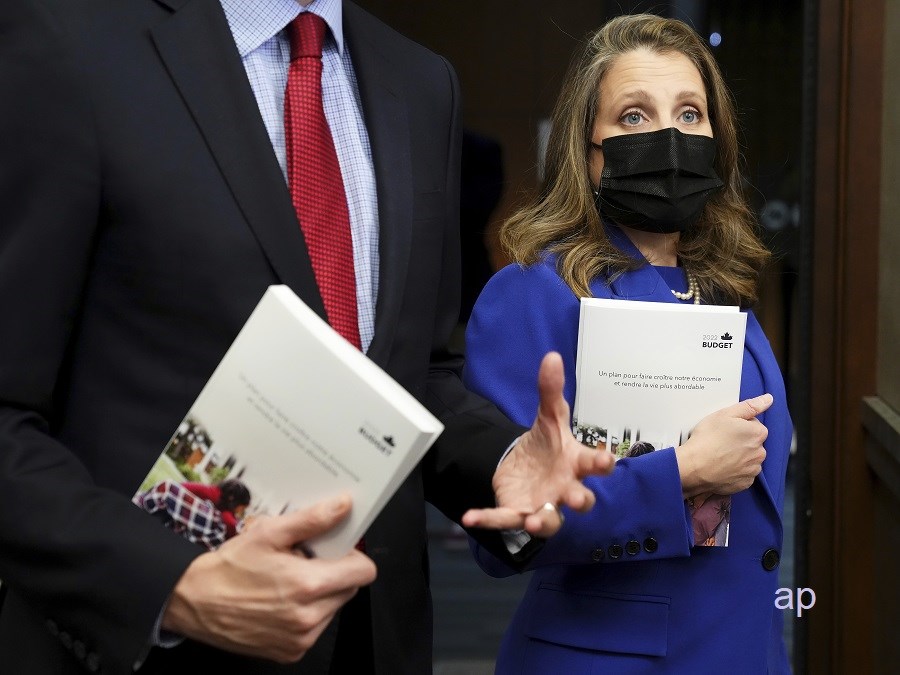

Earlier today, Finance Minister Chrystia Freeland tabled the federal government’s 2022 Budget. The government is forecasting a deficit of $52.8 billion in fiscal 2022-23, expected to decline to $8.4 billion in fiscal 2026-27.

Taxing the Banks

The government plans to implement a “Canada Recovery Dividend,” under which banks and life insurers will pay a one-time 15% tax on taxable income above $1 billion for the 2021 tax year. The Canada Recovery Dividend will be paid in equal installments over five years.

“Budget 2022 also proposes to permanently increase the corporate income tax rate by 1.5% on the taxable income of banking and life insurance groups above $100 million, such that the overall federal corporate income tax rate above this income threshold will increase from 15% to 16.5%,” the report outlines.

The two measures could raise $6.1 billion over the next five years.

According to a Canadian Press report earlier today, CIBC (CM)'s chief executive officer said a tax hike targeting major financial institutions could send the wrong signal to the world about investing in Canada. CEO Victor Dodig says he is an advocate for competitive tax policy, not policy that targets specific industries, and that he is supportive of moves that drive more human capital and foreign direct investment in Canada.

Investment Tax Credit for Carbon Capture, Utilization, and Storage (CCUS)

The 2022 Budget proposes a refundable investment tax credit for businesses that incur eligible CCUS expenses, starting in 2022. From 2022 through 2030, the investment tax credit rates would be set at 60% for investment in equipment to capture CO2 in direct air capture projects, 50% for investment in equipment to capture CO2 in all other CCUS projects, and 37.5% for investment in equipment for transportation, storage and use.

“To encourage the industry to move quickly to lower emissions, these rates will be reduced by 50 percent for the period from 2031 through 2040 The proposed refundable tax credit is expected to cost $2.6 billion over five years starting in 2022-23, with an annual cost of about $1.5 billion in 2026-27,” the budget report said.

A TFSA for Your First Home

In good news for first-time home buyers, the budget is providing a means for Canadians to save for their first home.

“To help Canadians save for their first home, Budget 2022 proposes to introduce the Tax-Free First Home Savings Account that would give prospective first-time home buyers the ability to save up to $40,000. Like an RRSP, contributions would be tax-deductible, and withdrawals to purchase a first home—including investment income— would be non-taxable, like a TFSA. Tax-free in, tax-free out. The government intends to work with financial institutions to ensure that a Tax-Free First Home Savings Account could be opened and contributed to in 2023. It is estimated that the Tax-Free First Home Savings Account would provide $725 million in support over five years,” the report says.

Help to Buy a Tesla?

To help make zero-emission vehicles more affordable for Canadians, Budget 2022 “proposes to provide $1.7 billion over five years, starting in 2022-23, with $0.8 million in remaining amortization, to Transport Canada to extend the Incentives for Zero-Emission Vehicles (iZEV) program until March 2025. Eligibility under the program will also be broadened to support the purchase of more vehicle models, including more vans, trucks, and SUVs, which will help make ZEVs more affordable.” Further details are awaited.

Charging stations are not left behind, as the Canada Infrastructure Bank will invest $500 million in large-scale urban and commercial zero-emission vehicle charging and refuelling infrastructure. The government also proposes to provide $400 million over five years, starting in 2022-23, to Natural Resources Canada to fund the deployment of zero-emission vehicle charging infrastructure in suburban and remote communities through the Zero-Emission Vehicle Infrastructure Program.