As a mutual fund with the ability to invest in alternative strategies such as short selling, Picton Mahoney Fortified Equity has been able to take advantage of a broader set of tools and greater diversification to navigate volatile equity markets.

While the management team has been unable to avoid losses completely in recent difficult markets, it has suffered slightly less damage, with Picton Mahoney Fortified Equity Class F showing a one-year return at June 29 of -17.3%, compared to a -18.2% return for Morningstar’s Global Equity Category.

Longer-term, the fund has shown superior performance, with a 7.7% average annual compounded gain for the three years ended June 29, ahead of 4.3% earned by the category. For the five years ended June 29, the fund had an average annual gain of 6.7%, again beating the category average of 5.1%.

New Tools Needed

“The fund is a bit of a different beast, and our net exposure is currently lower than the average ‘long-only’ portfolio manager,” says Michael Kimmel, portfolio manager (U.S. Equities) at Toronto-based Picton Mahoney Asset Management. “For long-only managers, their only option for defence is to raise cash. We have more tools available, it’s a bigger ball game.”

Tools include the use of options strategies, short-selling on an absolute basis, and holding high cash levels as a cushion while maintaining market exposure through the use of derivatives or other alternative strategies.

Although Picton Mahoney also offers alternative funds or hedge funds that are sold by offering memorandum and operate under different rules that allow them to use leverage and hedging strategies more aggressively, with funds classified as ‘mutual funds’ there are controls on margin safety and leverage.

Best in Bear Markets

The enhanced flexibility and differentiated investment solutions are particularly useful during bear markets when downside risk protection is crucial, says Kimmel and fellow team member, Michael Kuan, portfolio manager (International Equities).

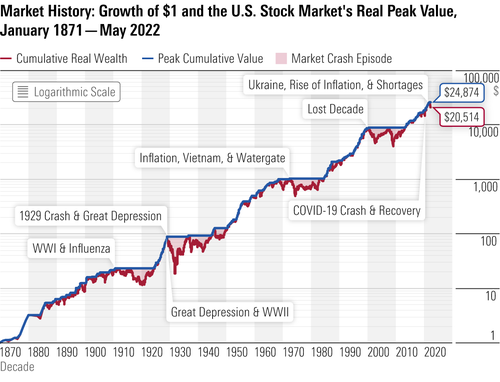

Markets have been rattled by strong inflation numbers that have spurred the U.S. Federal Reserve to raise its key federal funds rate aggressively in the past couple of months, and more hikes are expected. Central banks in Canada, Switzerland and England are also hiking rates.

“Markets are challenging, and we’ve had to become more like traders,” says Kimmel. ‘There’s a time to make money and a time to preserve, and right now it’s more of the latter.”

Bottom Not in Sight Yet

While markets have dropped dramatically in recent months, Kimmel and Kuan think the ultimate low has not yet been reached.

“There is a lot of ‘multiple compression,’ which is entirely appropriate in the current environment,” says Kimmel. “We expect negative earnings estimate revisions in the next few months.”

There are several “unknowns,” he says, including the war in Ukraine and the Covid-related slowdown in China and its effect on supply chains for various goods.

The fund is underweight relative to the MSCI World Index in the U.S. generally and also in tech stocks, which Kimmel says are more cyclical than many investors realize.

He foresees a potential short opportunity as stock prices fall and option-based compensation loses its allure for executives. Many companies could be forced to pay higher cash wages to attract talent, with negative consequences to the income statement.

“We are currently scrutinizing companies with excessive stock-based compensation, and that could be where our next round of shorting will occur,” he says.

Shorting Consumer Cyclicals

The team is also looking at short opportunities in some cyclicals such as consumer discretionary stocks that could be vulnerable to an economic slowdown. Consumer finance companies with high credit exposure may be hurt by rising interest rates, and leisure-related companies may be hit by pullbacks in personal spending.

Although shorting can deliver “significant alpha” Kimmel says, the team has become more cautious as some short positions have recently fallen in price by half to two-thirds, becoming ripe for a rebound or bear market rally.

“We are cognizant of how much the market has sold off, as one of the important risk factors is unexpected upside,” Kimmel says. “Any positive clarity in situations such as the war in Ukraine, Covid in China, inflation or the Fed’s interest rate policy could lead to massive rallies and thereby squeeze the shorts. We are being particularly careful given the selling we’ve already seen. If there is a market rally, we can then come back and re-engage some short exposure.”

Spots of Optimism

Picton Mahoney Fortified Equity’s managers have lately become more optimistic about the Hong Kong market with its potential to improve as Covid restrictions come off, and are starting to deploy capital there.

Canada is viewed as a commodity-oriented market and has a 7% geographic weight in the fund. It is the largest overweight position relative to the MSCI World Index.

Key long positions in the fund include U.S.-based Progressive Corp. (PGR), a home and auto insurance provider making market share gains, and PayCom Software Inc. (PAYC), a leader in online payroll and human resources services that will benefit as wages rise due to inflation.

Another key holding is Eli Lilly and Co. (LLY), a giant U.S.-based pharmaceutical firm with five new drugs soon to be launched that could drive annual revenue and profit growth of 7% to 10% for several years, Kimmel estimates. One of the most promising drugs, tirzepatide, is a new class of diabetes drug that can both control blood sugar and reduce obesity.

In Europe, a favourite is EUROAPI (EAPI FP), which produces the active pharmaceutical ingredients that drug and biotech companies use to make their products. It was recently spun off from French multinational healthcare firm Sanofi SA (SNY).

“The industry is fragmented and there is ample room to consolidate,” Kuan says. “EUROAPI took no debt when it was spun out and is well-positioned to be a consolidator. It’s a cost-efficient, scale operator.”