this summer and could be a good candidate for combination therapy with remdesivir.

Coronavirus vaccine advancement even faster than accelerated timelines

Vaccine development typically takes years--28 years for varicella and FluMist, and 15 years for HPV and rotavirus. We’ve been waiting decades for an effective HIV vaccine, without success. Preparing manufacturing plants to make a new vaccine can cost anywhere from $50 million to $700 million, according to a 2017 paper in the medical journal Vaccine, and the investments are typically made in a stepwise fashion at different scales, based on the available data and probability of eventual approval. However, if a firm is willing to take financial risks, the process can be accelerated.

Have you found your niche?

Explore the latest Global Thematic Fund Landscape report here