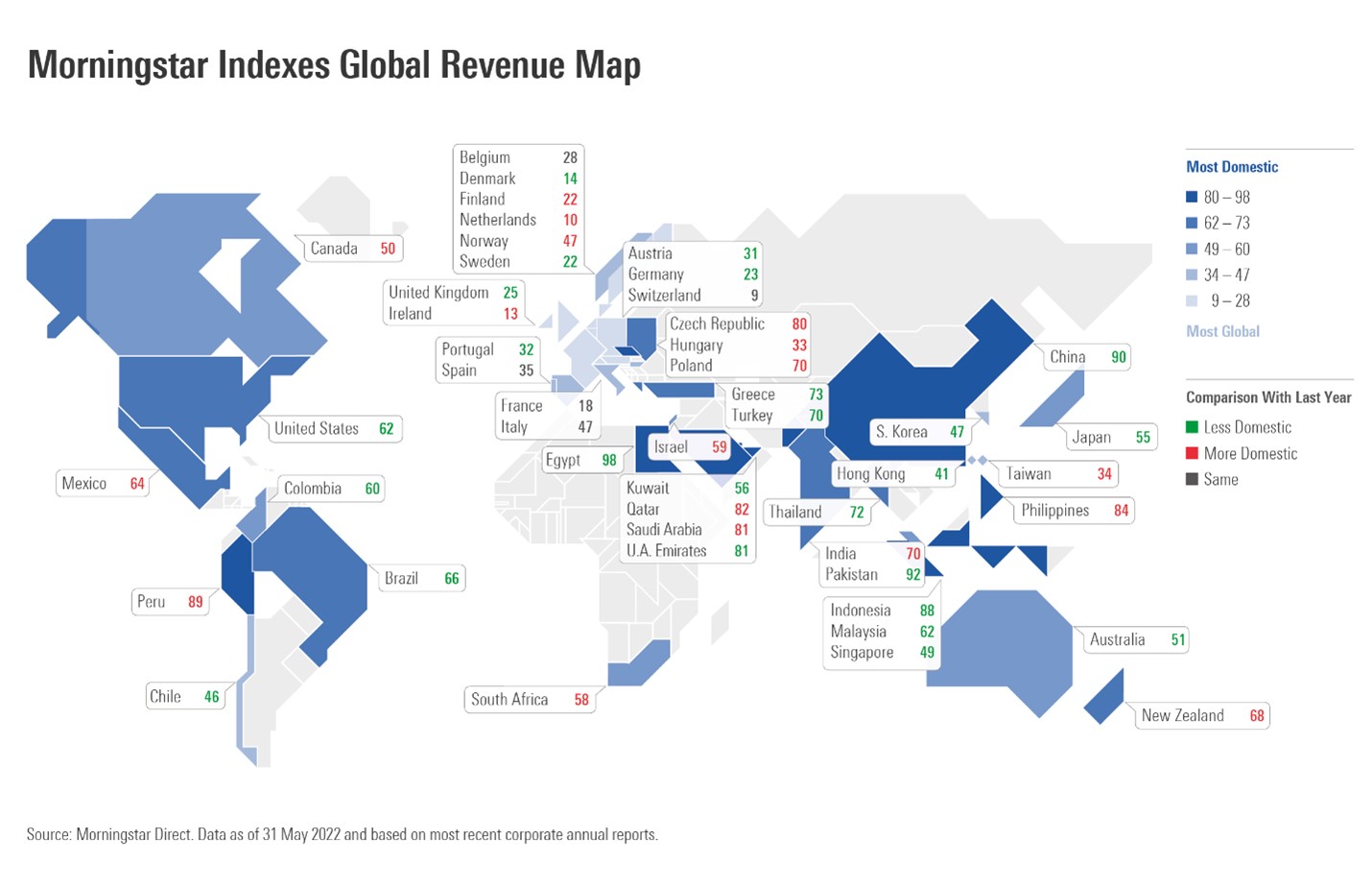

The Canadian equity market sources 50% of its revenues domestically and 50% internationally, according to Morningstar data. This compares with 45% domestic when the data was examined in June 2021, applying corporate revenue data to the Morningstar Canada Index, which covers more than 250 large, mid, and small-cap stocks representing 97% of equity market value.

Canada’s increased domestic focus runs counter to global trends. Of the 48 national equity markets that Morningstar tracks through its indices, which span the Americas, Europe, and Asia Pacific Region, only 18 have become more domestically focused compared with 2021. Equity markets in the United States, Japan, Germany, the United Kingdom, Brazil, China, and Australia all source more revenue outside national borders than they did in the prior year.

Deepening globalization runs contrary to the dominant current narrative. We live in a “post-global world,” according to the title of a new book describing a trend toward “localization.” A recent issue of The Economist focuses on “Reinventing Globalisation.” “Offshoring,” popular in the 1990s and 2000s, has become a dirty word, while “onshoring,” “reshoring,” and “slowablization” are trending. Even before the pandemic, inflation, and war in Europe exposed the weaknesses in global supply chains, political currents had turned against globalization. Independence and self-sufficiency are ascendant.

Pursuing Revenue Streams Across Borders

To understand what’s going on, remember the truism that stock markets are markets of stocks. Market-level trends are an aggregate of company-level behaviour.

Consider Royal Bank of Canada, the largest constituent of the Morningstar Canada Index. The bank slightly increased its domestic revenue share in the fiscal year ending Dec. 1, 2021, along with its U.S. share, at the expense of its business outside North America. It should be noted, though, that domestic revenue share is down from 2019. RBC’s global capital markets business simply did not grow as much as its Canadian business and its wealth management and commercial operations in the U.S. through its City National subsidiary.

Source: Morningstar

Source: Morningstar

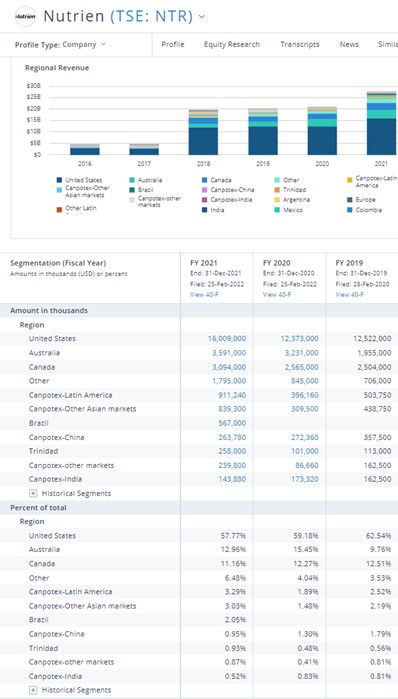

Now consider Nutrien, a smaller index constituent, but the world’s largest fertilizer producer. Canada actually represents a small and diminishing share of revenue derived from Nutrien’s sales of nitrogen, potash, and phosphate. Like many Canadian companies, Nutrien depends on the U.S. for a significant percentage of revenues.

Source: Morningstar.

RBC and Nutrien reflect sectoral differences in revenues. The technology and basic materials sectors are the most global, while utilities, real estate, and financials are the most domestic. Nutrien is classified as basic materials and RBC as financial.

Emerging Markets Remain the Most Domestic, Europe the Most Outward-Looking

Emerging markets, such as Egypt, Pakistan, China, Peru, Indonesia, the Philippines, and Persian Gulf states, remain the most domestically oriented. The fact that the Morningstar China Index sources an estimated 90% of revenue from China, despite the Chinese economy’s export orientation, can be explained by the domestic focus of its top constituents Tencent TCEHY, Alibaba BABA, Meituan MPNGY, China Construction Bank CICHY, and JD.com JD.

European markets remain the world’s most outward-looking. With the exception of Greece, which is largely domestic, European markets are dominated by global companies. The Morningstar Switzerland Index, which includes Nestle NSRGF, Roche RHHBY, and Novartis NVS, is the most global, with the U.S. representing an estimated 30% of its revenues. Amazingly, the Morningstar Netherlands Index sources more revenue from Taiwan (an estimated 13%) than from the Netherlands (10%). It’s less surprising to see countries with small populations like Ireland and Denmark among the world’s outward-oriented, than it is for larger economies like France, Germany, and the U.K. Other European countries are the largest sources of revenue for the Morningstar Europe Index, followed by the U.S. (an estimated 22%) and China (9%).

The energy sector did not explain much of the change between 2021 and 2022. Some resources-heavy markets became more global, including Australia, Brazil, Chile, and the United Arab Emirates; but others, like Canada, Peru, Saudi Arabia, Norway, South Africa, and Qatar did not. Similarly, some technology-heavy markets, including the U.S. and South Korea, globalized, while others like Taiwan and India, did not.

Revenue Sources Blur the Lines Between Domestic and Foreign

The fact that equity markets are globalizing certainly runs counter to the narrative that supply chains are onshoring and countries are pursuing self-sufficiency. But the stock market is not the economy. Revenue sources for public companies represent just a piece of the mosaic. There are many other ways to measure economic globalization—the most common being trade as a percentage of gross domestic product.

For investors, globalized revenue sources blur the lines between the domestic and international portions of a portfolio. While it’s true that global exposure can often come through domestic companies, it’s also true that leading players in an investor’s home market may be based offshore. As ever, a global portfolio offers the broadest opportunity set.