For many investors, their main financial objective is to build a portfolio that will pay an income. Traditionally, this was achieved by holding a mix of fairly safe bond investments, but ultra-low interest rates mean that these days investors need to be a bit more creative. Here are some investments that might fit the bill:

Bonds

Bonds are often considered the linchpin for investors seeking steady income because they regularly return money to their holders in the form of coupons. Historically, investing in developed market sovereign bonds has been a way to save while avoiding risk, but many of these bonds now offer negative returns.

Within the bond space there are varying degrees of risk. High-yield bonds, for example, pay a fixed interest rate, but are considered below investment-grade because their risk of default is relatively high. As a result, companies that issue them pay higher returns to investors who are willing to accept this relatively higher risk. One metric often associated with high-yield bonds is the difference in yield between these securities and higher-quality, lower-risk securities such as U.S. Treasury bonds.

Investors should not only focus on the coupons or the yield that bonds can offer. They should also look at the currency risk. For example, China bonds or U.S. bonds can offer a much higher yield than European bonds but with the added complication of changes in currency exchange rates.

Dividends

Seeking income in the equity markets involves selecting companies that pay attractive dividends. These are a way of companies distributing their profits to shareholders, and typically companies that are no longer in expansion mode are considered to offer the most reliable dividends, as they prefer to reward their shareholders rather than reinvest profits to grow. That said, there are many companies in growth mode that also offer dividends to their shareholders.

It is important to recognise that a company's dividend policy can indicate a number of strengths and weaknesses. For example, there is no guarantee that a company will be able to achieve its forecast dividend growth. In addition, a company that distributes high dividends will have less capital to reinvest and contribute to its own growth, which in turn could inhibit its ability to maintain high dividends in the future.

Investors often look at the dividend yield to assess how attractive its income prospects are, but this can be misleading. Yields can soar when a company's share price falls, which could indicate trouble ahead.

Funds or ETFs

A fund or exchange-traded fund can also provide a regular dividend. A fund is nothing more than a basket of securities (stocks or bonds or a mix of them) and, as such, will present more stability in the dividends’ payment as the risk of default is spread across many securities. In a mutual fund, the impact of one company's decision, or even several, would be felt far less acutely by the end investor than if they had picked individual shares for themselves.

An important point here is not to confuse a fund that distributes a dividend with a fund that invest in dividend-paying companies. A fund (we should say a share class) that invests in high-yielding companies may or may not distribute a dividend. If it rolls these dividend payments up into its gains then it can supersize your returns, but that may not be useful if you wanted the dividend paid out.

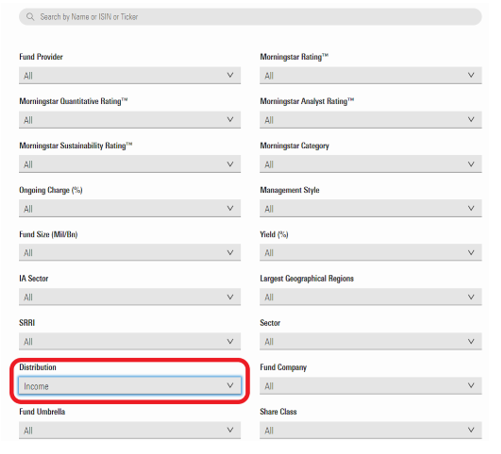

How do you know if the fund/share class or the ETF distributes a dividend? To differentiate the classes that distribute dividends (distribution or income classes) from those that accumulate them in the net asset value (accumulation or growth classes) one can use our fund screener in which we have enabled a special box for this purpose (see attached illustration).

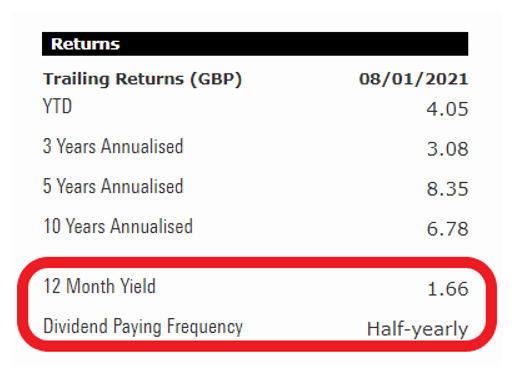

Another question is how much is the dividend yield distributed by the fund and its frequency. Both data are available at the end of the fund snapshot.

Real Estate

Real estate can also be an option if you want to generate a regular income. The idea is simple. You buy a house, an apartment or even a garage and you rent it, receiving a monthly payment for the renting.

It's not for everyone because generally it implies the use of debt to finance the real estate purchase. It also requires more costs than investing in stocks or bonds due to maintenance, taxes, insurance, and more. But one of the advantages is that the renting can grow with inflation.

Investors could tap into the trend through property funds, however, which own offices, retail units and warehouses and pay an incomee to investors from the rents collected. It's worth doing your research on these funds though as many open-ended property funds suspend trading - effectively locking investors in - when there is uncertainty in the market or fears of mass redemptions from the fund.

Annuities

Finally, for those already at the point of retirement, there is the option to buy an annuity. An annuity is an insurance product you buy with your pension pot, that will guarantee you an income for the rest of your life.

Morningstar director of personal finance Christine Benz says: “Annuities can range from low-cost, simple products that can deliver on a promise for a guaranteed stream of income and strengthen a retirement plan, to expensive, highly complicated packages offering uncertain results that critics often rightly deride as not much more than a way for an advisor (or insurance salesperson) to earn a commission”. This is an area where taking professional advice is typically recommended.