I just finished reading the book Invisible Women: Exposing Data Bias in a World Designed for Men, by Caroline Criado Perez. The author reports a wide range of data, research and empirical cases of a world built and designed by and for men, which ignores the needs of women, sometimes with disastrous consequences. Many are the examples: telephones that are too big for a woman's hand, drug prescriptions that are wrong for woman’s body, low participation of women in political life.

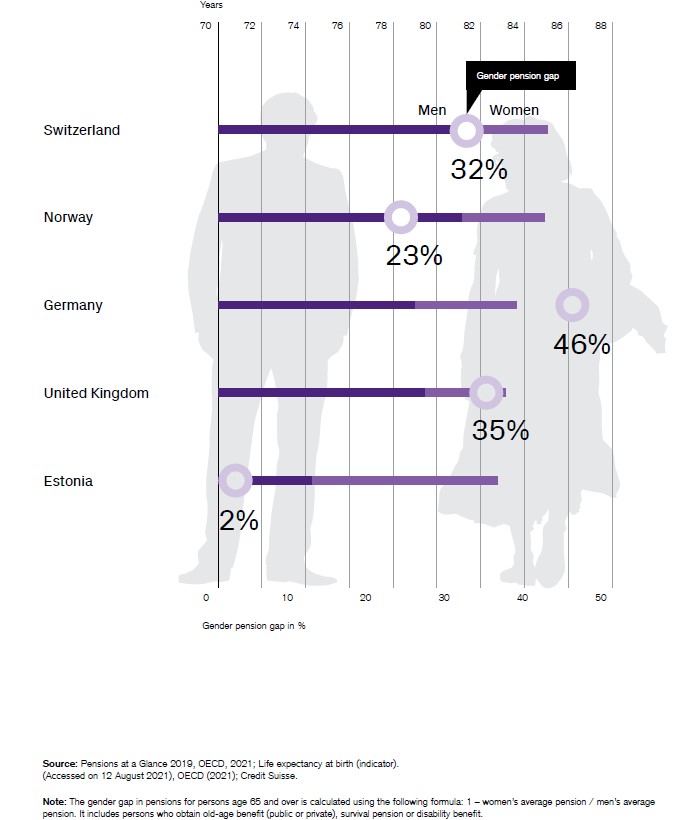

Investments are no exception. There are some unique considerations for women in investments that are often overlooked. Women make up about half of the world's population, and typically live longer than men. Across the OECD (Organization for Economic Cooperation and Development) countries, the average life expectancy (at birth) is 83.4 years for women compared to 78.1 for men. Single person households now represent 10%–30% of all OECD households depending on the age category; and the number is increasing.

Wealth and Pension Gap

These trends have two main outcomes: a gender wealth gap - also due to women’s lower average wages - that undermines financial independence; and a pension gap that can have serious consequences. There is hence a demographic and financial need for women to make their money and savings work harder for their future financial security.

Exhibit 1. Life Expectancy at Birth and the Gender Pension Gap in OECD Countries

Women Seem to Dislike Money Matters

Looking more closely to women in investment, there are some differences compared to men. According to the Credit Suisse’s report Woman to Woman, women tend to hold most of their assets in cash and fixed income, and avoid equities or alternative assets. “This more conservative approach is perhaps linked to a certain unease when it comes to investing”, said Nannette Hechler-Fayd'herbe, Chief Investment Officer of International Wealth Management and Global Head of Economics & Research at Credit Suisse. “The U.S. Bank survey found that the top three emotions associated with financial planning for men are self-confidence, excitement and happiness, while women list self-confidence, stress and anxiety. In short, women seemingly dislike money matters.”

Challenges for Women

The challenge is that in the zero interest rate world in which we have landed since the global financial crisis, putting cash into a savings account to build wealth no longer works.

Keeping money in a saving account exposes women to inflation risk. Investing in "safe" government bonds is not a valid alternative, since rates are close to zero. Negative yields mean that if women hold these bonds until they mature, they would end up paying for the opportunity to lend their money to governments instead of having earned a yield. In other words, women would have been sure of only one thing: losing money at maturity.

To better understand the remarkable difference that investing can make, Credit Suisse calculated possible wealth trajectories for women of different generations in Switzerland if they had invested in a multi-asset strategy in 2009 versus if they had kept their money in a savings account. For example, let’s take a woman aged 30–45 in 2009. Credit Suisse assumed that she would have accumulated CHF 50,000 in savings and wealth to invest in a balanced payout strategy (50% equities and 50% bonds and alternatives). She would have grown her capital to CHF 147,000 by the end of 2020 (vs. CHF 105,000 with a savings account), and she could expect to have CHF 205,000 by the end of 2025 instead of CHF 130,000 in a savings account.

The Anti-Stress Rules

One way to overcome women's difficulty in relating to investments is through life-cycle financial planning. The different stages determine specific goals that also depend on the type of professional career and family situation. Some basic rules apply to all.

- Don't wait until you have big sums of money to start investing. Start small, even with as little as $50 a month, and let the power of compounding do the rest.

- Have a long-term approach, rather than entering and exiting frequently trying to chase market trends. In this way, you reduce costs and the probability of entry on the highs and exit on the lows.

- Avoid financial instruments that you are not familiar with.

- Have an emergency cash fund covering 6–12 months of living expenses in case of unemployment or illness.

Lifecycle Investing

According to Credit Suisse, women often have different life stages shaped by education, family, work and aging. During each phase, women have distinct needs and preferences that call for an investment approach that supports them in building their wealth and securing their long-term financial independence.

- Age 20-30: Women tend not to have a steady income, but it is important to start thinking about saving for retirement, because in this way they can build their wealth and secure their long-term financial independence.

- Age 30-45: Women may take a maternity break to have and take care of children, so they may need to reduce their earnings and pension contributions, which can lead to wealth setbacks later down the road. Women should ensure that their planning reflects their reduced ability to take risks during this period in order to counteract some of these effects. For example, they can focus on payout strategies.

- Age 45-60: As their careers advance, women look toward a phase in their lives in which they can generate higher income and therefore savings, so they can become more sophisticated investors.

- Age 60+: Women’s risk tolerance declines as they rely more directly on capital income and predictable cash streams to fund their activities and living costs during their pre-retirement or retirement phase.

The Effects of COVID-19

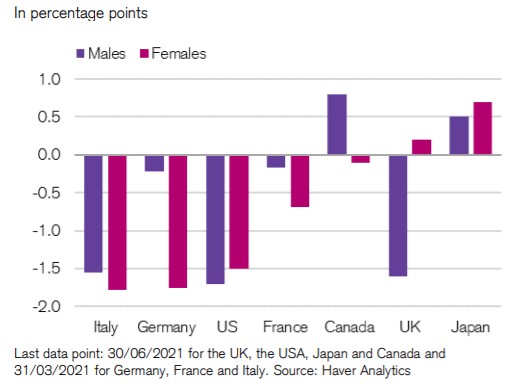

The lifecycle (and investment) described above is an ideal scenario, and one must keep in mind that reality is often different. COVID-19, for example, has had more severe consequences for women's work than men's because it has affected more sectors where their percentage is higher, such as retail trade or restaurants. The International Labour Organization (ILO) estimates that 4.2% of women’s employment worldwide was destroyed between 2019 and 2020 versus 3% of men’s employment. The drop in women’s employment disrupted the progress made over the past 15 years. Along with losing jobs, women also dropped out of the labor force in greater numbers.

Exhibit 2. Change in labor market participation rates (Q4 2019-latest)

The investment and pension gap has therefore widened, making it even more urgent to find solutions to close it.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZFNNTX73BFEFFVRRAFYC6OEOQ.png)