Learn more about sustainable Canadian investment funds here

In a tumultuous market, sustainable U.S. stock funds had the wind at their back in 2020, with help from their tilts toward the market's top-performing technology stocks and their avoidance of energy companies thanks to their environmentally friendly mandates.

Among the holdings that fueled strong performance in a number of environmental, social, and governance funds were Tesla (TSLA), up 743% last year, and Nvidia (NVDA), up 122%.

In this article, we look at the performance drivers behind some of the sustainable U.S. stock funds that chalked up the best returns in 2020.

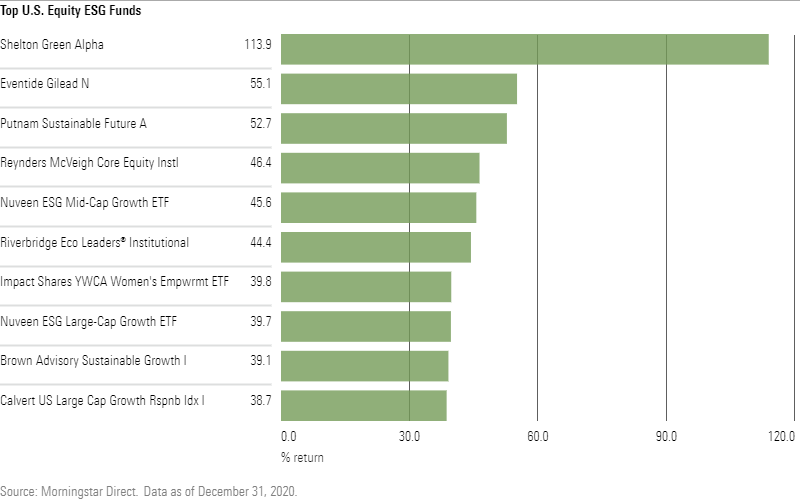

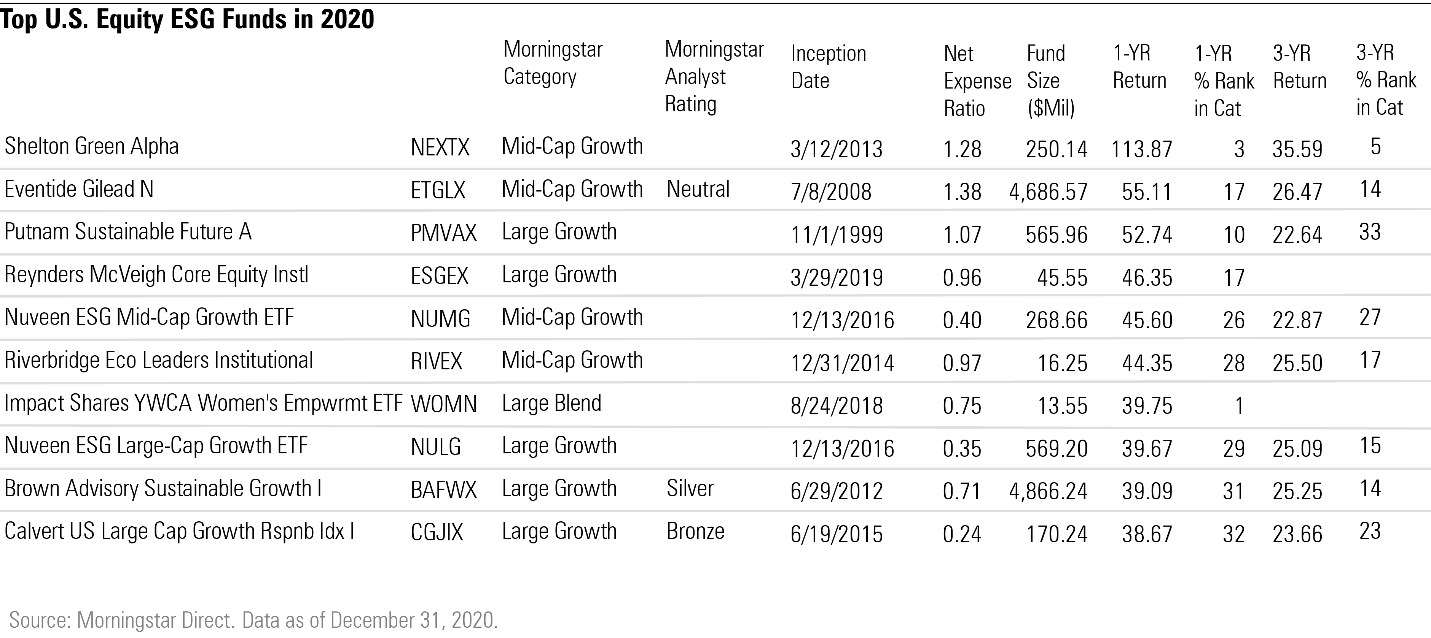

For this screen we pulled the 10 top-performing diversified U.S. stock funds from Morningstar's U.S. list of sustainable funds. Each returned more than 35.0% last year--compared with a 20.9% rise in the Morningstar US Market Index--and all ranked in the top half of their respective Morningstar Categories. Six out of the 10 are actively managed.

Shelton Green Alpha returned 113.9%, one of only 18 stock funds to gain over 100% in 2020. This landed fund in the top 3% of all mid-cap growth funds for the year, repeating its ranking from 2019, when the fund returned 43.7%.

Shelton Green Alpha's five biggest holdings each rose over 100% during the year, including Moderna (MRNA), which gained 434%, and Tesla. The fund also made bets in foreign markets, investing in Taiwan Semiconductor Manufacturing (TSM) and Vestas Wind Systems (VWDRY), which returned 91% and 133%, respectively.

The fund's strong performance in 2019 and 2020 landed it in the top quartile of mid-cap growth funds over the trailing three- and five-year periods.

Eventide Gilead returned 55%, landing it in the 17th percentile of mid-cap growth funds. The fund has a Morningstar Analyst Rating of Neutral and ranks in the top quartile of mid-cap growth funds over the trailing one-, three-, five-, and 10-year periods.

"The fund navigated the turbulent market of 2020 pretty well, losing less than the category and the benchmark in the sharp February-March downturn, then outperforming both by a healthy margin in the subsequent rebound," wrote Morningstar senior analyst David Kathman in his September 2020 report on the fund. The portfolio's tech holdings offset disappointing results from its healthcare stocks, he added.

Eventide's most recent commentary on the fund noted that in the third quarter, the largest positive contributors were Wayfair (W), CrowdStrike Holdings (CRWD), The Trade Desk (TTD), Fiverr International (FVRR), and Five9 (FIVN).

Reynders McVeigh Core Equity fund which launched in March 2019, had a strong year without a larger allocation to tech stocks. The sector constitutes 20.5% of the fund compared with 32.3% for the average large-growth fund. Still, Tesla and Nvidia contributed to outperformance, along with Vestas Wind Systems.

Brown Advisory Sustainable Growth also took a more conservative approach to technology stocks. The concentrated strategy's allocation to Russell 1000 Growth Index titans Facebook (FB), Amazon.com (AMZN), Apple (AAPL), Netflix (NFLX), and Alphabet (GOOG) in September 2020 was just 8.4% versus the benchmark's 28.6%.

The fund also has a lower risk profile, and that helped it through 2020's market volatility. From the benchmark's Feb. 19 peak to its March 23 trough, the A shares fell 30.1% versus the index's 31.0% drop, and the strategy also outpaced its benchmark in the subsequent rally, thanks to strong healthcare picks such as Danaher (DHR).

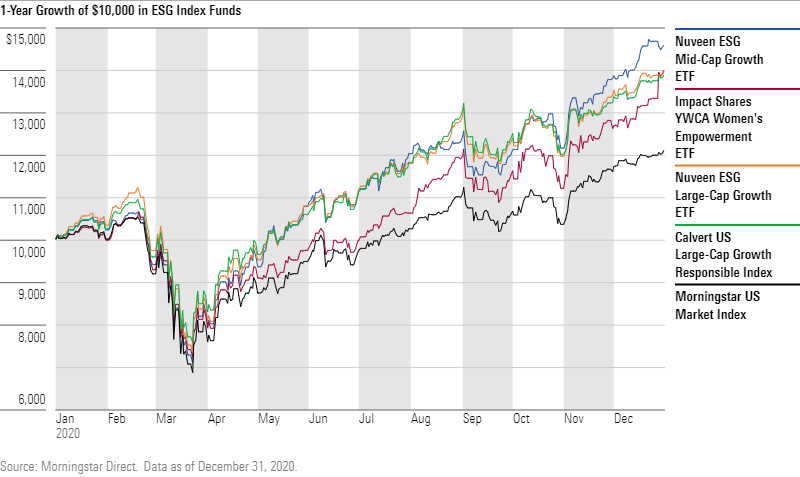

Index Funds

Sustainable stock funds are typically overweight technology, and this was a benefit to ESG index funds in 2020.

Nuveen ESG Mid-Cap Growth ETF (NUMG) had the strongest performance in 2020 of any ESG index fund, returning 45.6% and beating roughly three fourths of funds in the mid-growth category. Forty percent of the fund is allocated to technology stocks, and top holdings Etsy (ETSY), Align (ALGN), RingCentral (RNG), and Pinterest (PINS) each returned over 90% in 2020. Nuveen ESG Large-Cap Growth ETF (NULG) is similarly overweight tech compared with the average large-growth index, with Tesla and Nvidia among the fund's top holdings.

Investments in two solar companies--Enphase Energy (ENPH) and SolarEdge (SEDG)--propelled Impact Shares YWCA Women's Empowerment ETF (WOMN). The fund tracks the Morningstar Women's Empowerment Index. Top holding Enphase, which now makes up 8.33% of the portfolio, gained 571.5% in 2020. The fund recorded a gain of 39.8% during the year, besting the large-blend benchmark by 20 percentage points and putting it in the top 1% of all large-blend funds.

Calvert US Large-Cap Growth Responsible Index fund returned 38.7% in 2020, putting it in the 32nd percentile of all large-growth funds. In his report, Morningstar analyst Neal Kosciulek noted that the fund is notably overweight technology stocks, writing that "as of October 2020, nearly 37% of the fund's portfolio was allocated to tech stocks, versus 32% for the category average."

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VYKWT2BHIZFVLEWUKAUIBGNAH4.jpg)