Canadian Finance Minister and Deputy Prime Minister Chrystia Freeland tabled the Liberal Government’s first full fiscal plan of the COVID-19 era. Freeland earmarked $101.4 billion to be spent over three years, on things from childcare to business supports to worker benefits.

The budget shows a deficit of $354.2 billion for the fiscal year that just ended, with another $154.7 billion in deficit spending for 2021-22. That deficit spending will push the country’s federal debt-to-GDP ratio to 51% this fiscal year.

Here are some key highlights:

COVID-19 Benefits Continue

The Canada Emergency Wage Subsidy, Canada Emergency Rent Subsidy and Lockdown Support, and the Canada Emergency Business Account will be extended.

Also, in a move to reduce misuse, any publicly listed corporation that increased executive pay while receiving taxpayer support may have their wage subsidy funds clawed back, the document said.

$10/day Childcare

The budget also outlined a focus on supporting the economy through families: “Here is our goal: That, in the next 5 years, Canadian parents across the country have access to high quality early learning and childcare, for an average of $10 a day,” the document said.

The program is expected to cost $30 billion over the next five years, and $8.3 billion ongoing thereafter, in order to drive down the cost of childcare to $10 per day by 2025-26. Ottawa is aiming to cut current child-care costs in half by the end of 2022 through the program, which shares many aspects with Quebec’s long-running subsidized child-care program, which has helped boost the participation rate among core-aged women substantially higher than the national average.

Increasing Old Age Security

The budget also increases support for older generations in the face of inflation. “We are delivering today on our promise to increase Old Age Security for Canadians aged 75 and older, which will provide up to $766 more for eligible seniors in the first year, and that will grow with indexation,” the document said.

The Government is boosting the Old Age Security benefit for Canadians aged 75 and over. The government will provide a one-time payment of $500 to retirees who will be 75 or older by next summer in August, and then plan to increase ongoing payments by 10% as of July 2022.

Non-Resident Owned Empty Home Tax

The document also addresses contributors to increased housing costs. “Budget 2021 announces the government’s intention to implement a national, annual 1 percent tax on the value of non-resident, non-Canadian owned residential real estate that is considered to be vacant or underused, effective January 1, 2022. The tax will require all owners, other than Canadian citizens or permanent residents of Canada, to file a declaration as to the current use of the property, with significant penalties for failure to file.”

In an attempt to address the housing affordability crisis, the federal government plans to impose a tax on foreign-owned, unoccupied homes. Under the plan, an annual 1% tax on the value of the home would be applied to any non-Canadian citizen or permanent resident deemed to have a vacant or underutilized home.

$2.5 billion for Affordable Housing

The budget also looks to stimulate new housing construction. “The government has a plan to invest $2.5 billion, and reallocate $1.3 billion in existing funding to speed up the construction, repair, or support of 35,000 affordable housing units,” the document said.

In the same vein, the federal government is planning an additional $2.5 billion over the next seven years for affordable housing initiatives. That funding would help finance rapid housing initiatives to help under-homed Canadians find a place in short order, rather than being forced to wait for long lag-time construction of acceptable accommodation.

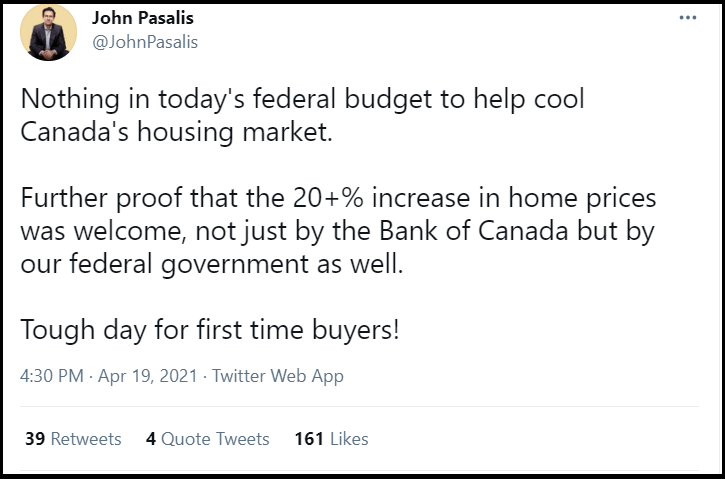

Apart from these supply-side measures, experts feel the budget lacked an immediate plan to tackle the current the red-hot housing market:

Green Deals

For Canadians that already own a home, the government is providing support to tackle climate change. The 2021 budget also to provide $4.4 billion on a cash basis ($778.7 million on an accrual basis over five years, starting in 2021-22, with $414.1 million in future years) to the Canada Mortgage and Housing Corporation (CMHC) to help homeowners complete deep home retrofits through interest-free loans worth up to $40,000.

“Loans would be available to homeowners and landlords who undertake retrofits identified through an authorized EnerGuide energy assessment. In combination with available grants announced in the Fall Economic Statement, this would help eligible participants make deeper, more costly retrofits that have the biggest impact in reducing a home’s environmental footprint and energy bills.”

It is estimated that more than 200,000 Canadian households would take advantage of this opportunity.

The budget also looks to support businesses with their climate change goals.“We propose a historic investment of a further $5 billion over seven years, starting in 2021-22, in the Net Zero Accelerator. With this added support, on top of the $3 billion we committed in December, the Net Zero Accelerator will help even more companies invest to reduce their 22 greenhouse gas emissions while growing their businesses. This will help build Canada’s clean industrial advantage and bolster the domestic market for Canada’s own clean technology innovators."

In an attempt to come back stronger after the COVID-19 pandemic, the government has earmarked another $5 billion over the next seven years for what is described as a “Net Zero Accelerator.” The hope is that this will help the country’s goal of achieving net-zero emissions by 2050. The idea is to decarbonize large emitters like steel, aluminum and cement while accelerating the adoption of clean technologies in sectors like aerospace and auto, and incentivizing a push toward lower carbon emissions.

Digital Services Tax

To help fund Canadian climate change action, the government looks to tap into the digital world. “Budget 2021 proposes to implement a Digital Services Tax at a rate of 3% on revenue from digital services that rely on data and content contributions from Canadian users. The tax would apply to large businesses with gross revenue of 750 million euros or more. It would apply as of January 1, 2022, until an acceptable multilateral approach comes into effect. This would help ensure that Canada’s tax rules capture new ways in which businesses carry out value-creating activities.”

This tax is likely to impact companies like Alphabet (GOOG), Facebook (FB) and Netflix (NLFX). The government estimates this tax would raise $3.4 billion in revenue over the next five years.

$15 Minimum Wage

Costs related to labour will also rise for employers of more than 26,000 workers who currently take in a sub-$15 an hour paycheque in Canada. The federal government announced plans to increase the minimum wage to $15 across the board.