Tesla's (TSLA) stock price surged an astounding 743% in 2020, a growth rate that would have put many dot-com stocks to shame during the tech bubble in the late 1990s. Although the stock briefly dipped at the end of January 2021, the price has risen another 24% thus far this year.

The value the market is placing on Tesla is eye-popping. At the current stock price, the market value of its equity is $825 billion, making Tesla the sixth-largest company by equity market capitalisation in the Morningstar US Market Index. At its current market cap, Tesla's equity is 8 times more valuable than the world's largest auto manufacturer, Volkswagen (VOW3), and approximately 7 times the combined equity valuation of both General Motors (GM) and Ford (F). Over the course of 2020, Tesla's equity market cap increased by almost $600 billion, which is greater than the total equity market cap of Warren Buffett's Berkshire Hathaway (BRK.B).

What Next for Tesla?

Tesla's amazing run has left many investors wondering if the stock will surge higher still. We answer this question by relying on intrinsic value and thinking about the long run. In other words: What is the discounted present value of the cash flows we expect Tesla will generate? This is the value that we would expect Tesla's stock to converge to over the long run.

So, should I buy Tesla stock now? We lay out our forecast for the company here--and also the forecast that we think would justify the current market price. In short, despite our positive view of the company's competitive advantages, we think the stock is overvalued, and it's hard to justify the assumptions the market seems to be making.

Morningstar's View of Tesla's Stock Value

Tesla is the global leader in designing and manufacturing battery electric vehicles, or BEVs, as well as a pioneer in developing solar power and large storage batteries. Tesla's addressable markets have a strong tailwind from the secular shift from internal combustion engines to BEVs.

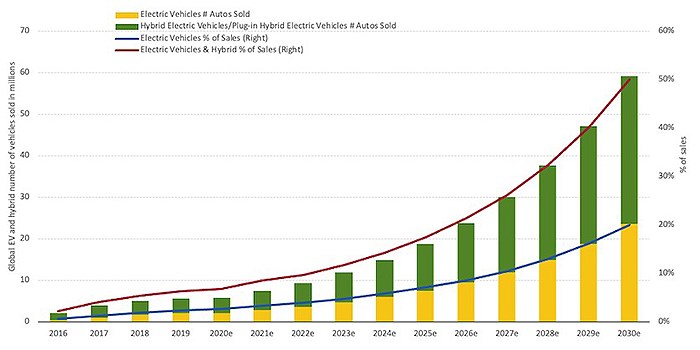

We forecast that BEVs will account for an increasing share of new auto production over the next decade and that renewable power generation and the associated required energy storage business will continue to take a greater amount of market share from traditional fossil-fuel electricity generation. Yet, even after incorporating all of these positive attributes into our financial model, we think that Tesla's stock is significantly overvalued, and at a price/fair value of 2.7 times, it is one of the most overvalued stocks that we cover.

Tesla Closes 2020 With a Strong Quarter

Sources: Morningstar, U.S. EPA, International Energy Agency.

Embedded within the assumptions of our $306 fair value estimate for Tesla, we forecast that the firm's auto sales will grow from just under a half-million in 2020 to an annual selling rate of 3.6 million light vehicles in 2029. That sales rate would represent approximately 19% of global market share for BEVs.

In addition, we forecast that Tesla's energy business will grow about 30% annually over the same time period. At this growth rate, the energy generation and storage business would grow from a little under $2 billion in sales to over $17 billion in 2029. As the company's unit growth more than triples from our 2021 forecast to our 2029 forecast, we expect that fixed cost leverage and increased efficiencies will increase the firm's operating margin from approximately 8.8% in our 2021 forecast to the low- to midteens over our forecast period.

Due to the wide range of outcomes in being able to accurately forecast the combination of auto sales, BEV adoption, and Tesla's market share and cash flow generation nearly 10 years from now, the company earns a Morningstar Uncertainty Rating of very high.

The Market's View of Tesla's Stock Value

In order to determine what the market is pricing in today, we utilized our financial model to conduct a sensitivity analysis.

We had to increase our forecast for light vehicle sales to 7.4 million, essentially doubling our current base case. Based on our outlook for global auto sales, if Tesla were to sell 7.4 million BEVs in 2029, that would represent a 39% market share of electric vehicles--double our base-case assumption. Compare this with the two largest auto manufacturers in the world, Volkswagen and Toyota (TYT), which each sold a little under 11 million vehicles in 2019. Based on current sales rates, that would place Tesla as the fifth-largest global auto manufacturer.

We have also increased our forecast for the operating margin to reach 20% by 2029 on the assumption Tesla will continue to be able to charge a premium for its vehicles and that the higher sales will drive additional efficiencies. In addition to the increase in vehicle sales, we also increased our forecast for the energy business to grow at a 40% compound annual growth rate.

Based on its early development, Tesla currently has strong shares in BEVs across many markets as there has been limited competition. However, we expect that this first-mover advantage will dwindle over time as Tesla faces an increasingly greater amount of competition across all of its markets.

In addition to mounting competition from existing competitors, there is a slew of early-stage companies pursuing not only the BEV business itself but also targeting autonomous-driving software, electric trucks, batteries, and lidar (light detection and ranging, which is used for autonomous driving). These early-stage companies are attracting a significant amount of capital; according to PitchBook, 26 mobility tech companies merged with special purpose acquisition companies (or are in the process of doing so) in 2020, representing a combined valuation of over $100 billion.

Tesla has a narrow Morningstar Economic Moat Rating based on its cost advantages and intangible assets. Among the cost advantages, the company benefits from a first-mover advantage in electric vehicles--it is able to build factories and vehicles from scratch and create processes that legacy automakers will likely find hard to match. In addition, Tesla's intellectual property and planned reductions in battery cell costs will take incumbent automakers years to catch up. While we expect that Tesla will outearn its weighted cost of capital, the market's growth assumptions at the current price appear unrealistic to us.

How Else to Invest in Burgeoning Electric Vehicle Growth?

Although we think Tesla's stock price has well outpaced our estimates for future growth, there remain a few other investments that we think are fairly valued to slightly undervalued. These investments will also benefit from the transition to electric vehicles.

Sociedad Quimica y Minera (SQM)

Fairly valued with a Morningstar Rating of 3 stars, is a Chilean commodities producer with significant operations in lithium. Lithium is a required material for energy storage in transportation batteries, and as electric vehicles increase as a percentage of new vehicle sales, we expect that lithium demand will grow six times over the next decade. To meet this demand, higher-cost resources will need to enter production, pushing lithium prices higher and benefiting low-cost producers. We have awarded SQM a narrow moat based on its cost advantage in the production of lithium, iodine, and specialty fertilizers.

BorgWarner (BWA)

A supplier to electric automotive manufacturers, BWA has a narrow economic moat and a 4-star rating. Suppliers like BorgWarner are well positioned to benefit from the adoptions of EVs, as they will see a strong increase in the demand for the electronics that control propulsion systems, battery power optimization, electric drive motors, and torque transfer.

Edison International (EIX)

A 4-star utilities company that will need to build out the infrastructure to support the growth in demand for electricity and supply the electricity and electric distribution to "fuel" electric vehicles. Although not usually thought of as a growth investment, Edison International supplies electricity to California, that largest car market in the U.S. In September 2020, Gov. Gavin Newsom signed an executive order instructing the California Air Resources Board to develop a policy toward eliminating the sale of new internal combustion passenger cars and trucks by 2035. In order to reach that goal, sales of new electric vehicles would have to increase by an annual rate of 18%. In order to accommodate the new electricity load, California will need to upgrade its distribution grid and build out a significant amount of new infrastructure. We rate Edison International with a narrow moat based on its service territory in Southern California, which benefits from a monopoly position and efficient scale.