Investors don’t need Tesla stock (TSLA) in their portfolios in order to benefit from the mega shift to more-sustainable driving.

Instead, they can apply the old Gold Rush maxim of focusing on the shovel and pick sellers. In this case, as electric vehicles go from being a niche product to mainstream and traditional automakers ramp up production, the opportunities among suppliers is set to grow exponentially in coming years.

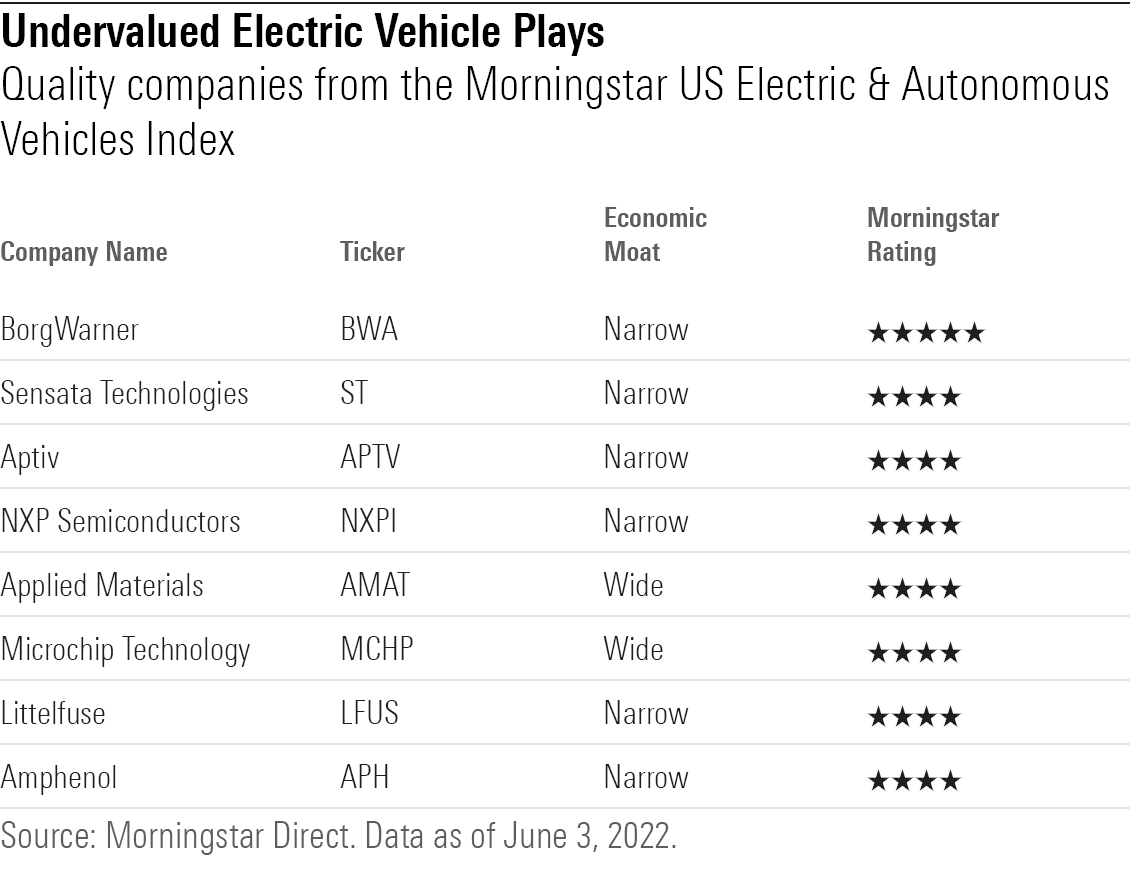

At the same time, companies that supply key auto parts to electric vehicles, such as BorgWarner (BWA), Sensata Technologies (ST), and Aptiv (APTV), are trading below their fair value estimates.

“Pure play electric vehicle companies like Tesla and Rivian are getting a lot of media attention, but there are other ways for investors to play the same theme, throughout the supply chain,” says Andrew Lane, director of equity research for index strategies at Morningstar.

Many investors may not understand the considerable differences between manufacturing electric vehicles and traditional, combustion-engine vehicles.

“When you replace the gas powered engine with a battery, and a motor, it requires hundreds of extra electric components,” says Will Kerwin, equity analyst at Morningstar. “Normal cars require 12 volts of electricity,” he says. “But for electric vehicles, their batteries require hundreds of volts—and that’s where the greater dollar content per car comes from. The suppliers that are able to win are those that are already the best at serving complex applications.”

“More electric content means electric suppliers can sell more into each vehicle. If they sell into the same amount of vehicles, they’re growing,” Kerwin says. “For example, Littelfuse (LFUS) sells $5 of content into a traditional vehicle on average. But for electric vehicles, they can sell $35 of content per vehicle.”

It’s a similar story for semiconductors. Semiconductor manufacturers that focus on automotive are well positioned to win because EVs need 2 to 3 times more semiconductors per vehicle, he says.

Undervalued Electric Vehicle Stocks

Morningstar analysts think there’s plenty of room for share prices to drive up further: “We’re forecasting that battery electric vehicles will take a 30% market share globally by 2030, versus a little over 5% last year,” says Seth Goldstein, equity sector strategist and chair of the electric vehicles committee at Morningstar.

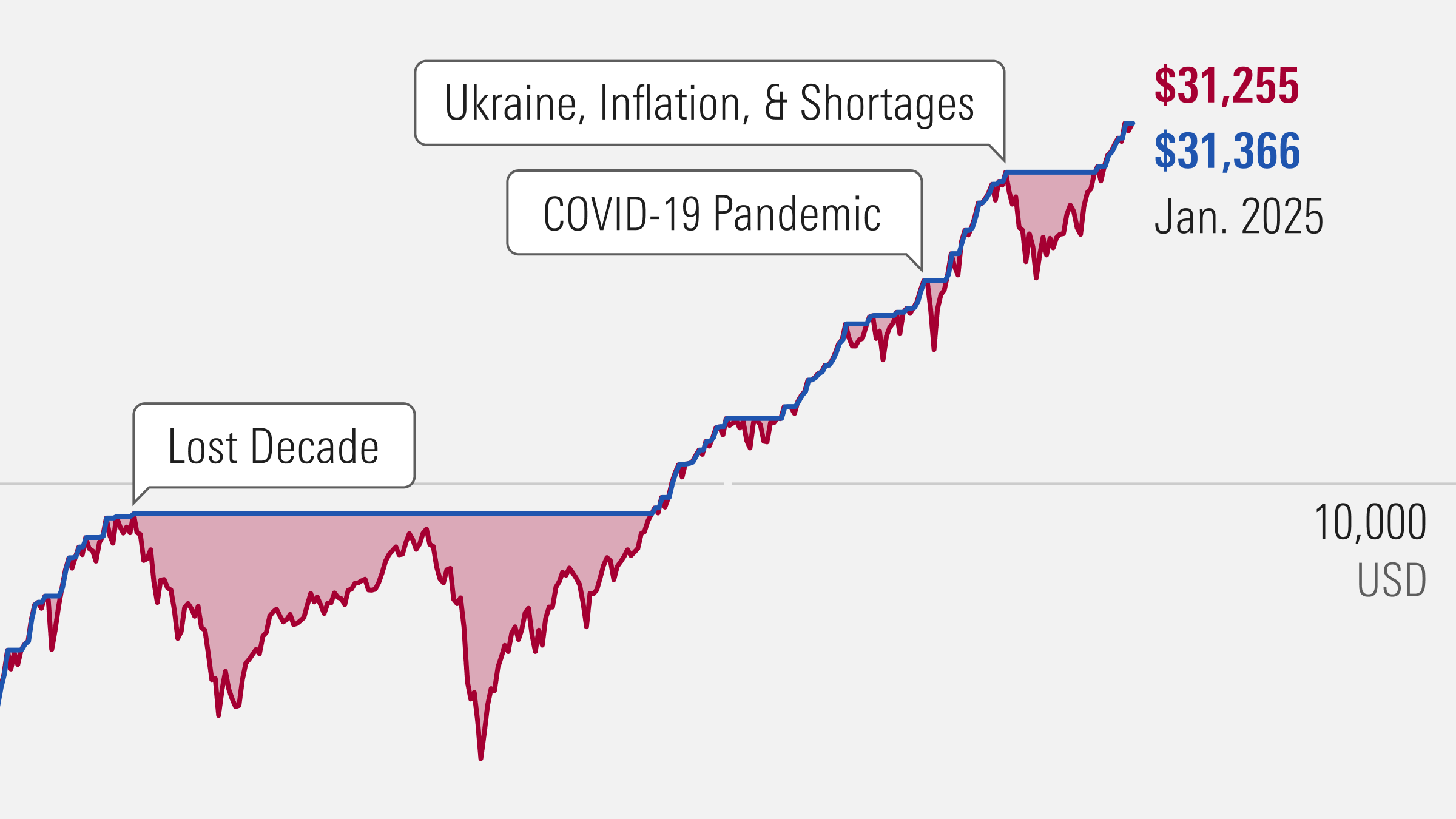

Like other parts of the stock market, electric vehicle stock plays have had a rough 2022. The Morningstar US Electric and Autonomous Vehicles Index, a collection of analyst-reviewed U.S. companies considered to benefit from increased adoption of electric and autonomous vehicles, has fallen 11.6% for the year to date, just a hair above the Morningstar US Market Index, which is down 13.2% for the same period.

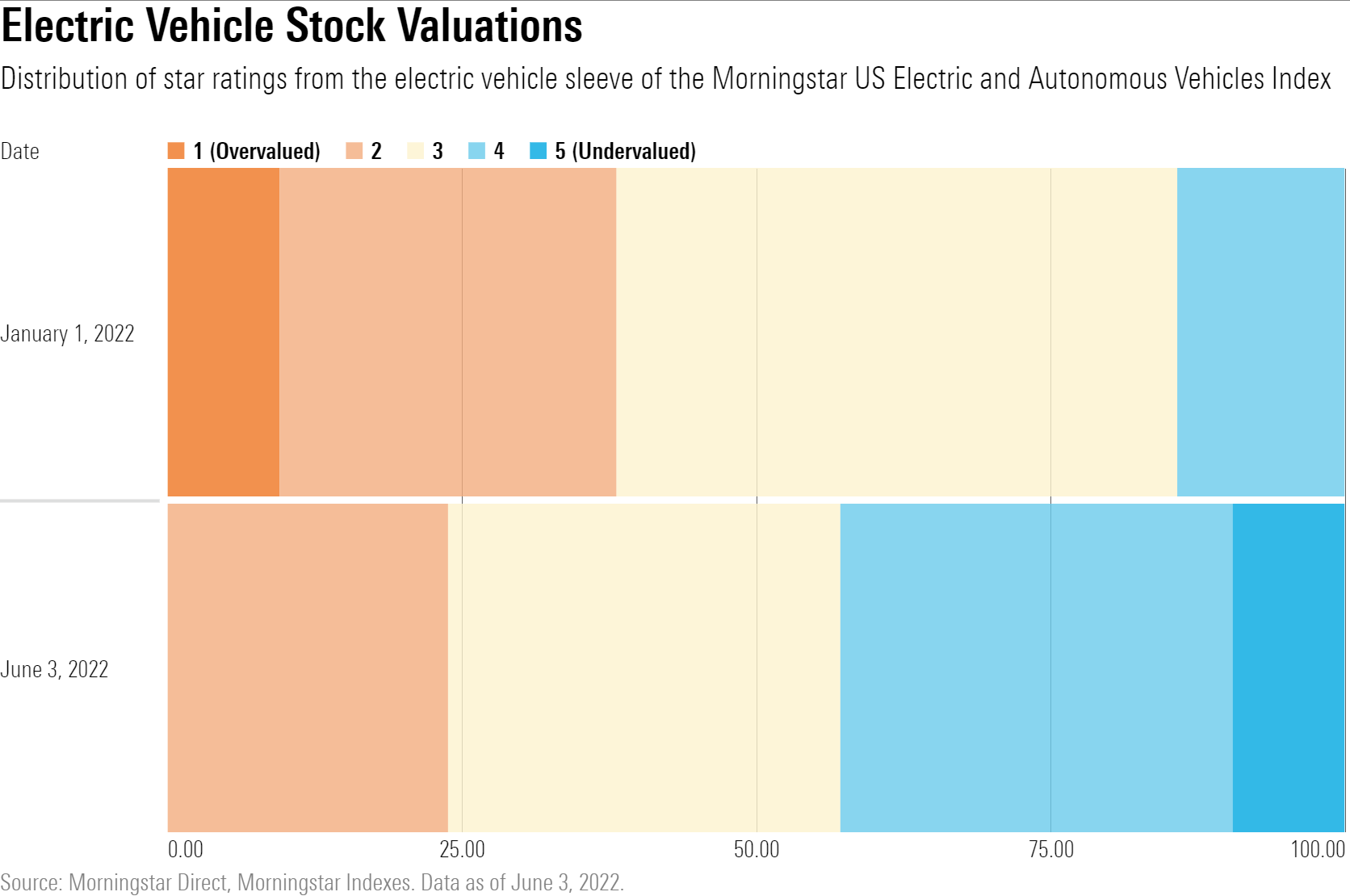

Eight of the 21 companies in the electric vehicles portion of the Morningstar Electric and Autonomous Vehicles Index are currently trading at 4- and 5-star undervalued prices, up from just three companies at the start of the year. The index overall is currently trading at an 11.6% discount from its aggregate fair value, while the broader market’s valuation is estimated to be discounted 6.8% from its aggregate fair value estimate, as measured by the Morningstar analysts and the Morningstar US Market Index.

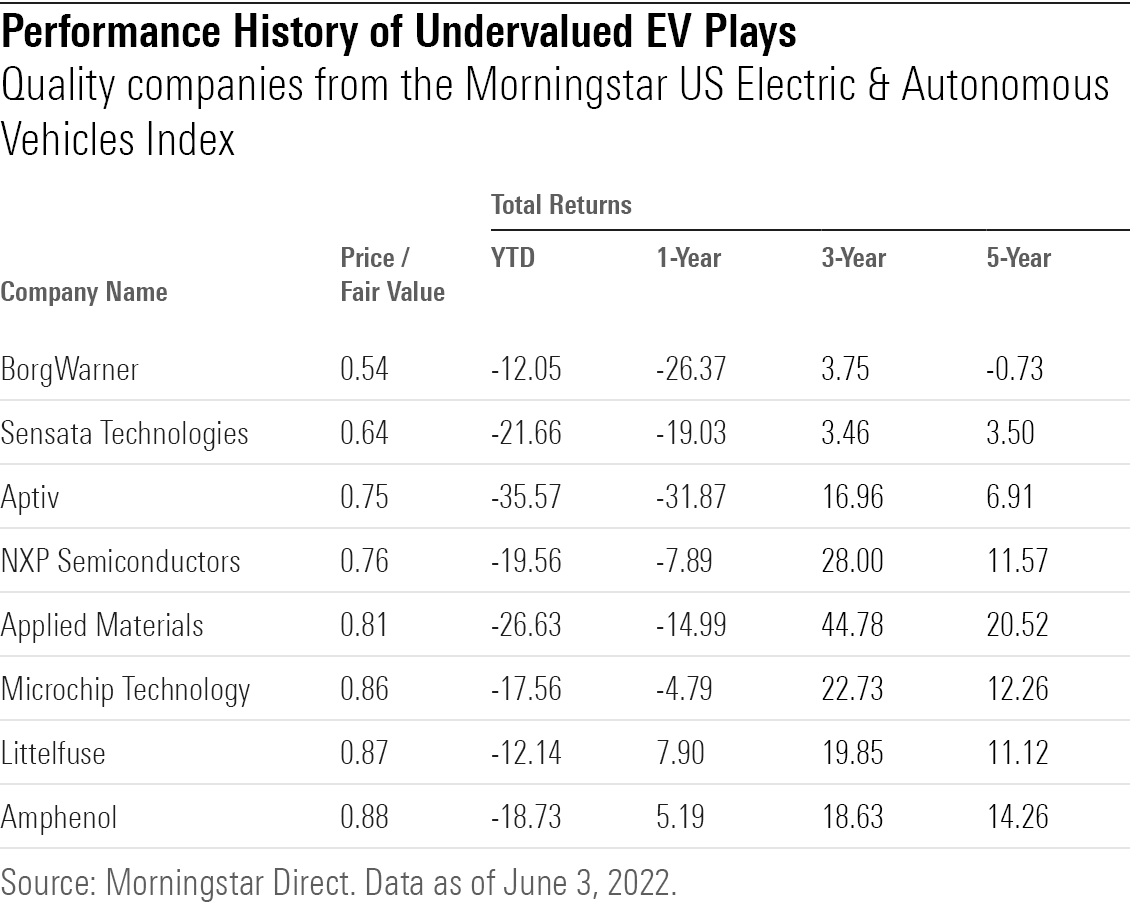

Within the Morningstar US Electric and Autonomous Vehicles Index, automotive technology supplier Aptiv has fallen 35.6% for the year to date as of June 3, and Applied Materials (AMAT), an American corporation supplying equipment and software to semiconductor manufacturers, is down 26.6%.

Before this year’s big market selloff, undervalued electric vehicle stocks in the index, including Sensata, Littelfuse, Applied Materials, and Aptiv, haven’t been this discounted since April and May 2020.

But over the longer term, the returns on many of these stocks are strong.

Electric Car Stock Performance

Applied Materials stock has risen 160.6% over the past five years, nearly double the growth of the Morningstar US Market Index, which was up 82.7% during the same time frame. Amphenol (APH) gained 98.4%, and Littelfuse gained 75.6%.

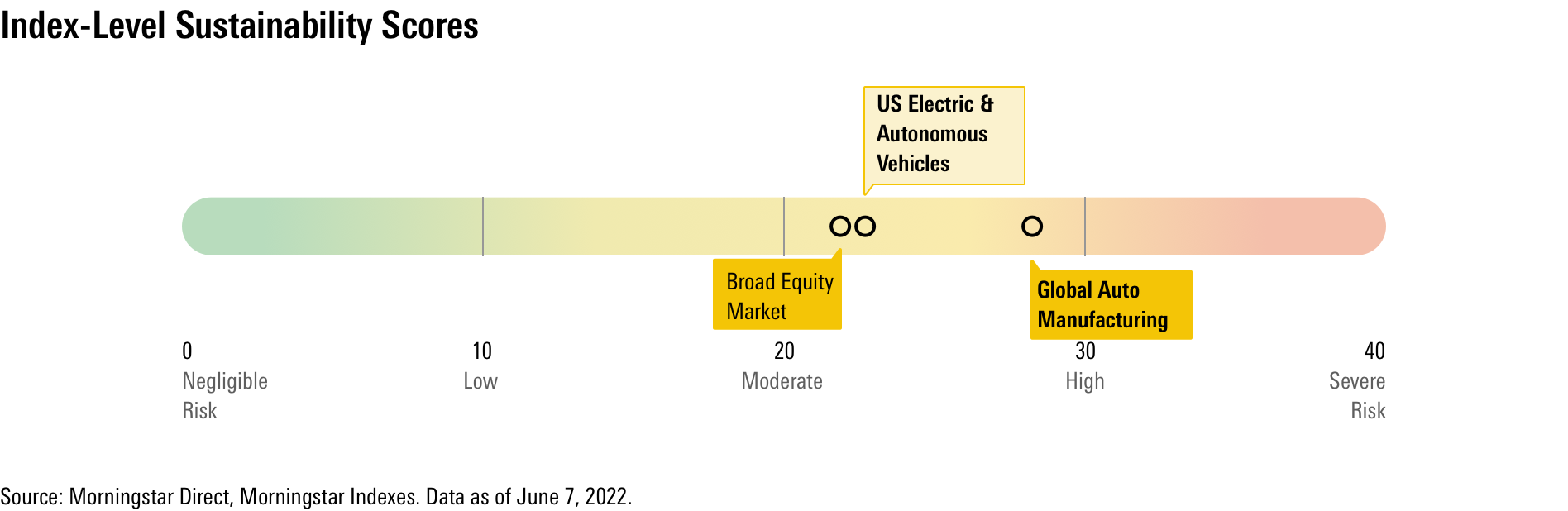

Sustainability Ratings on EV Stock Plays

The Morningstar US Electric and Autonomous Vehicles Index does not screen out companies with High Morningstar Sustainalytics’ ESG Risk Ratings, but the group carries less risk than traditional automakers, as measured by the ratings. Companies in the electric and autonomous vehicles index currently have a risk score of 22.9—considered Medium risk, scoring slightly higher than the broader equity market’s average of 21.8. Meanwhile, the Morningstar Global Auto Manufacturing Index’s current risk score is 27.9, much closer to High risk territory.

Within the electric vehicles supply chain, business ethics, human capital, and natural-resources use are key sustainability risk factors.

Here’s the Morningstar take on eight undervalued electric vehicle stocks:

BorgWarner BWA

“BorgWarner’s economic moat rating is narrow. The sources of the company’s moat include intangible assets, high customer switching costs, and cost advantages. BorgWarner benefits from a substantial global manufacturing presence, highly integrated and long-term customer ties, and a moderate level of pricing power from the regular commercialization of new technologies.

“BorgWarner’s consistent technology innovation and ability to find alternative vehicular applications enable more favorable pricing relative to many automotive industry suppliers, increasing the company’s dollar content per vehicle. Automakers are willing to pay for components and systems that provide substantial product differentiation, weight reduction, enhanced safety, or reduced cost, all while meeting fuel efficiency and emissions regulatory requirements, as is the case with BorgWarner.”

--Richard Hilgert, senior equity analyst

Sensata Technologies ST

“We award Sensata Technologies a narrow economic moat on the basis of customer switching costs and intangible assets. Sensata is a leading designer and manufacturer of sensors, selling into the transportation and industrial verticals. In Sensata’s Performance Sensing segment (75% of 2021 sales), the firm sells tire pressure monitoring systems (TPMS) and a plethora of other pressure, temperature, and position sensors into the automotive and heavy vehicle end markets. In the firm’s Sensing Solutions segment (25%), Sensata sells inverters, thermostats and electrical protection into the aerospace, heating, ventilation, and cooling, and industrial end markets. We think Sensata’s moat will allow it to earn returns on invested capital in excess of its cost of capital over the next 10 years.”

--William Kerwin, equity analyst

Aptiv APTV

“We have assigned Aptiv a narrow economic moat rating. Intangible assets and switching costs (and, to a lesser extent, cost advantage) are the sources from which the company derives its economic moat. The intangible asset moat source flows from a product pipeline continuously filled with intellectual property development and the ability to commercialize on these new technologies, as well as contractual long-term, highly integrated engineering relationships between Aptiv and automaker customers. Contractual supply agreements, which include vehicle development, last for six years on the low side and 14 years on the high side.

“Steep switching costs result from incremental engineering, development, and tooling costs; the need to relocate or even repurchase large, heavy industrial equipment; the risk that the automaker’s assembly line may be shut down during a switch; the lengthy time to develop the competing supplier’s product to customer specifications; and preproduction validation to ensure process and product integrity.”

--Richard Hilgert, senior equity analyst

NXP Semiconductors NXPI

“We believe NXP Semiconductors warrants a narrow economic moat rating, consistent with other broad-based analog and mixed-signal semiconductor peers. We believe NXP prospers from intangible assets stemming from the firm’s design expertise, as well as customer switching costs, as NXP’s products are rarely ripped out once designed into a device, particularly in the company’s four main segments-- automotive, industrial and Internet of Things, mobile, and communications infrastructure.

“By end market, automotive analog/mixed signal chipmakers tend to benefit from intangible assets, as auto chip suppliers have their manufacturing processes perfected in order to deliver parts with maximum reliability, in some cases even offering zero defects per million parts. Automotive chipmakers also benefit from high switching costs, thanks to the long design cycles and programs associated with automobiles. Semis are often selected two to three years before cars hit production, and the chips are almost always retained throughout the life of the car program, which could be five to seven years.”

--Brian Colello, senior equity sector director

Applied Materials AMAT

“We believe Applied Materials has a wide economic moat based on its intangible assets around wafer fabrication equipment design expertise and research and development, or R&D, cost advantages required to compete for the business of leading-edge manufacturers. These characteristics have allowed it to become the top vendor in the semiconductor equipment market. Applied’s scale and resources allow a research and development budget in excess of $2 billion to serve cutting-edge technologies and thus benefit from inflections such as fin field-effect transistors, or FinFET, and 3D NAND. Advanced tools in deposition and etch have become critical for multiple patterning that enables leading-edge foundry and logic processes. As a result, these segments have grown faster than the broader market in recent years, and firms such as Applied have directly benefited, as it can outspend smaller chip equipment firms in research and development to develop more advanced solutions.

“When chipmakers operate numerous fabs around the world, maximizing throughput and reducing process variability across their fleet of tools are top priorities. We believe incumbent tool providers, such as Applied, also have intangible assets derived from service contracts and customer collaboration during process development and subsequent high volume manufacturing. Field service engineers that are on-site at customer fabs help troubleshoot high-value problems to improve yields and output, ultimately driving productivity and reducing cost. We believe a positive feedback loop is subsequently created in which top equipment vendors leverage existing relationships and insights into future customer technology needs to ultimately design and offer superior equipment. Furthermore, the resultant virtuous cycle cannot easily be replicated by potential new entrants. Applied’s installed base of over 43,000 tools is the largest in the industry, which gives us added confidence in our wide moat rating.”

--Abhinav Davuluri, equity sector strategist

Microchip Technology MCHP

“We believe that Microchip has a wide economic moat. Moats for analog and microcontroller, or MCU, chipmakers, such as Microchip, tend to come from intangible assets around proprietary chip designs and manufacturing expertise, as well as switching costs that make it difficult to swap out analog and MCU chips for competing offerings once they are designed into a given electronic device. Given Microchip’s track record of stellar profitability in recent years and ability to retain its leadership position in MCUs while expanding its analog business, we think it is more likely than not that Microchip will earn on excess capital over the next 20 years.”

--Brian Colello, senior equity sector director

Littelfuse LFUS

“We award Littelfuse a narrow economic moat rating, on the basis of customer switching costs that pervade the entirety of its product portfolio. Littelfuse acts as a co-designer with its customers to design its circuit protection, power management, and sensor products into mission critical systems that bear a high cost to failure, and thus high switching costs. As a result, we expect the firm to earn returns in excess of its cost of capital for the better part of the next decade.

“Littelfuse has a broad portfolio of circuit protection and power management products, along with sensors and power semiconductors, that it sells into the automotive, industrial, telecom, and consumer electronics end markets. Circuit protection products include fuses, breakers, diodes, relays, and other components that ensure the safe function of electrical systems by guarding against surges and overcurrent. Because Littelfuse’s SKUs are sub-components to larger electrical or electronic systems, the firm works closely with customers, acting as a design and engineering partner to integrate its passive components into OEMs’ end products. Littelfuse engineers begin working with its customers two to three years before production, to collaborate on designs and craft a manufacturing strategy. Once Littelfuse’s products are designed into an end product, they are likely to remain in for the entire life cycle. In transportation and industrial applications, Littelfuse’s customer relationship for a single design win can be up to 8-10 years. An end customer would face prohibitively high switching costs if it wanted to prematurely end its contract with Littelfuse mid-product cycle.”

--William Kerwin, equity analyst

Amphenol APH

“We award Amphenol a narrow economic moat, resulting from firmwide switching costs and intangible assets that give us confidence in Amphenol’s ability to earn returns on invested capital in excess of its cost of capital for at least the next decade.

“In electric vehicles, or EVs, OEMs are attempting to move to high-power charging that would achieve 200 miles of charge in as little as 10 minutes. To do so is analogous to drinking water from a fire hose—the electrical infrastructure in a vehicle has to safely manage the larger power transfer and distribute the heat that comes with it. Enabling an innovation like high-power charging allows Amphenol to occupy a larger portion of the overall bill of materials, both through incorporating more SKUs and through selling higher-tech, higher-priced SKUs—we estimate Amphenol’s dollar content in an EV to double its content in an internal combustion engine, or ICE. As ICEs become more electrified, and EVs take up a larger share of the global fleet, Amphenol’s average content per vehicle increases. Amphenol has been able to consistently grow its automotive revenues at a faster clip than the underlying market—since 2015 years it has averaged nearly 14% outgrowth above underlying automotive production. This trend of Amphenol’s products underpinning advancements in technology that keep its prices elevated can be seen across its many industry verticals. In industrial equipment like robotic arms, the increasing prevalence toward smart and connected factories drives more sensor content, and more complex machinery requires more electrical connections.”

--William Kerwin, equity analyst