Readers of the articles and analyses published by Morningstar very often find references to “value” or “growth”. It is a way that investment professionals identify the styles towards which the investment instruments are oriented. What do these terms mean, and how are the styles different from each other?

Understanding Value Vs Growth

‘Value’ stocks are those that are seen to trade at a lower stock price relative to the company fundamentals. These stocks have low market valuations in relation to some multiples, such as: Price / Earnings, Price / Book value, or Price / Cash Flows. These companies also tend to, on average, pay higher dividends. Some examples include companies like Enel, Total, Telefonica or JPMorgan which, although belonging to different sectors, ‘value’ as a common denominator.

On the other hand, ‘growth’ stocks are stocks that are expected to grow at a higher rate than the market, and have higher multiples of the market average, based on the ratios cited above. These higher valuations are generally justified by higher rates of expected growth in sales, earnings or cash flows. Companies in sectors such as technology or healthcare (typically growth sectors) tend to fall into this category. They also do not usually pay high dividends.

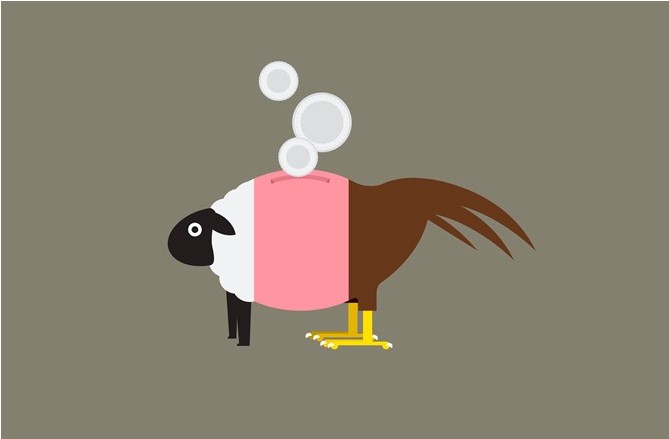

The split also applies to the investment styles of funds. In this case, however, a third segment must be taken into account: the blend funds.

What are ‘Blend Funds’?

Blend funds are mutual funds (or exchange traded funds) that that invest in both value and growth stocks. The objective of this type of fund is to help diversification by spreading investment and risk control opportunities over both solid and quality companies that have a market value lower than that of competitors (value), and on companies that promise a fast growth of the business and of the value on the list (growth).

Three Distinct Styles

In summary, there are three different investment styles when it comes to funds:

-Equity funds that adopt a Value style select well-established companies in the sector to which they belong. In most cases they are large caps that have low debt and growth forecasts in sales, and dividends that are consistent over time.

- Equity funds that use a Growth style select stocks in sectors with strong growth potential, and companies that guarantee high profitability regardless of debt. Often these companies do not distribute dividends or, if they do, the payout ratio (or the amount of dividends paid to shareholders) is very low compared to the company's net profits.

- Blend style equity funds do not adopt a specific investment style (Growth or Value). In this case the manager, depending on the market situation, can make a choice of style by taking a clear direction towards Growth or Value, but can also not choose by keeping the portfolio bar halfway between the two.

However, different investment styles imply different risk and return profiles. For this reason, Morningstar introduced the Style Box in 1992, a nine-box matrix that is the synthesis of a fund's portfolio analysis. For equities it represents positioning with respect to capitalization and value, growth or blend orientation. For bonds, the indicators are the interest rate sensitivity and the credit quality.

Funds and ETFs are classified taking into account the same logic and on the basis of the portfolio stocks, in order to make them comparable. For example, an instrument that invests mainly in European stocks with large value capitalization, will not simply be an “equity Europe”, but will also be characterized from the point of view of style (Equity Europe large cap value).