Yes, there are many advantages to owning your home. But renting brings other advantages, that to some people are even more important. What argument weighs most heavily for you probably depends a lot on your age.

But first, before discussing the argument for and against owning your home, it is important to be aware of the genuine uncertainty about future home prices. And the risks this creates, depending on how long-term your ownership is. Looking around the world, there are extreme differences in price movement in local housing markets.

Doubling of Price, or 30% Lower?

Countries like Canada, New Zealand and Sweden have seen real home prices more than double in the last 30 years. But, in other countries like Germany and Switzerland, according to the Economist house-price index, prices adjusted for inflation have stayed on the same level as 30 years ago. And in Japan they are 32 per cent lower than in 1990.

People’s expectations on future home prices are strongly influenced by local historical price trends. The question “Is renting throwing money away?” in the title of this article makes more sense in a country with rising prices. In other countries with negative ownership returns, people focus more on financial risk rather than opportunity cost when renting.

One of the most well-known experts on long-term home price movements is Robert Shiller, a professor at Yale University. His summary of research on home price movements during 100-year periods using the repeat-sales method (only including price movements of the same properties) shows that the very long-term trend is that home prices stay constant with household incomes. And outside dense urban areas, upward price movements are limited by construction costs. Based on this, countries with strong price increases in recent years should expect the supply to increase as well until prices fall back to the long-term trend.

Arguments for Renting

Young people moving away from their parents, especially students, often have no other choice than renting. And even after gaining steady employment, there are other temptations in life.

Freedom is the key advantage of renting, not only avoiding commitment to monthly bank payments and taking care of your real estate but also being more flexible when new opportunities appear. Avoiding the financial risk in homeownership means that you can be more flexible in the job market and that more of your long-term savings can be invested in the equity market, with higher expected returns.

The risks caused by homeownership depends on how long you expect to stay. In the extreme case where you live in the same house until you die, the limit is what monthly cost you can handle. On the other hand, if you might need to move again in 12 months, adding a price decline to transaction costs could make the experience terribly expensive.

Arguments for Ownership

Many common arguments for ownership centre around the potential for lower average cost. By doing repairs and upgrades yourself, using tax benefits, and hopefully realizing capital gains, in the end, you can afford a larger home. Also, ownership gives more control and added safety, especially in countries where rent contracts are time-limited.

By entering the ownership ladder, committing to investing in your home and paying down the mortgage, and with salary increases gradually moving to larger apartments and houses, it is possible to gradually grow real estate wealth. In some countries, this is a dominant lifestyle of high-income families. But it is not necessary, in other countries renting is more common.

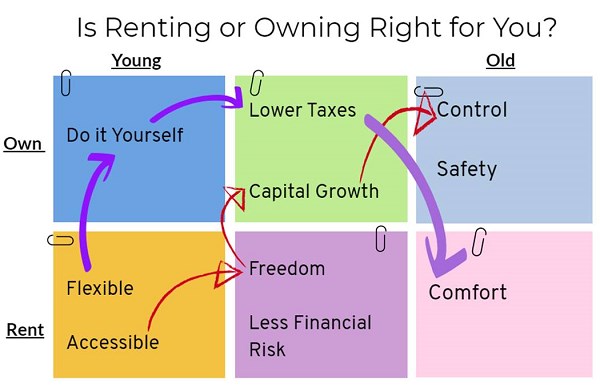

Age is a key factor, deciding the strength of some of the arguments above. Other arguments, like the trade-off between risk and potential returns, are general.

Young people tend to start by renting, both because they lack the financial muscles to buy a home and because they value their freedom. As illustrated in the diagram above, there are many potential paths, with different arguments causing people to move.

Let’s look at two potential paths a person might take: Person A (indicated by the purple arrows) starts with renting but later decides to focus on upgrading a run-down apartment with some do-it-yourself renovations, and later also buys a larger apartment hoping to gain by additional tax advantages, realizing those gains at retirement by moving to a smaller rented flat with no responsibility for maintenance and housekeeping. Then more can be spent on travel and comfort. Oh, the comfort of just calling the landlord when something needs fixing!

Person B (red arrows), meanwhile, first gives priority to what financially possible, and a touch of freedom. When finding well-payed employment in the capital, a rented flat is ideal for helping you stay career-focused. Later, news stories of enormous capital gains in the housing market become too tempting, and after retirement the key argument changes to being able to control and decide all aspects of the interior and garden design.

Ultimately, there’s no right or wrong answer when it comes to renting or owning a home. As with any financial decision, it’s important to base the decision on your overall goals, risk appetite and a host of other factors to determine which is the right choice for you.

.jpg)