Did you know that the world’s first ETF was launched right here in Toronto? It started out in 1990 as the Toronto 35 Participation fund (TIPS), and has continued to this day as the iShares S&P/TSX 60 Index ETF, Canada’s largest by net assets.

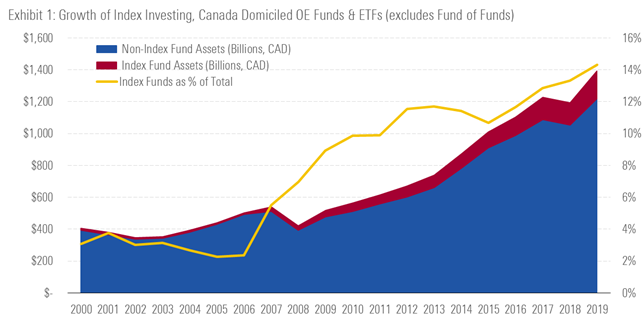

Index investing has risen in popularity here over the last two decades, particularly during the period preceding the global financial crisis.

Source: Morningstar Direct | Index funds inclusive of Strategic Beta Funds

As investors realize that on average, active managers end up losing out to their respective benchmarks after fees, more are opting to gain exposure to the asset class of their choice at a lower cost, through index funds and ETFs. At the end of 2019, roughly 14% of assets invested in Canadian domiciled mutual funds and ETFs were in indexed products – a stark contrast to the early 2000’s.

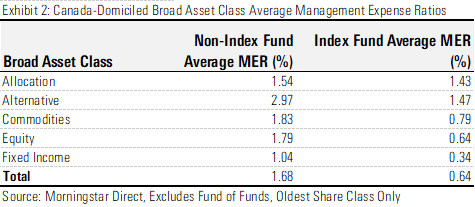

As an investor, this is generally a smart move. Indexed products have lower management expense ratios than actively managed products across different asset classes. These products provide a good ‘bang for buck’ in gaining diversified exposure to a broad asset class.

On average, an actively managed equity fund will cost an investor 2.8 times more per year to hold than an indexed investment (when considering the oldest share class of each fund). We’ve iterated recently why this is important in a handful of articles and videos. However, it’s not all rainbows and butterflies when it comes to index investing. Depending on the way that the index is constructed, and the region it is exposed to, index investing may not leave you as diversified as you might think or assume.

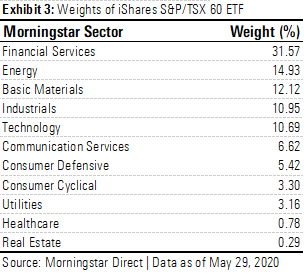

Take for example, the S&P/TSX 60 index which is tracked accurately by the iShares S&P/TSX 60 Index ETF.

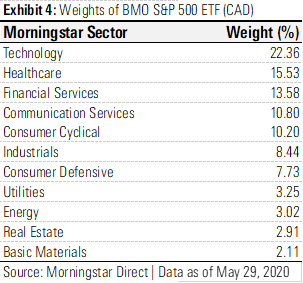

The S&P/TSX 60 Index tracks the 60 largest companies in Canada, where larger companies receive a higher weighting (known as a market-weighted index). Investors in this product are heavily exposed to the financials, materials and energy sectors, which together make up almost 60% of the portfolio, with very little exposure to real estate, health care, and utilities. The index was built to represent the largest Canadian companies, but this doesn’t mean that it is representative of the opportunity set that is available to you. In the US, the issue is skewed in a different direction. The S&P 500 is currently heavily skewed toward technology companies with little exposure to energy and basic materials. Here's the BMO S&P 500 ETF:

It can be argued that market-weighted indices afford the investor some inherent risk mitigation by weighting heavier in large companies. After all, don’t we want larger more stable companies to drive the price of the index? The issue with this is that large companies are stable – until they aren’t.

A Lesson from the Dot Com Bubble

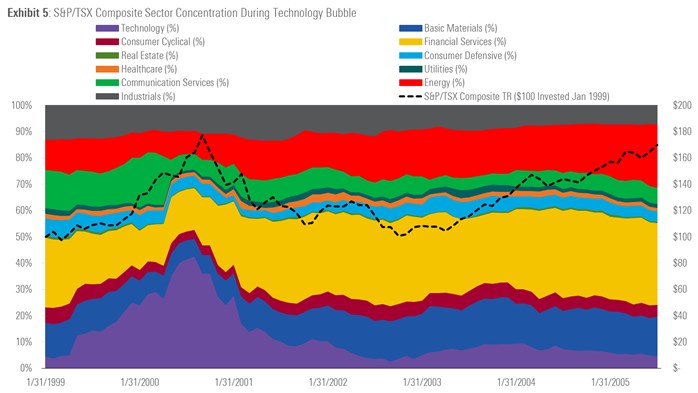

The benefits of diversification start to dissolve if an index becomes concentrated in a sector. For Canadians, this painful lesson was exemplified in the wake of the tech/dot com bubble.

At the peak of the market, the S&P/TSX Composite had a 40% weight on technology stocks. Worst yet, a whopping 35% of the index was made up of a single stock: Nortel Networks. The fall from grace of Nortel contributed immensely to the drop in the index value. Prudent investors would certainly balk at having more than 1/3 of wealth invested in a single stock.

Although nowhere near the stock or sector concentration observed prior to the tech bubble, it can be argued that today’s S&P500 is showing similar signs of concentration sector given the spectacular performance of tech companies over the past decade, and in the known recovery period of the COVID-19 pandemic.

The Takeaway

Although index investing is a cost-effective way to invest in a broad basket of companies, investors are served well to take a peek beneath the hood to keep an eye on sector weights across your whole portfolio (perhaps by using the “X-ray” tool right here on Morningstar.ca). Remember that indexing does not automatically remove the risk of sector concentration, particularly in well-known benchmarks like the S&P 500 and the S&P/TSX Composite indices. Ensure you are aware of the risks that occur when a sector is over-represented. Conservative investors may consider re-balancing if it is observed that holdings start to represent one or two economic sectors as opposed to a mix of the full economy.

This article does not constitute financial advice. It is always recommended to speak to a financial advisor or professional before investing.