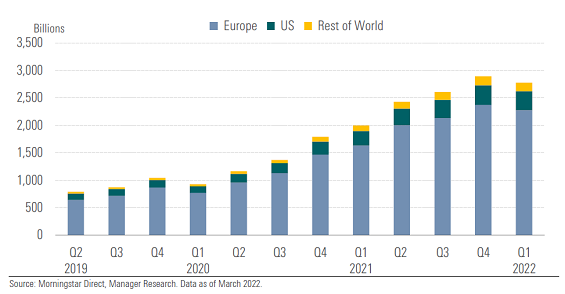

Sustainability considerations are becoming increasingly top of mind for investors. Europeans have led the charge on sustainable investing, but its popularity is also growing elsewhere, particularly in the United States, where net inflows into sustainable-investment funds continues. As noted by Morningstar, even with recent headwinds from heady inflation, rising interest rates, and the Russian invasion of Ukraine, sustainable funds attracted nearly US$97 billion in net new money in the first quarter of 2022, pushing the total assets to US$2.8 trillion.

The mainstreaming of sustainable investing means it is worth considering the broader influence of environmental, social, and governance factors upon dominant investment styles. Value and growth investing remain the two primary investment philosophies employed by investors in their efforts to outperform the market. Both styles offer investors a solid framework and overarching approach to their investing endeavors—particularly during times of market volatility, when one is more easily tempted to deviate from one’s customary approach. Nonetheless, investment philosophies themselves evolve over time, with the successive generations of investment practitioners leaving their mark on their respective investing style.

Take value investing as an example. Benjamin Graham laid the foundation for this popular investing style with the publication of his seminal Security Analysis in 1934. Value investing emerged after a once-bitten, twice-shy Graham, who had all but lost his shirt in the bear market of 1929, urged investors to focus on buying stocks with what he referred to as a margin of safety. That meant a marked discount to the intrinsic value of the company’s stock that would help the investor manage the risk inherent in investing. Value investing was adopted and enhanced by its most prominent current practitioner, Warren Buffett, who advised investors that the path to achieving superior long-term investment performance is to invest in companies that boast a durable competitive advantage relative to their peers. Buffett coined the term “economic moat” (which Morningstar also later adopted) to describe the favorable economics that these types of stocks tend to enjoy. Of course, a keen focus on a stock’s price relative to its intrinsic value equally remains key to investment success, according to value-investment aficionados.

Will Increased Interest in Sustainable Considerations Alter Value Investing?

The answer is complicated, but we found that companies with wider moats tend to face fewer ESG risks on average.

In considering this, a logical starting point is the sustainability credentials of stocks with economic moats. On one hand, it could be the case that companies benefiting from the most durable competitive advantages—known as wide-moat companies in Morningstar parlance—could be under less pressure to deliver on sustainability outcomes than those with fewer advantages. The argument goes: Robust competition drives companies to reduce costs and allocate capital efficiently, and these efforts lead to firms using as few resources, including energy and raw materials, as possible in order to compete effectively. Because wide-moat companies face lower amounts of competitive pressure, they may face less pressure to deliver on sustainability issues. If this were the case, value investors seeking to invest in wide-moat companies but also wanting to keep ESG risks in mind may need to adjust their investing style to incorporate ESG factors more fully.

On the other hand, it could equally be argued that wide-moat firms—which tend to generate greater free cash flow than companies that aren’t competitively advantaged—have greater financial resources at their disposal to manage ESG risks or to take action on ESG-related issues such as climate change or human capital diversity issues. If these wide-moat companies were willing to harness their financial flexibility to address ESG issues, value investors probably wouldn’t need to alter the way that they invest all that much to account for their rising concerns over ESG performance.

One approach to answering this question is to look at the number of controversial ESG events that wide-moat companies have faced—to provide a real-world list of risks that have materialized for investors—and compare that list with the same of no-moat firms. It is also instructive to examine how companies are managing the key ESG risks that they face across the economic moat spectrum to determine whether companies with wide moats tend to do more or less to manage ESG risks than firms without an economic moat.

On the first approach, when we look at data from Morningstar Sustainalytics on media coverage dating back to December 2018 regarding ESG-related news events, we find strong evidence that wide-moat companies tend to be less prone to ESG-related controversies. After we control for market capitalization—to account for the natural inclination of news flow to follow companies of greater size—it is apparent that wide-moat firms on average face a lower number of newsworthy ESG incidents than do their no-moat counterparts. To the extent that news coverage of ESG-related events and controversies of a company is a decent proxy for the ESG risk borne by its investors, this result certainly suggests that wide-moat firms are under less pressure to address key ESG issues. Otherwise, one could plausibly expect that wide-moat firms would face a greater degree of negative ESG-related media coverage, not less.

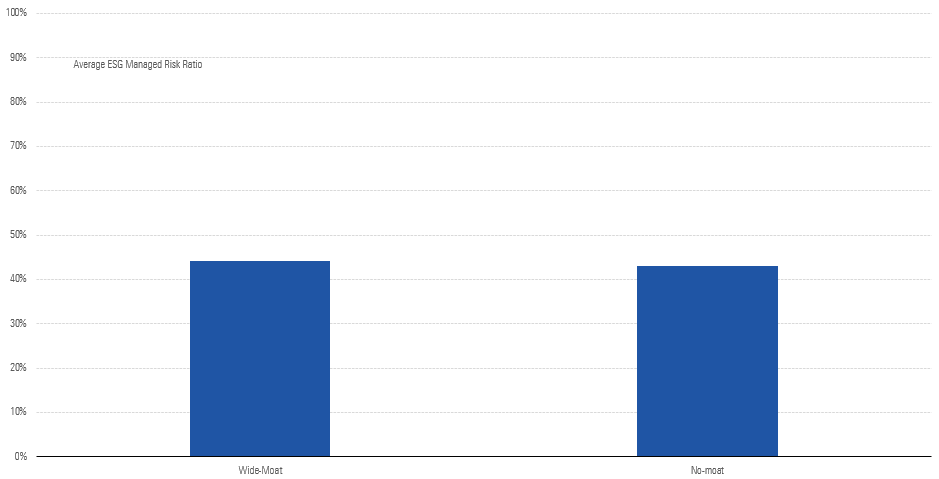

However, as we dig a little deeper, we don’t find evidence that wide-moat companies are managing the ESG-related risks that they face any better than their no-moat counterparts. In making this assessment, we’ve looked at two data points measured by Sustainalytics—the Manageable Risk and Managed Risk scores—across the wide-moat and no-moat spectrums. The Manageable Risk score reflects Sustainalytics’ view as to the potential to manage a company’s ESG risk exposures through related programs and policies. In turn, the Managed Risk score reflects Sustainalytics’ view as to how much of that manageable risk is actually being effectively managed by the firm. Taking the ratio of these two scores—which for our purposes we will call the “ESG Managed Risk Ratio”—gives a sense of how well a company is managing the types of ESG risks it faces. The higher this ratio is, the better ESG risks are being managed, in Sustainalytics’ view.

If it is the case that wide-moat firms are indeed managing ESG risks better, then it stands to reason that their ESG Managed Risk Ratio should be on average higher than that of no-moat counterparts. However, when we compare the mean ESG Managed Risk Ratio of the companies with Morningstar Economic Moat Ratings of wide against that of no-moat firms, we find no statistically significant difference.

So, if wide-moat companies tend to face lower ESG risk on average but aren’t outdoing their no-moat counterparts on managing the ESG risks they face, this implies that the starting position—that is, the underlying exposure of companies to ESG risks before considering what is being done to manage those risks—is more favorable for wide-moat companies on average than it is for no-moat ones. Certainly, Sustainalytics’ ESG Exposure scores support this notion. ESG Exposure Scores reflect Sustainalytics’ view on a firm’s exposure to 20 material ESG issues including carbon emissions, human rights, land use, and biodiversity. When we compare the ESG Exposure scores of wide-moat to no-moat companies, there is strong evidence to suggest that, on average, the ESG risk that wide-moat companies are exposed to is lower than that of no-moat peers.

While there appears to be scant evidence that wide-moat companies are doing more to address their most-material ESG issues, value investors’ focus on economic moats nonetheless appears to provide some level of inherent protection against ESG risks. But while there is correlation between a wide moat and lower ESG risk, whether there is causation between the two is unclear. Nonetheless, correlation—provided it remains persistent—is sufficient to say that, if value investors continue to focus their attention on locating stocks with the widest of moats and remain focused on price versus fair value when making stock selections, they may well find the ESG risks that their portfolios face are inherently lower than the broader market.

With this in mind, it seems that long-term returns for value investors who continue to heed the teachings of Graham and Buffett may not be impaired by latent ESG risks in their portfolios. Accordingly, the rising awareness of ESG considerations may not elicit a substantial evolution in the value-investing style that its rising popularity may imply. Rather, keep looking for the widest moats that are filled with the proverbial piranhas and crocodiles that protect a business’ economic profits, just as Buffett suggests. They, too, may well provide investors with good insulation from ESG risks.