Investor interest in thematic funds has increased dramatically in recent years, with themes like artificial intelligence, cannabis, and ESG (environmental, social and governance investing) gaining attention. Does this translate into performance?

Earlier this week, Morningstar launched the 2021 version of the Global Thematic Fund Landscape, with a new look at whether it's worth investing in these specialized strategies.

In the Landscape, authors Kenneth Lamont, Ben Johnson, Dimitar Boyadzhiev and Daniel Sotiroff find that over the three years through March 2021, collective assets under management in these funds more than tripled to US$595 billion from US$174 billion worldwide. This represented 2.1% of all assets invested in equity funds globally, up from only 0.6% 10 years ago.

They find that actively managed funds account for the majority of assets invested in thematic funds. In general, actively managed funds have higher fees than their passive counterparts. Additionally, thematic funds also tend to levy higher fees than their nonthematic counterparts.

More than two-thirds of thematic funds globally survived and outperformed global equity markets (as proxied by the Morningstar Global Markets Index) in the year ended March 2021, the authors found. This success rate drops to just 22% of thematic funds when we look at the trailing 15-year period, and 57% of the thematic funds were closed during the period. They suggest that this lacklustre long-term performance can be partly explained by the higher fees.

If you’re wondering what makes a thematic fund, the authors have developed an updated three-tier taxonomy to classify the space, and to help investors make sense of this expansive and diverse universe.

Thematic Funds in Canada

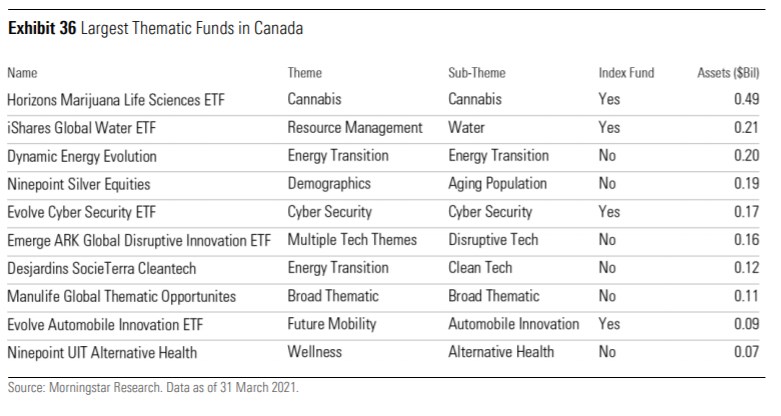

As Morningstar Canada’s director of investment research Ian Tam pointed out in a recent piece, thematic funds in Canada have ballooned. The 36 thematic funds domiciled in Canada held close to $2.5 billion, up from just $52 million in March 2016.

As in other regions, the Landscape notes that thematic fund launches in Canada have tended to track the market cycle, indicating that investors' appetites for these strategies and the desire for providers to offer them typically move in sync with the broader market.

Canadian fund providers introduced 12 new thematic funds in 2018 and another 10 in 2019. Six more funds were launched in the first quarter of 2021 alone.

With $490 million in assets under management, the Horizons Marijuana Life Sciences ETF dominates the Canadian thematic fund landscape, representing almost 20% of all Canadian thematic assets as of March 2021, the report finds.

But in Canada as well as elsewhere, higher fees charged by thematic funds have contributed to their relatively poor performance over longer periods. Over 80% of Canadian thematic funds survived and outperformed global equities (as proxied by the Morningstar Global Markets Index) over the trailing year through March 2021. The success rate drops to two in five funds over five years. Neither of the two thematic funds with a 10-year track record has survived and outperformed over the trailing 10 years, the report finds.

Should You Buy a Thematic Fund?

The Landscape notes that because of their narrower exposure and higher risk profile, thematic funds are best used to complement rather than replace existing core holdings. These funds might be considered as single-stock substitutes for those investors looking to express a view on a theme but lacking the resources needed to conduct due diligence on individual companies.

Investors in thematic funds are making a trifecta bet. They are betting that they are: 1) picking a winning theme; 2) selecting a fund that is well-placed to survive and harness that theme, and 3) making their wager when valuations show that the market hasn't already priced in the theme's potential.

“The odds of winning these bets are low, but the prospective payouts can be large,” the report says.

Passionate about Investing in New Ideas?

Explore the latest Global Thematic Fund Landscape report here

.jpg)