A Small Milestone

At the end of Q3 and for the first-time retail assets invested in sustainable funds as identified by Morningstar topped $10 billion, a small milestone relative to the size of retail fund and ETF assets in Canada. This said, the growth in the sustainable fund market continues to be resilient observed by positive flows, significant growth in assets, and reasonable performance.

Product Launches

The third quarter of 2020 brought 13 new sustainable products to market according to Morningstar's taxonomy in identifying sustainable funds. Comparatively, the number of new products brought to market so far this year has outpaced all of 2019 with a quarter remaining in the year. Despite the friction caused by the COVID-19 pandemic, we can see that Canadian fund manufacturers forge ahead in offering new products to market which we will see in the following sections investors are readily accepting and being rewarded for doing so.

The above chart also outlines the fact that increasingly new sustainable funds are increasingly being launched as passive products. Case in point the majority of this year (16 of 30) and last year's launches (10 of 17) are indexed.

Notably, both iShares and BMO launched what appears to be suites of sustainable target allocations funds covering the gamut of global balanced fund categories with iShares taking a passive approach.

Market Size

At the end of the third quarter of 2020, assets invested in Canada-domiciled sustainable investments (inclusive of mutual funds and ETFs) exceed $10 billion for the first time, exhibiting a substantial year-over-year increase of 30 per cent. Additionally, passive or indexed sustainable investments continue to grow market share in this space echoing similar trends seen globally (a detailed look at global passive sustainable investments is available here).

Asset Flows

Estimated net flows were positive in Q3 at close to $400 million with a small net outflow totaling CAD -15 million observed in passive funds in July. Flows were decidedly more positive in Q3 compared with the prior quarter but nowhere near the large inflows experienced in the first quarter of the year.

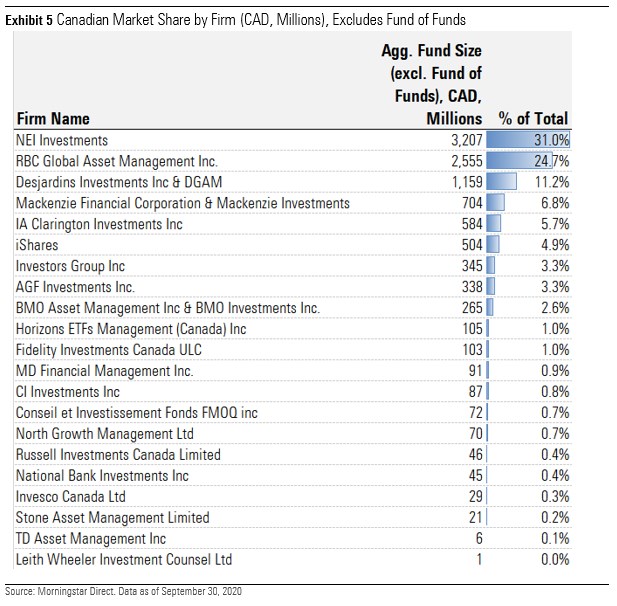

Market Share

As outlined in the Q1 report, the sustainable fund market in Canada is dominated by three main players, together controlling over half the retail assets invested in sustainable funds. This has not changed substantially.

However, looking at a time-series chart shows that as assets invested in sustainable funds continue to grow, so too does competition amongst Canadian asset managers. Over the last quarter for example Mackenzie and WealthSimple launched the Wealthsimple North America Socially Responsible ETF and the WealthSimple Developed Markets Ex-North America ETF which is likely held in many of the robo platform's client accounts. The two tickers have collected $470 Million in assets, accelerating Mackenzie's position within the top ten sustainable fund managers in Canada.

Are Canadians Paying More for Sustainability?

As sustainable investment techniques continue to evolve in Canada, so too are regulations and disclosure requirements. Case in point, over the Summer the Taskforce for Modernization of Ontario's Capital Markets commissioned by Ontario's Minister of Finance released a consultation report recommending actions to the Ontario Securities Commission including the recommendation to enhance ESG-related disclosures for TSX-listed issuers, alluding to well-known disclosure frameworks like SASB and TFCD. Separately, organizations like the Responsible Investment Association (RIA) Canada, the Canadian Investment Funds Standards Committee (CIFSC), and the CFA institute are also laying groundwork for the identification and verification of sustainable funds in Canada. This constant change across the landscape puts the onus on fund managers to ensure that their research teams, technology, and investment processes are up to task. This begs the question of whether these required additional resources end up taking a toll on the cost to the investor.

To answer this question at least based on known information, we leverage a similar methodology used in Morningstar's Global Investor Experience report from 2019 to calculate the asset-weighted median net expense ratio for broad asset classes of funds inclusive of both active and passive products. We calculated these ratios for both sustainable investments (as defined by fund prospectus and through Morningstar's sustainable fund taxonomy) and "traditional" counterparts. The intent of using an asset-weighted expense calculation is to understand not just what fund manufacturers are charging, but what Canadians are paying based on assets currently invested.

Through this calculation, it was found that in allocation and fixed income categories, the asset-weighted median net expense ratio for sustainable investments were coincidentally both 11 bps higher than traditional (non-sustainable) funds. Surprisingly, it was also found that that equity funds (notably the category with the highest number of funds and share classes) showed fees that were 7 bps lower than traditional counterparts.

The cause of this can be attributed to the fact that of the 38 passive sustainable investments in Canada, the broad majority (30) are equity funds. Excluding one outlier, MERs for passive sustainable equity funds in Canada range from 17 to 74 bps which intuitively skew lower than active funds.

Admittedly the small number of sustainable funds identified in fixed income categories leave much to be desired in terms of determining a true indication of median net expense ratio. Morningstar will continue to keep an eye on this area as we hopefully see additional product offerings come to market.

Performance of Sustainable Investments

Over the third quarter we observe continued resiliency amongst Canadian sustainable investments in that the majority (58 of 93) funds outperformed their respective Morningstar category peers highlighted particularly by the well-represented equity asset class. This said, it was also found that the majority of fixed income sustainable funds (9 of 12) under-performed their peers. For reference, a similar table outlining year-to-date performance is below.

Conclusions

Overall, we observe that the continued momentum of investments in sustainable mandates points clearly upward both in terms of new products launched and in terms of assets being invested by retail investors.

Helpful Links:

Q1 2020 Sustainable Landscape for Canadian Fund Investors

Q2 2020 Sustainable Landscape for Canadian Fund Investors

Q3 2020 Sustainable Landscape for Canadian Fund Investors

Morningstar's Sustainability Rating Fund Methodology

The Rules of Responsible Investing

Understand how ESG regulations affect investors and managers in our latest report