Note that this is an updated version of an article published in March of 2020.

Being a well-informed investor is both a blessing and a curse. As Russia launches an attack on Ukraine, fears of economic shocks are starting to dominate newsfeeds. In response, equity markets moved into the red, and continue to be volatile.

It takes an immense amount of discipline to not be shaken, or at the very least deeply concerned, about the state of the world and how this impacts your investment portfolio. It’s times like these that take an emotional toll that might prompt us de-rail our own investment plans. Here are some key points that might help stay the course:

Risk is More Important Than Volatility

Short term market volatility should not affect how much risk you take on. If you feel like the change of your portfolio value over the last few days is too much to handle, you are probably taking on too much risk. Use this attention and energy to reconsider your risk budget and act accordingly to ensure that your long-term asset allocation (mix between stocks, bonds, cash, and other asset classes) is right for you. Remember that the closer you are to retirement, the less risk you can afford to take.

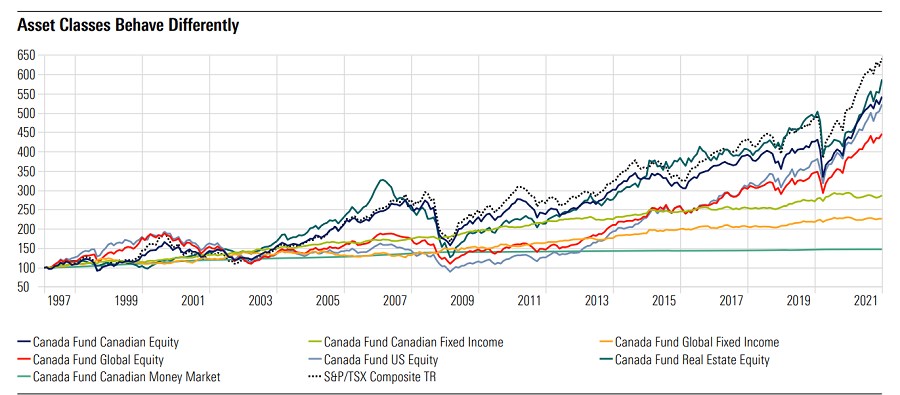

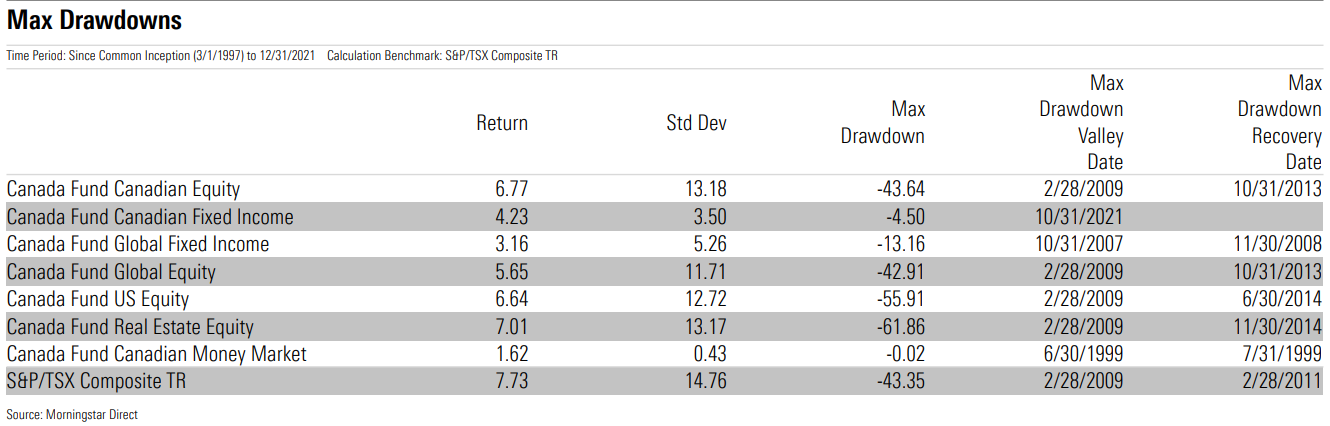

Here’s a reminder of a ‘worst case’ scenario illustrated best by the systematic financial market crash of 2008:

The above chart and table show the long-term performance of several popular Canadian fund category averages, coupled with a table that shows the max drawdown of each category. The maximum drawdown measures the portfolio value drop from the highest peak to the lowest subsequent valley in an investment. For most fund categories, this happened during around the financial crisis. The max drawdown recovery date indicates when the original peak portfolio value was recovered. For riskier categories (like Equity and Real Estate) the recovery period was about 5 years. If you had been invested purely in these asset classes, and planned to retire during the financial crisis, it was likely that you would not have been able to do so. Another very good reminder that being invested according to your risk tolerance is of utmost importance.

Time in the Market is Better Than Timing the Market

Don’t time the market. The most sophisticated investors in the world cannot predict what will happen tomorrow, and neither can we as retail investors. By nature, the farther out financial models forecast into the future, the less accurate they are. Take these forecasts with a grain of salt. As we near the 2021 RRSP contribution deadline here in Canada, many Canadians might be considering ‘holding back’ in terms of investing. Remind yourself that dollar-cost averaging, does not afford you more wealth in the future and investing according to your long-term asset allocation is the best plan to ensure you reach your financial goals.

For investors that have these two concepts in check, staying the course and allowing the effects of diversification and compounding to do the heavy lifting will likely lead to a successful path to financial independence.

Now might also be a good time to revisit your values as an investor. It is unfortunate that it sometimes takes shocking events to for investors to re-consider the impact that their investments have on the state of our world. Whether it be impacting climate change, increasing diversity in the c-suite, or reducing the use of controversial weapons, there are now a plethora of sustainable investment products available to Canadians that can help control and direct your assets in ways that positively impact the world. Moreover, investing in line with your personal beliefs might just help you stay invested during times of turmoil. For a starter, check out Morningstar’s sustainable investing framework for a good understanding of where you sit on the spectrum of sustainable investment approaches.

This article does not constitute financial advice. Investors are always encouraged to conduct their own research before buying or selling securities.