Should retirees invest in stocks? It depends on your wealth, life expectancy and, ultimately, the level of risk you’re prepared to take in retirement.

Historically, investors have looked to reduce the risk as they approach retirement and buy a safe annuity which guarantees an income for life after they finish working. But ultra-low interest rates and the introduction of pension freedoms have changed things. Now the strategy of keeping your money in the stock market is becoming increasingly common for those looking make their money last a lifetime.

But we must also take into account the current market situation and the question must be understood as follows: assuming that a retiree can stomach some risk and has medium-to-long time horizon, should he or she invest in stocks to obtain some return on his savings? The answer is yes.

A longtime ago, when interest rates were at 5 or 6% and bank deposits offered attractive returns, retirees did not need to invest in stocks to get a decent return on their savings. Although it should also be said that when interest rates were high, inflation generally reached high levels as well.

Today, with interest rates at historically low levels or even in negative territory, annuity rates are meagre and it is very difficult to obtain a decent return by investing exclusively in fixed income products.

Switching from Saving to Spending

But for many people, there is the idea that retirement is the time to consume your savings and investments. The moment when you retire is generally the line in the sand that marks the separation between the accumulation and the decumulation phases of an investment journey. In an ideal world (for those who have accumulated significant wealth) this may be true, but for the vast majority of retirees, this is not the case and they will need their money to keep growing even after they stop working.

There are several reasons for this. First is that our life expectancy is getting higher and higher. We are living longer and that means the retirement period is also getting longer. The retirement age was originally set at 65 because life expectancy was below that age, now we can expect to live a quarter of our lives in retirement or even longer. And if we live longer, we need more money during their retirement period. It’s that simple.

The second reason why retirees must continue to accumulate wealth is that if they don’t, they will probably have difficulty in maintaining their standard of living. And if you don't get a decent return for your money, you may run out.

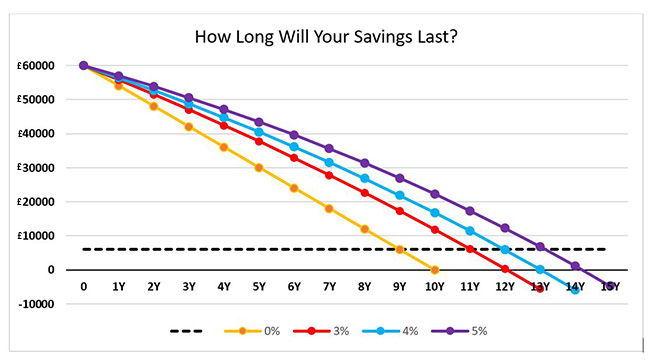

Let's assume the following example: a retiree has managed to save $60,000, which he intends to use to supplement his retirement. He will use $500 a month to complement his pension payments. If he does nothing (i.e., he doesn't get any return on that capital) he will consume all his or her money after 10 years (the yellow line in the below graph). If he manages to get a return of 3% a year (red line) he will be able to supplement his pension for about 13 years (we have ignored the impact of inflation to simplify the calculations), 14 years if he gets a return of 4% a year (light blue), and 15 years with a return of 5% a year (purple).

The third reason is that the trend is that the government pensions will be increasingly reduced. We must bear in mind, for example, that consequence of Covid-19 is that the governments have become even more indebted, which increases the pressure on public pensions. A reduction in the State Pension means retirees must provide more for themselves.

Remember the Risks

We see, therefore, that first saving and then getting an acceptable return on that money is going to be an essential issue for retirees. And considering today’s low interest rates, the only way to get a good return is investing in stocks. But that doesn't mean that if you're retired, you should put all your money in the stock market; diversification is important for retirees and fixed income continues to play a crucial role in portfolios, not so much because of the returns it can offer but because of the protection it can provide in the event of a stock market fall.

It is indeed important to remind ourselves of the major risks that a stock investor can endure, risks that are exacerbated for retirees:

Volatility Risk

One of the consequences of investing in stocks for a portfolio is that it will be more volatile. More than a risk, it is an intrinsic characteristic of investing in equities. Stocks fluctuate more than bonds and one must take this into account. The only way to fight volatility is to increase the time horizon, but that’s not always easy for a retiree.

Valuation Risk

As Christine Benz comments in this article (What High(ish) Equity Valuations Mean for Your Retirement Plan): “The prospect of a 10-year stretch of weak equity market returns shouldn't be a great concern for people who are many years from retirement. But what if you're getting close to retirement or are already retired? In that case, high equity valuations are more significant.”

“High equity valuations have implications for the asset allocation of in-retirement portfolios, as well as how that asset allocation might change over time.”

“Lofty equity valuations make a good case for retirees starting out with a lower equity weighting. That's because sequencing risk is of most concern for new retirees. By starting out with more conservative portfolios, new retirees have a buffer of safe, nonequity assets that they can spend through as retirement progresses.”

“What I like”, says Benz, “is the optionality. If the stock market continues to perform well, the new retiree can subsist, at least in part, on the appreciation from the equity holdings. But if stocks slide, as high valuations suggest they could at some point, the retiree can use cash and bond holdings to meet living expenses.”

“Retirees concerned about sequencing risk might also take a look at the complexion of their equity holdings. That's because one feature of the current bull market is the dominance of a handful of names at the top of the US market and the relative underperformance of the rest.”

“Retirees and pre-retirees can arguably improve their portfolios' return potential over a full market cycle by ensuring that they at least have some exposure to these undervalued areas. If you're conducting year-end rebalancing, be sure to assess your portfolio's intra-equity exposures as well as your baseline asset allocations.”

Make Sure You Can Sleep at Night

In theory, it makes a lot of sense for retirees to increase the weight of equities in their portfolio but we should not forget the psychological impact. Increasing the weight of equities inevitably leads to increased volatility and can increase the risk of sequencing which can go beyond the purely financial impact. Ultimately, whether or not you invest through retirement depends on your own needs and risk appetite.

How Exposed Is Your Equity?

Get The Global Makeup Of Equity Indexes With Our Free Tool Here