Money can’t buy love but it sure can make the warm, fuzzy feeling between partners disappear if studies are to be believed. A recent US study found a sizeable population of young adults would ditch a romantic relationship if the prospective partner had debt.

It’s not a phenomenon that can be dismissed as one of those American things. Closer to home, similar studies have shown Canadians would be just as likely to call it quits over a partner’s debt.

While the COVID-19 outbreak has had a profound impact on the household income of millions of Canadians, many were struggling with unmanageable debt levels before the pandemic. The most recent Statistics Canada report on household debt shows Canada’s average household debt-to-income ratio is over 170%, meaning the average Canadian owes $1.70 for every $1 they make. This is among the highest consumer debt to income ratios in the world.

With the coronavirus pandemic exacerbating financial vulnerabilities of Canadians, debt, especially bad credit, has taken centre stage as the determinant of the staying power of a romantic relationship.

Let’s Talk About Debt, Baby

Couples often avoid talking about money in the early stages of their relationship for fear of causing awkwardness and not wanting to come off as unromantic. However, money is a fundamental aspect of our lives, asserts Tina Tehranchian, senior wealth advisor at Assante Capital Management Ltd.

“Avoiding the conversation about money in the early stages of a relationship may lead to nasty surprises and major arguments down the road,” she says. “It is very important to find out about your partner’s attitude toward money and ensure that you can at the very least find a middle ground that is acceptable to both parties.”

Communication and transparency are key when entering any financial relationship, romantic or otherwise, says Teresa Valenti, senior wealth advisor at Meridian Credit Union. “It’s important for both parties to understand where the debt was created and accumulated, which will also help indicate how likely it is to be a pattern and how the debt can be overcome.”

Depends on the Debt

While debt is a four-letter word, it’s not an unforgivable anathema. Debt can come in many forms. Job loss, student debt, or a spendthrift lifestyle are some of the most common causes of debt, especially in younger couples. “Knowing the cause of the debt allows each partner to evaluate the financial position the couple will collectively face,” says Valenti.

From there, they will either find solutions that work for both or decide that their financial differences are too great and go their separate ways.

Acceptability is strictly a personal choice. “Acceptable debt may be a mortgage, student loan or a small business loan where there is a history of consistent payments that constitutes a good-disciplined approach to managing future debt,” Valenti notes.

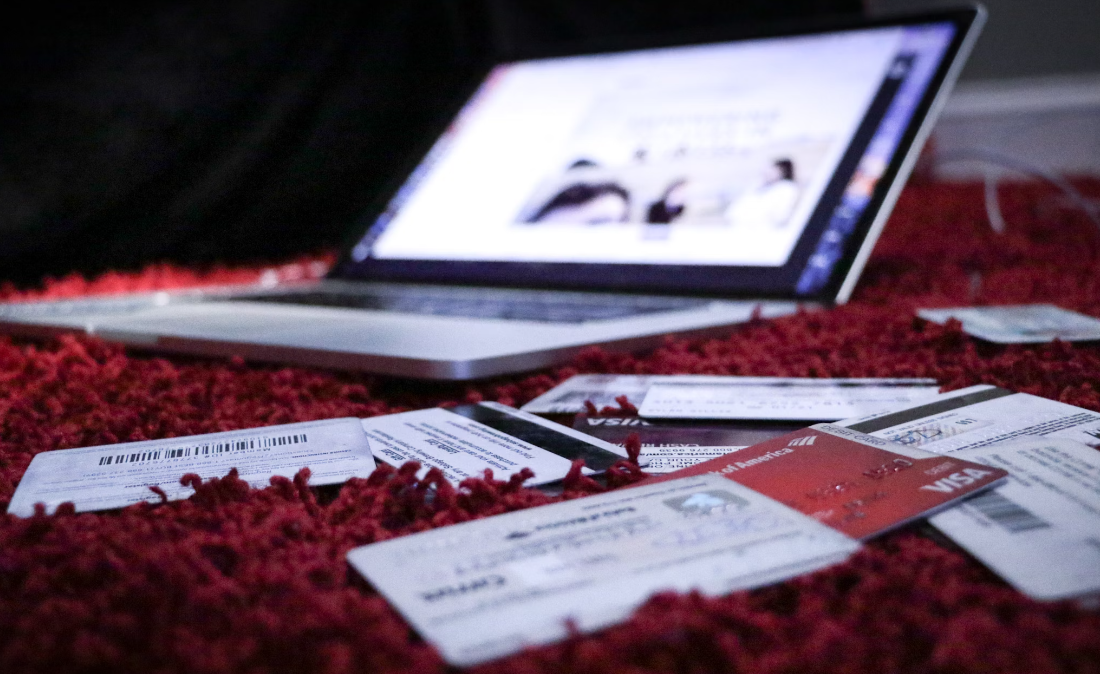

On the other hand, high credit card balances, car loan debt above the value of the vehicle or even a poor credit rating are red flags. “If a partner has more debt than can be managed by his or her income, that is cause for concern and may be a deal-breaker,” she adds.

Experts tend to agree there is no absolute number that would make partners walk away from a relationship. “It all depends on each person’s tolerance for risk and debt and the faith partners have in each other and their ability to pay off the debt,” Tehranchian says.

Good Debts vs. Bad Debts

Make no mistake, there are good debts and there are bad debts, no matter their size. Any stubborn debt resulting from recurrent borrowing to spend should send alarm bells ringing. “Borrowing to go on a vacation or buy expensive clothes or furniture, or cars, is considered a bad debt,” explains Tehranchian.

Interest paid on such debts is not tax-deductible. Worse, the borrower may “have to resort to using expensive means of borrowing such as credit cards or high-interest car loans that are tougher to pay off,” she warns.

Any debt that may hinder plans for financial stability should not be ignored, says Valenti. “A poor credit score of a partner or high level of debt may make it harder to get approved for a mortgage, plan for children in the future, or live the lifestyle that the partner with a better financial position wants,” she notes.

Certain types of borrowing may be considered reasonable by some people. As part of long-term strategies to build wealth, a mortgage on a property or an investment loan, for instance, are generally regarded as good debts. “If the mortgage is for an investment property or if you borrow to invest, the interest cost is tax-deductible, which makes this kind of borrowing more attractive,” says Tehranchian.

If the borrower has stable cash flow and can service the loan during good and bad economic cycles and despite increases in interest rates, then these types of loans are acceptable and could help build equity in the long run, she says.

Student loans are also viewed as a prudent investment. “If their payments are affordable given the future expected earnings of the borrower, they are considered a good debt,” Tehranchian notes.

Any debt that increases your net worth or produces a future value should be considered a good type of debt, says Valenti, but adds “each partner must be very honest and upfront about their financial situation from the beginning of the relationship.”

Pandemic Can Change the Picture

The COVID-19 pandemic underscored the fact our lives and livelihoods could change rapidly due to reasons beyond our control. It also drove home the point that “if you are fully leveraged and have no cash cushion for emergencies, even if all your debt is good debt, it can be a recipe for trouble in tough times,” says Tehranchian.

For many couples, the full extent of the pandemic’s financial impact may not be known yet. However, some of the most obvious financial fallout of the global health crisis is evidenced by the debt accumulation due to mortgage and credit card deferrals, additional borrowing to pay expenses and buying homes often $100,000 over asking price. “Deferrals lead to higher debt balances as interest charges have accrued for most debts during the deferral period,” says Valenti, noting that “any debt that does not have a plan for repayment should raise a red flag.”