Perhaps you’re looking to make use of your saved commuting hours when working from home, feeling you need extra money to make your monthly budget, or seeking a hobby in retirement that can lead to some extra cash. How can you tell whether the new endeavour is a good financial fit?

“Like so much in life, we need to look at both sides of the coin,” says Morningstar’s director of financial planning methodology and former president and CEO of PlanPlus Global, Shawn Brayman. He provides some examples where a side hustle might not work:

• You are preretirement and have a side income, but you do not save more. Your lifestyle may be enhanced, but it has no impact on your financial plan.

• In some countries, there are ‘clawbacks,’ or a loss of certain government benefits, above a particular level of taxable income. If you happen to be at that level, the positive impact on your financial plan might not be worth the effort.

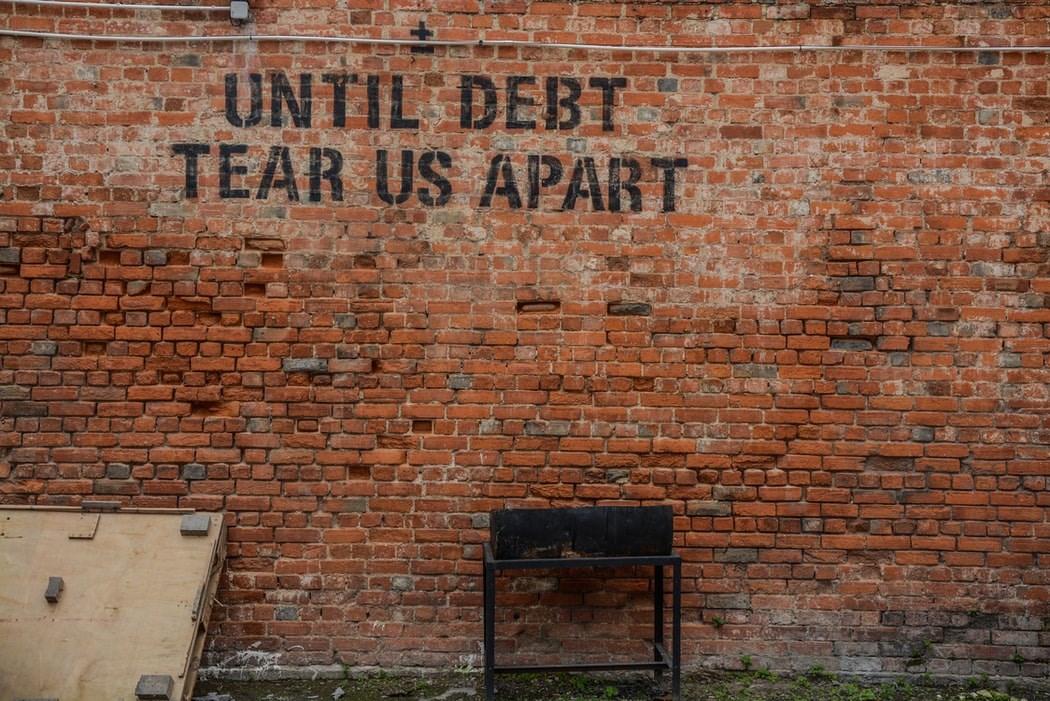

“But outcomes like these should be the exception,” he adds. “In the vast majority of cases, a ‘side income’ can have both positive financial and psychological benefits for an investor. The obvious benefit is that during my accumulation years, a side income might provide a greater ability to save or pay down debt. In retirement, we usually see side incomes in the early years as people transition from full-time employment, but they still want to leverage their skills and remain engaged with colleagues. The income might enhance lifestyle or can be used to reduce the need to dip into the investment pool. Both good things.”

From a long-term financial-planning standpoint, individuals will almost always benefit from a side income, he adds. At the same time, financial planning is inherently about personal circumstances, he says. This means assessing your own tax and lifestyle factors, for example, along with aspects of the gig itself.

Annie Kvick, certified financial planner with Money Coaches Canada, suggests asking yourself a few questions about the side hustle: Is this something you really would like to do? Will this extra money help you reach your goals? And how much of this new income is offset by costs related to the new gig?

The Price of Time

“There are trade-offs to any side hustle or taking additional work, with the obvious trade-off being time,” says Nicholas Hui, certified financial planner with Vave Financial Planning.

“You should track the total time it takes for your side hustle,” says Hui. “Don't forget to include the hours it takes for you to research, plan, and set up your side hustle. A simple spreadsheet could help, and there are time-tracking apps/sites that could be used.”

Once you’ve established the time commitment, consider what those hours are worth to you. Hui suggests assigning a dollar value to your time. “You can come up with your own personal hourly rate and if you aren't able to make that amount in your side hustle, then it may not be worth it,” says Hui. “The basis for deciding on your minimum hourly rate could be your regular job or what others make at a similar side hustle. However, note that if your side hustle is something you love to do or a hustle that could enhance your future income prospects, it can certainly make sense to take a lower rate.”

Taxes Can Tip the Scales

While weighing the income potential of the new activity, be sure to consider what almost always comes with more money: more taxes. It’s easy to get caught off guard by extra taxes from a new business, especially in a progressive tax system like Canada’s.

Every dollar you earn in Canada can have a different tax rate attached to it, notes Kvick. Earning an extra $10,000 a year can kick you up to a higher tax bracket, which may deter some individuals. But depending on which tax bracket you’re starting from, it might not be that bad.

Kvick gives an example: “If you are in the 26% marginal federal tax bracket and earn an additional $10,000 (and jump a tax bracket for the full $10,000), the extra $10,000 is taxed at 29.3%, 3.3% more = $330 more than what you paid on your income in the tax bracket below. To me, making an extra $10,000 and only paying an extra $330 in taxes is well worth it ($2,600 + $330) and shouldn’t be stopping you from earning more.”

For some workers and their families, taxes can tip the scales much more. “There are a few periods in life one should tread more lightly and be extra cautious and know the impact on taking on extra work,” says Kvick. “The first one is when you are raising children and collecting the Canada Child Benefit. A family earning $80,000 combined net will receive approximately $9,400/year of CCB (for two children). If the same family starts earning an extra $10,000 net, they will lose $1,000 of CCB (receive $8,400/year for two children).”

Before retirement, there are some ways a side income can help you maximize government benefits, notes Brayman. “Many countries like the United States, Canada, or the United Kingdom allow investors to elect the age when they will start to receive certain government benefits/pensions. For each year the investor delays triggering the start of the benefits, the gross amount they receive annually might increase by 5% or 6% a year for life,” says Brayman, “So, some side income and a little of my investment pot this year might let me increase my Social Security, Canada Pension Plan, or State Pension Benefits for the rest of my life. Massive payback!”

If you’re already in retirement (over age 65), however, starting the side gig could have some extra complications, notes Kvick. “If you are collecting the OAS pension (Old Age Security Pension) and have a net taxable income (gross minus deductions) of approximately $79,000, then this extra income will claw back the OAS with 15% for each dollar earned above $79,000. Consider this an extra tax. If you have a net taxable income of $79,000, you are in the 20% federal marginal tax bracket and any new/extra income will claw back the OAS at 15%. It is like you are paying a 20+15=35% of federal tax (plus provincial) for each dollar earned over $79,000. The extra earnings might be worth it or maybe not.”

At the end of the day, however, “More money in your pocket is still more money,” says Kvick. And if you feel it’s something you need, the decision may be easier – especially with another perspective.

Do You Need the Gig?

Regular budget shortfalls or rising inflation can be concerning but aren’t necessarily signs of needing additional income. For example, they could be from forgotten or unnecessary expenses and potentially offset by other assets unaccounted for.

“Sometimes people take on extra work or jump into a side hustle because they feel they need the extra money, without actually reviewing how their money fits in with their life goals,” says Hui. “Take a moment to think through whether or not you even need to make extra income. Maybe even hire a financial planner to help you understand your full financial situation.”

Kvick agrees, “Often we are worried about not having enough income and not able to save enough towards retirement (while working) or not having enough in retirement. Find out where you stand financially and how much you really need to earn and/or save.”

And if you’ve found yourself in a financial bind because of losses in your investment portfolio, a silver lining of a side hustle is that it can help problems in the future. Consider “risk capacity” or “capacity for loss,” Brayman says. “A good risk capacity analysis is not about ‘Can you stomach the ups and downs of the market,’ but, if markets perform worse than we expect and you need the money to support your lifestyle, will you be OK? When the income an investor needs is partially covered by defined-benefit pensions, government pensions, or a side income, it means their portfolio does not need to ‘do all the work.’ ” This can increase the portfolio’s capacity for loss and, assuming you can tolerate the risk, you can take more risk in your portfolio, he says. “Whether this is used to increase lifestyle or simply increase the investor’s probability that they will achieve their goals doesn’t matter – their plan will show better outcomes.”