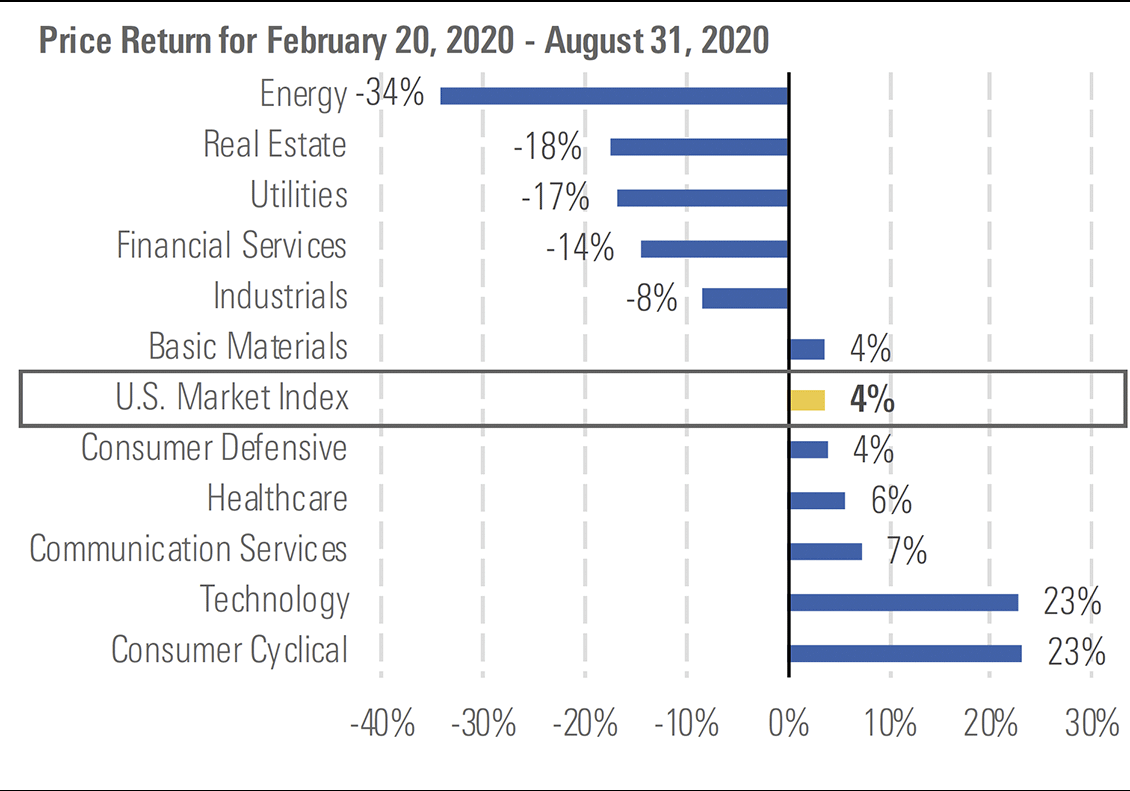

There is considerable debate about the long-term impact of Covid-19 on the economy. Many people have argued that the coronavirus will dramatically accelerate ongoing shifts in the economy (such as the shift from bricks-and-mortar retail to e-commerce), or that it will create new trends entirely (such as permanent shifts away from dine-in restaurants or air travel).

In this first report in our "World After COVID-19" series, we lay out a framework for understanding the post-pandemic economy. Morningstar analysts see three main causal channels whereby COVID-19 could have a long-run impact on economic outcomes.

Firstly, consumer habits could permanently change because of the pandemic. Second, fear of the next pandemic could make consumers reluctant to engage in social activities. Third, sunk costs incurred during the pandemic could change the long-term economic calculus of consumers and firms.

Here, we consider five historical episodes in order to best understand the world after Covid-19. Our goal is to understand, in general, what happens when the economy is perturbed by an extreme but temporary external shock. Pandemics are one type in this class of events, but so too are wars, political upheaval, and related disruptions.

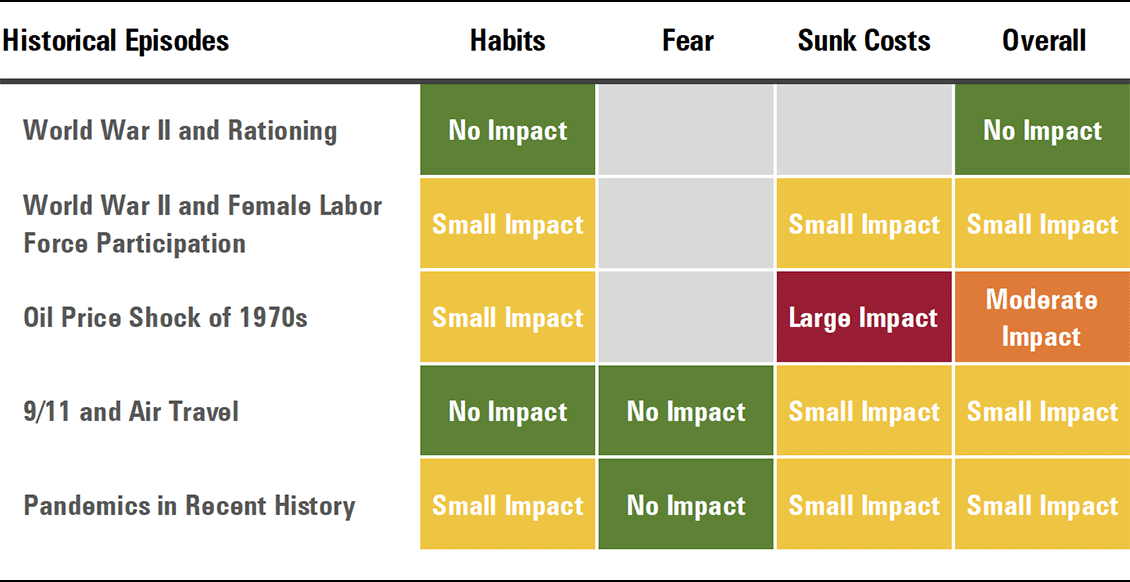

Overall, these episodes provide only modest support for the idea that the three channels posited above will have a long-term impact on the post-Covid-19 economy.

Source: Morningstar

Habits, Fear and Sunk Costs

We see three main channels whereby Covid-19 could have a long-run impact on the economy: habits, fear, and sunk (or unrecoverable) costs.

Habits could change during the pandemic as people get used to doing less of certain activities like eating out, causing lasting changes in consumer behaviour. Fear of the next pandemic could make consumers reluctant to engage in activities involving a high degree of social contact. And sunk costs incurred during the pandemic could change the long-term economic calculus of consumers and firms.

As a concrete example of sunk costs, retailers' increased investment in e-commerce capabilities during the pandemic could have a long-term positive impact on the online shopping experience for their customers.

We consider five historical episodes in order to best understand the world after Covid-19. We look at the broader class of events - wars and political upheaval, for example - rather than just strictly pandemics.

World War II and rationing provides a clear example of people being deprived of goods for several years for reasons outside their control. Did consumers' habits change, thereby depressing long-run consumption of rationed goods even after people regained access to goods after the war? Our analysis shows this wasn't the case; demand for rationed goods generally mounted a full recovery.

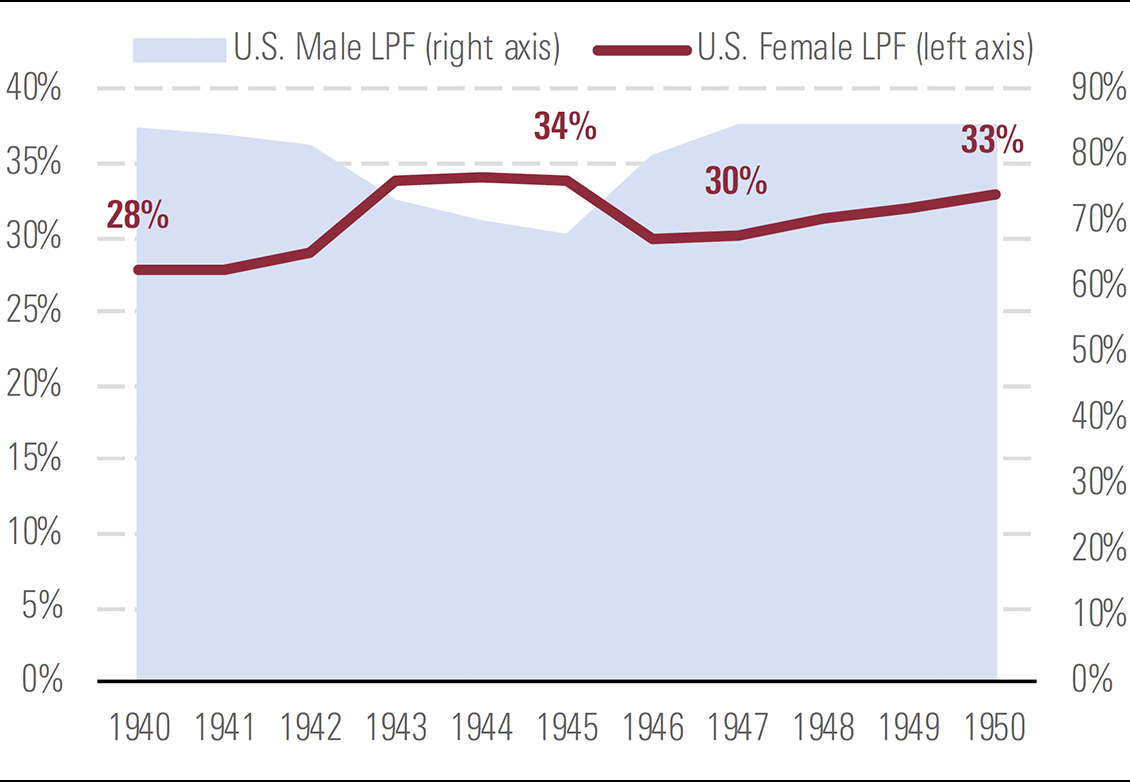

The surge in US female labour force participation during WWII is one example of people drastically changing how they worked. Likewise, the work-from-home experiment today is a large change in how people work. But our analysis doesn't indicate that WWII had a large long-run impact on US female labour force participation.

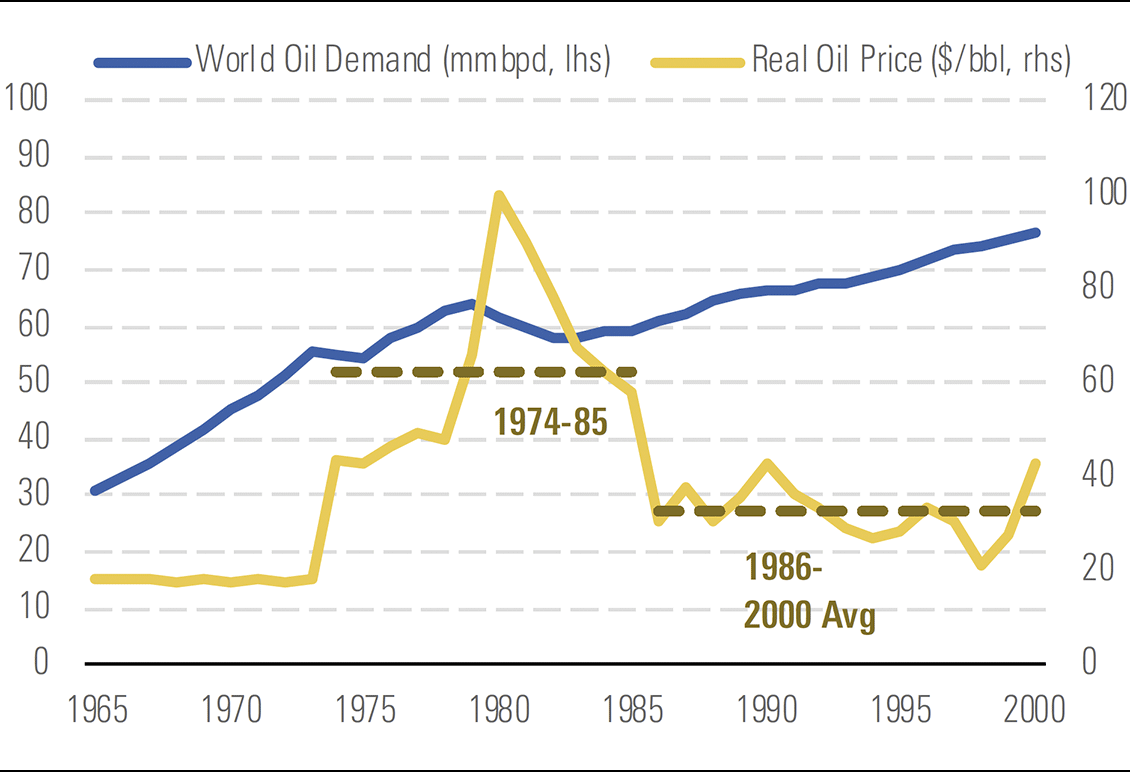

Moving forward to the 1970s and the oil price shock did cause a long-term reduction in oil demand, even after prices fell. The oil price shock catalysed a series of fuel efficiency improvements. These fuel efficiency gains didn't reverse once oil prices eventually fell in the late 1980s. As such, this temporary shock did have a long-term impact on demand.

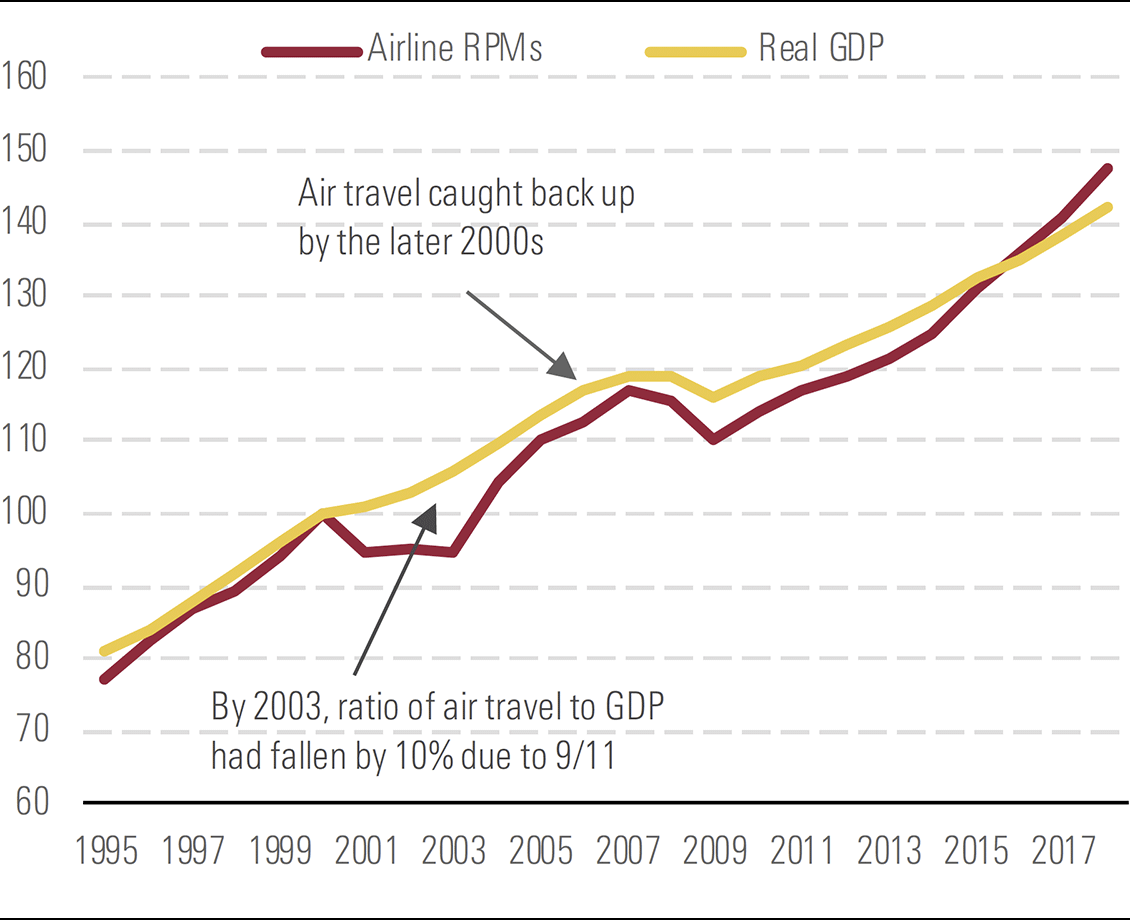

Another scenario analysts considered is 9/11, which had a large negative impact on US air travel in the short run. However, at least in aggregate, US air travel recovered its losses by the later 2000s. Therefore, the intense fear provoked by the attacks eventually subsided and did not weigh on long-term consumer activity.

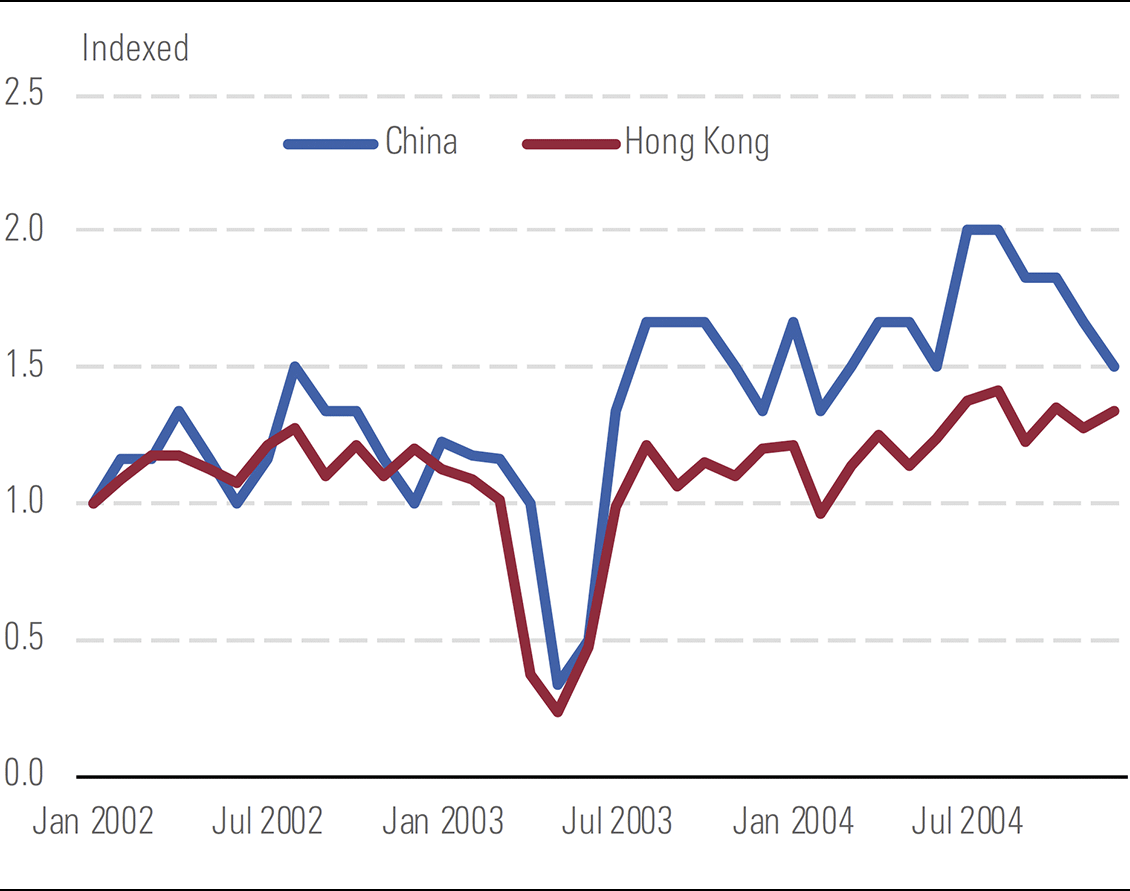

Pandemics in recent history haven't had major long-run impacts on the economy. We analysed three noteworthy epidemics of the last two decades: SARS, H1N1 (swine flu), and H7N9 (bird flu). Of the three, the 2002/3 SARS epidemic clearly had the largest short-run impact on consumer behaviour (such as reduced air travel and tourism). However, SARS doesn't appear to have had a significant long-run impact in these areas overall.

Our historical episodes provide little support for the idea that consumer habits or fear will lead to a long-run reshaping of the economy. WWII and rationing are perhaps the best test of whether consumer habits will be reshaped by a temporary shock, given the degree and duration for which people were deprived of various goods, but we saw little change in habit as a result of that deprivation.

Sunk costs emerge as the most likely channel for long-run impact. In the 1970s oil price shock, the technologies and government regulations that boosted fuel efficiency became sunk costs, which had a long-term negative impact on oil demand.

Exhibit sources: U.K. Department for Environment, Food & Rural Affairs (2b), Acemoglu, Autor, and Lyle (2c), Rystad (2d), Bureau of Transportation Statistics (2e), Civil Aviation Administration of China (2f), Morningstar.