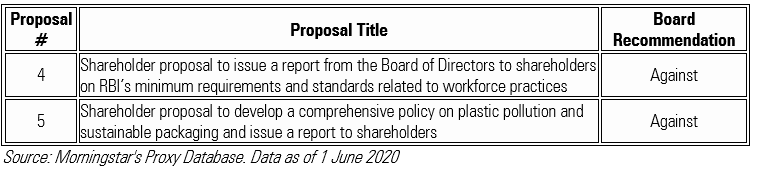

Tomorrow, June 10th, 2020, the shareholders of Restaurant Brands International (QSR), the parent company of Tim Horton’s, Popeye’s Louisiana Chicken and Burger King, will meet for its annual general meeting, where shareholders will put forward proxy resolutions to bring up for a vote. This year, there are two shareholder proposals up for vote, one on workforce practices, and the other on pollution.

Here are the proposals:

Both these shareholder proposals are the exact same as the ones filed last year. In fact, the one on workforce practices is even worded the same way. It received close to 26% support last year, which was a majority of the independent shareholder vote.

Not all Shareholders are Equal

Much like the situation we outlined with Alphabet, the parent company of Google, at Restaurant Brands International, one share does not necessarily translate to one vote.

Brazilian-American investment firm 3G Capital owns 32% of the total voting power, while Pershing Square Funds and Capital World Investors own an additional 7.7% of the voting power. Without support from these shareholders, it would be hard for proposals to gain a majority vote. It could perhaps explain why the same issues get voted on in consecutive years.

Different Year, Same Issues

Restaurant Brands International has seen the same proposals come up for vote in consecutive years, with support rising in each year. Here’s a look at the votes filed between 2016 and 2019, and their outcomes:

| Year | Proposal | Support | Issue |

| 2016 | Adopt a Written Board Diversity Policy | 16.94% | Board Governance |

| 2017 | Adopt a Written Board Diversity Policy | 22.67% | Board Governance |

| 2018 | Supply Chain Impacts on Deforestation | 19.12% | Environment |

| 2019 | Policy on Plastic Pollution and Sustainable Packaging | 22.15% | Environment |

| 2019 | Supply Chain Impacts on Deforestation | 22.12% | Environment |

| 2019 | Report on Minimum Requirements and Standards Related to Workforce Practices | 25.81% | Human & Workers' Rights |

Source: Morningstar's Proxy Database. Data as of 1 June 2020.

Clearly, if major shareholders had chosen to vote in favour of the shareholder proposals in 2019, all would have passed with a majority. But they haven’t, and shareholder activists say that the company has not been receptive to addressing issues raised in the ballot, and has, in fact, rebuffed shareholder concerns.

Shareholder advocacy group SHARE pointed out that in 2019, it filed a proposal asking the company for a report on decent work practices across all operations, which received a large majority of independent shareholder support, and when Restaurant Brands International failed to act, it re-filed the proposal this year on behalf of Atkinson Charitable Foundation. “In spite of clearly demonstrated shareholder concern regarding decent work practices in the company’s franchisee operations, the company has not yet provided any of the information requested in the proposal or made any commitment to address these issues,” it noted.

For better or worse, because of social concerns around the treatment of essential workers through the coronavirus pandemic, there will be heightened scrutiny on shareholder proposals involving workers – and Restaurant Brands International will have to pay attention.

Essential, but Unimportant?

In 2020, the issue around workforce practices is more pertinent than ever, as employees in Restaurant Brands International’s restaurants are deemed “essential workers” and continue to work through the lockdown brought about by the COVID-19 pandemic.

As we have discussed in the past, the pandemic has surfaced some critical issues around how we understand environmental, social and governance actions, or inactions, as the case may be. There could even be a reset on how we consider ‘ESG’, especially around workers and the workforce – for instance, sick leave, adequate pay, approach to layoffs, and benefits.

For Restaurant Brands International, the inaction of 2019 has backfired, as the combination of the pandemic and its weak response to shareholders previously is a bit of a perfect storm in the current scenario, which has some investors considering voting against the entire board.

In Restaurant Brands International’s 2020 Proxy Statement, the filing shareholder notes that “The widely-publicized response by some Canadian Tim Hortons’ franchisees to Ontario’s minimum wage increase in January 2018 (e.g., clawing back of other employee benefits), as well as related conflicts with Tim Hortons’ franchisee operators over the past few years, and reports from Burger King and Tim Hortons’ employees of on-call shift scheduling and unpaid overtime, suggest that workforce management questions are contributing to reputation problems for the Tim Hortons’ brand which may affect sales.”

The shareholders ask that the company disclose action it is taking to ensure decent work practices, including wages and benefits, working hours and breaks, health and safety, shift scheduling and training, for corporate offices, branded operations and franchisees, among other things.

The company rejects these asks, and recommends that independent shareholders vote ‘Against’ the proposal, saying, “While we are committed to protecting and promoting a fair and rewarding work experience at our branded restaurants, we are generally subject to franchise agreements with our franchisees and do not adhere to a one-size-fits-all policy that ignores local market dynamics and applicable laws and regulations. Furthermore, our franchisees, who are independent business owners, are responsible for handling all employment matters, including all policies for benefits and wages, for their restaurants. For these reasons, we do not believe that a report would provide meaningful information to shareholders and would therefore be an inefficient use of resources.”

Once again, it looks like the company hasn’t responded in a substantive way to shareholder concerns, and this, perhaps even more than any other reason, will give independent shareholders pause.

What About the Environment?

The second shareholder proposal that is also a repeat from 2019 is an ask to develop a comprehensive policy on plastic pollution and sustainable packaging and issue a report to shareholders. It was filed by U.S.-based shareholder advocate As You Sow.

The proposal notes that the company lags competitors and “Has not developed comprehensive packaging sustainability policies to deal with low recycling rates of its packaging and the high volume of plastic waste that ends up in oceans.

It asks for a report on developing environmental leadership commitments on plastic pollution and recycling through a comprehensive policy on sustainable packaging.

Restaurant Brands International’s Board recommends that shareholders vote AGAINST this proposal “Due to our current and ongoing efforts to improve the recyclability of our packaging and the size and use of packaging to reduce our overall carbon footprint. At the end of 2019, we launched an updated Sustainability website that will be updated periodically to provide much of the information requested by the proposal.”

The Thought That Counts

Investors could be forgiven for asking “why bother filing the same resolutions year-after-year?” The answer can be found in the vote history. Each time a proposal is repeated, it gains more support – with the hope that eventually, it might even hit a majority.

Also, sometimes, you don’t need to win a majority share of a vote to ‘win’. ESG investing and engagement is about negotiation and dialogue, and with each vote, the management teams get an insight into shareholder sentiment. Activist shareholders believe that if enough of the minority shareholders vote in favour of a resolution, it is enough for management and the board to take notice, and perhaps effect change.

As investors, should you vote at all?

Yes. You should. As my colleagues Jess Lui and Carole Hodorowicz point out, proxy voting and investment stewardship are key to protecting long-term portfolio value. More broadly, the degree to which the proxy process gives voice to investors' concerns about material ESG factors will shape the resilience of the stock market. As a business owner and participant in the market, you have a right and a responsibility to have your say. In so doing, you contribute to a more resilient financial system for the future.

The Rules of Responsible Investing

Understand how ESG regulations affect investors and managers in our latest report