"The world has seriously changed over the last few months," said Ben van Beurden, CEO of Royal Dutch Shell (RDS.A), in an April 2020 statement announcing that the integrated oil and gas giant was reducing its dividend for the first time since World War II. "The global economic decline and uncertain outlook may have significant impacts on our profitability, cashflow and balance sheet," said Van Beurden as he predicted that Shell would "reinforce our resilience, preserve the strength of our balance sheet and support value creation in the long term" by reducing its quarterly dividend by 66%.

Shell was hardly the only company whose dividend fell victim to a "seriously changed" world. The pandemic-driven economic slowdown triggered thousands of companies worldwide to reduce, suspend, or eliminate shareholder payouts. For investors who depend on dividends for income, cuts represented a cash flow interruption. And because they reflected larger business challenges, dividend cuts were typically accompanied by share price declines. Shell lost roughly 40% of its market value in 2020.

The pandemic has been described as a black swan event. Blindsided companies cut dividends so they could live to fight another day, or even as a condition of government assistance. Should dividend investors just chalk 2020 up to unforeseeable events and move on?

In fact, 2020 provides a valuable stress test for screens used in Morningstar dividend indexes. Our research indicates that high quality, financially healthy companies were likeliest to sustain their payouts in 2020. The ability of economic moat, Morningstar’s measure of corporate quality, and the Distance to Default financial health metric to identify at-risk payouts is consistent with a longer-running pattern.

The Dividend Disaster of 2020

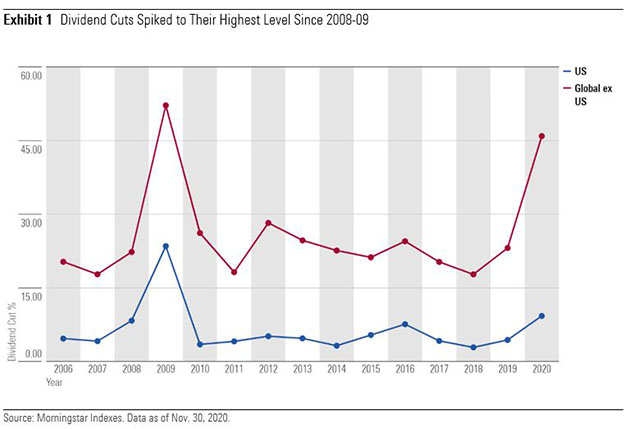

Of the 7,365 constituents of the Morningstar Global Markets Index, which spans developed and emerging market equities across large, mid, and small capitalisation segments, some 6,083 paid dividends as of January 2020. Of those, 2,434 companies cut their dividends in 2020, by far the highest percentage since 2008-09. In the US, cuts were far less frequent. Of the 981 payers, 91 cut their dividends.

Cuts are defined differently depending on region. For the US and Canada, where dividends are paid regularly, we calculated the indicated dividend per share by annualising the latest dividend paid by the company. If the company decreased its dividend per share compared with the previous year, it's considered a cut.

For stocks outside North America, cuts are determined by comparing adjoining fiscal year-end dividend per share figures over a multiyear period. If the company decreased its dividend per share year over year, it's considered a cut. Cuts are far more frequent outside of North America. In some markets, dividends are often paid out opportunistically when the company has excess cash on hand.

Hardest hit were the so-called BEACH stocks—booking, entertainment, airlines, cruises, and hotels. Companies such as Intercontinental Hotels Group (IHG) in the UK, Universal Entertainment in Japan, Flight Centre Travel Group in Australia, Singapore Airlines (SINGY), and Royal Caribbean (RCL) cut dividends, as travel restrictions and societal lockdowns halted their businesses.

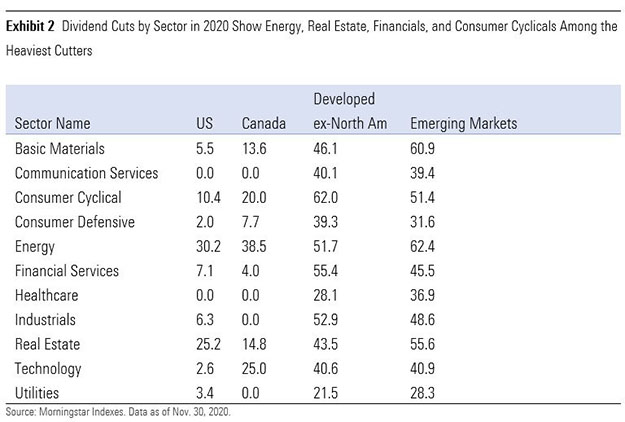

But plenty of companies across economic sector were forced to reduce, suspend, or eliminate shareholder payouts. The below chart depicts dividend cuts by sector. Shell was emblematic of a larger trend, asthe energy sector, suffered from falling demand and a price war among oil producers, was the biggest cutter across the globe. Companies like ENI, Equinor, Marathon, Suncor, Woodside Petroleum, Gazprom, and Petrobras were all among the cutters.

Financial Services battled the headwinds of low interest rates and loan losses, with more than half the dividend paying financials outside the US cutting, including UBS, AXA, Deutsche Bank, Barclays, SEB, and Westpac, as well as Capital One and Progressive in the US.

Consumer cyclicals, meanwhile, suffered from falling demand, prompting cuts at companies like Adidas, Gap, and Nissan. Industrials were hit by falling economic activity, explaining cuts at Raytheon, Komatsu, and Vinci. Real estate was another badly affected sector, as offices and commercial spaces closed, forcing cuts among companies like Voranado, Mitsubishi Estate, and British Land.

Utilities stocks, which had been market darlings in previous years for their rich yields, retreated on an anticipation of lower electricity use by industrial and commercial customers, which is why Centerpoint Energy, EDF, and Korea Gas, cut payouts. Even the high-flying technology sector saw cutters—Western Digital, Electrolux, and SK Hynix, for example.

Screening out Dividend Cutters

Was there any way to avoid 2020’s dividend disaster? We tested two screens employed by Morningstar’s dividend indexes: economic moat and distance to default.

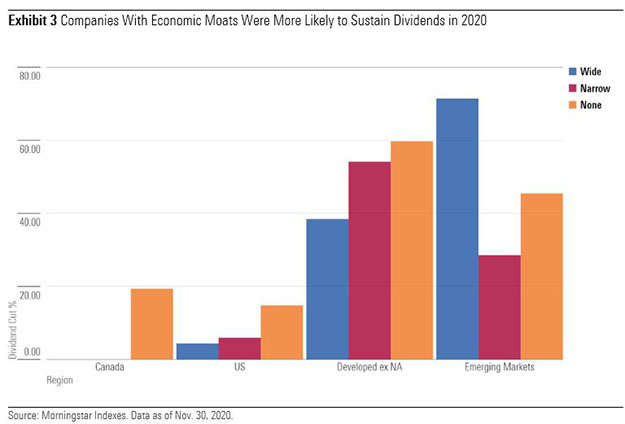

A company with an economic moat around its business possesses a sustainable competitive advantage that should allow it to sustain profitability, and by extension dividends. The chart below shows that companies with wide economic moats sustained their payouts best, except in emerging markets where five of seven wide-moat companies cut. In Canada, no wide or narrow-moat companies cut their payouts. The five wide-moat-rated US stocks to cut dividends in 2020 were Walt Disney, Wells Fargo, Boeing, Harley-Davidson, and Blackbaud. Even within the troubled energy sector, several companies with moats, like Total, Exxon, and Enbridge—sustained dividends.

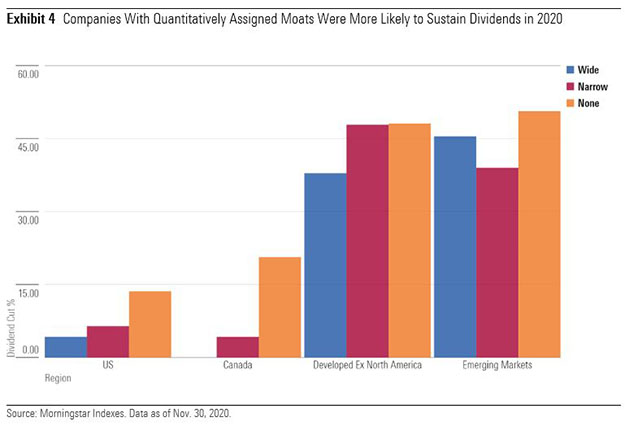

The other dividend screen tested was Distance to Default, a quantitative measure of financial health.

Morningstar's Distance to Default metric ranks companies on likelihood of distress, using option-pricing theory to gauge the risk that a company's assets will fall below the sum of its liabilities. Balance sheet data, including short- and long-term liabilities, is a critical input. So is market-related information. A company's equity value, most importantly the volatility of a company's equity, can be a leading indicator of financial distress, reflecting deterioration well before it shows up in financial statements. If a company has a shaky balance sheet, struggles with solvency, or experiences share price volatility due to questions regarding its long-term viability, future dividend payments may be in jeopardy.

As depicted in the chartt below, the Distance to Default measure was also an effective predictor of dividend cuts in 2020. Dividing the universe of dividend payers into equal bands (quartiles) by their Distance to Default scores, companies with stronger financial health sustained payouts more frequently on a global basis. Several wide-moat rated stocks that cut dividends in 2020 were screened out by the Distance to Default metric, including Imperial Brands, Anheuser Busch Inbev, Harley-Davidson, and Boeing. Distance to Default also flagged such dividend cutters as Canada’s CAE, Japan’s Komatsu, JD Sports of the UK, Australia's Westpac, China's Everbright Securities, and Heineken of the Netherlands.

Approach Divided Payers Selectively

Income investors would do well to remember that dividends are not guaranteed. Owners of regular shares don't have the kind of claims on a company's assets enjoyed by debt holders. Stocks with juicy yields may be tempting, but they often belong to companies with fundamental problems that go on to experience financial deterioration and share price declines. Dividends can be cut in a flash, as they were in 2020, 2008, and many other points in history.

Dividend-paying stocks have a long and impressive history of delivering for investors—not just income but also total return. But they are best approached selectively. Companies that can sustain profitability due to an economic moat and that are financially healthy are best positioned to sustain their dividends. Equity income investors who prioritise income over total return can end up sacrificing both.