Defenders of investing with an awareness of environmental, social, and governance issues have been pushing back on the political right’s attempts to politicize ESG.

One must-read is the takedown made by corporate governance expert Nell Minow of the letter sent to BlackRock by 19 Republican state attorneys general. In response, Minow conjures the old Key & Peele routine, imagining herself as BlackRock CEO Larry Fink’s anger translator:

“I will begin with one key point: it takes a lot of chutzpah for a bunch of elected officials to claim—without any substantiation—that the decisions made by financial professionals are based on politics rather than financial returns when it is you who are urging us to bend our criteria based on your political pandering.”

To the contrary, Minow notes, asset managers operate within strict regulatory and legal standards requiring adherence to the fiduciary obligations they have toward their clients. They also operate in a globally competitive market. These two factors are powerful incentives for the investment decisions they make to be based on their best assessment of risk and return.

“That includes doing whatever it takes to create sustainable growth and continue to attract and retain clients.”

To do otherwise at the behest of politicians would be simply a subsidy to “un-economic enterprises” like fossil fuel companies.

“Your letter implies the kind of political decision-making that, a hundred years ago, would have directed us to keep investing in buggy whips because they are an important part of the state economy, instead of investing in the automobile technology of the future.”

Investors pressuring fossil fuel companies on how they plan to manage amid the global transition to renewable energy help these firms make better decisions, Minow argues.

The AG letter contends that BlackRock’s commitment to accelerate net-zero emissions across all of its assets, regardless of client wishes, is somehow political or unfair to clients who don’t want to invest in the energy transition. Minow’s response:

“This fundamentally misunderstands the basic principle of managed funds and index funds, which now take up the majority of the market because clients, including individuals and intermediaries like pension managers, recognize, since you like sports examples, that a non-professional making investment decisions is like a non-professional playing one-on-one with Steph Curry—with your entire bank account on the line.”

Why use ESG information?

“If we have learned anything from the market upheavals of the last 40 years, from the dot.com implosion to the Enron-era accounting failures to the financial meltdown caused by wildly inaccurate ratings of bundled sub-prime derivatives, it is that GAAP is inadequate to give us the information we need to assess risk and return, particularly over the long term. ESG is still in its earliest stages, but already it is a vital element that enhances our understanding of value as we make our investment decisions.”

Wrong Side of History

Also worth a read is this essay by Stephanie Cohn Rupp, CEO of Veris Wealth Partners. Rupp notes three big errors in the political right’s anti-ESG efforts: ignoring the impact of stranded assets on investments, not recognizing that some major fossil fuel companies have already started taking steps toward net-zero emissions in their production while others are investing in renewables, and misreading Republican opinion on climate change.

On the latter point, Rupp cites public opinion polling that shows majorities of Republicans support the transition to renewable energy and taking steps to reduce emissions. Republican women care more about climate change than Republican men, something Rupp expects will be reflected in their investing decisions:

“Also, Research by McKinsey found that in the US more than two-thirds of wealth will be held by women by 2030…and Republican Women care more about Climate issues than Republican men. This massive wealth transfer to Women will yield an even greater tidal wave towards ESG Investing—and especially Climate. Republican politicians and State Treasurers may attack ESG investing as ‘woke,’ but wealthy Republican women will increasingly invest in the clean energy transition—it’s smart investing after all.”

Bizarro ESG World

Seinfeld fans will remember the Bizarro Jerry episode in which Elaine meets three friends who look like Jerry, George, and Kramer but act like their exact opposites.

Now comes Bizarro ESG World, in which a right-wing dark-money group called the National Legal and Policy Center objects to the shareholder resolutions it proposed this year being labeled as “anti-ESG.”

Morningstar’s Ruth Saldanha wrote a piece assessing how well the group’s anti-ESG resolutions fared this year. Her verdict: not well.

“Morningstar’s proxy database has tracked 43 anti-ESG proposals filed by the National Legal and Policy Center, the National Center for Public Policy Research, and Steven J. Milloy during the 2022 proxy season. In the six months from January to June, proposals filed by these groups received only 7% support on average, and only 12 received over 5% support. In contrast, resolutions filed by other shareholders achieved an average of over 30% support across the board.”

In response, the NLPC was outraged—outraged!—that its anti-ESG proposals should be labeled anti-ESG. A nice way to put it is that it’s a bizarro ploy to get publicity, but you can read its press release and decide for yourself. On second thought, a more accurate word than bizarro comes to mind: gaslighting.

While you’re at it, scroll through its site and draw your own conclusions about whether or not this is an anti-ESG group.

Bizarro-Inspired Funds

And if you want to delve deeper into Bizarro ESG World, check out this statement from Robert Netzly, CEO of Inspire Investing.

Netzly’s firm offers eight “biblically responsible” exchange-traded funds that combine values-based exclusions and ESG criteria. In my view, Inspire ETFs reflect pretty extreme views on abortion and LGBTQ+ rights. Their exclusions extend to companies that advocate for abortion and for “promotion and acceptance” of the LGBTQ+ “lifestyle.” This extends to a company’s philanthropic activities.

After making these and other “sin stock” exclusions, Inspire ETFs score the remaining universe on a range of ESG considerations, listing in their prospectuses these issue areas: corporate governance, data privacy and security, environmental stewardship, innovation, labor practices, marketing ethics, political action, renewable energy, social impact, and supply chain.

It’s a mix of values exclusions with ESG integration that may seem odd to some, but it’s not far off from the structure of many Catholic-values funds that have been around for a long time.

Inspire, in fact, seemed to feel so strongly about ESG that “ESG” was added to the names of all its funds in 2019, helping it amass just over $1 billion in assets at the end of August for Inspire’s brand of biblically responsible ESG investing.

But then came this year’s attempt by the extreme right to politicize and weaponize ESG, which pretty much threw Inspire under the bus. If left unchecked, it would threaten Inspire’s business, which is generated through a network of Inspire financial advisors. In response, you might think Inspire would be forced to stand up for itself and for its commitment to ESG.

Here is Netzly’s response: “For anyone who is unfamiliar, ESG is an approach to investing that seeks to ascertain potential risks and rewards inherent within an investment based on environmental, social and governance criterion, which at face value is a rather benign concept.”

So far, so good, but remember, we’re in Bizarro ESG World.

“Unfortunately,” writes Netzly, “ESG has become weaponized by liberal activists to push forward their harmful, social-Marxist agenda, hence the problem.”

And with that, Netzly proclaims:

“We hereby renounce ESG. We have removed ESG from the names of all our products and no longer identify our investment approach as being part of the ESG category.”

It is unclear at this point whether Inspire’s ESG investment criteria will remain the same or just go away. No other changes to Inspire funds’ prospectuses have been made as of the end of August. Welcome to Bizarro ESG World, where a fund can renounce ESG, saying it has become weaponized by Marxists, but still use it as a central feature.

Back to Reality: Pension Plan Support for ESG Resolutions

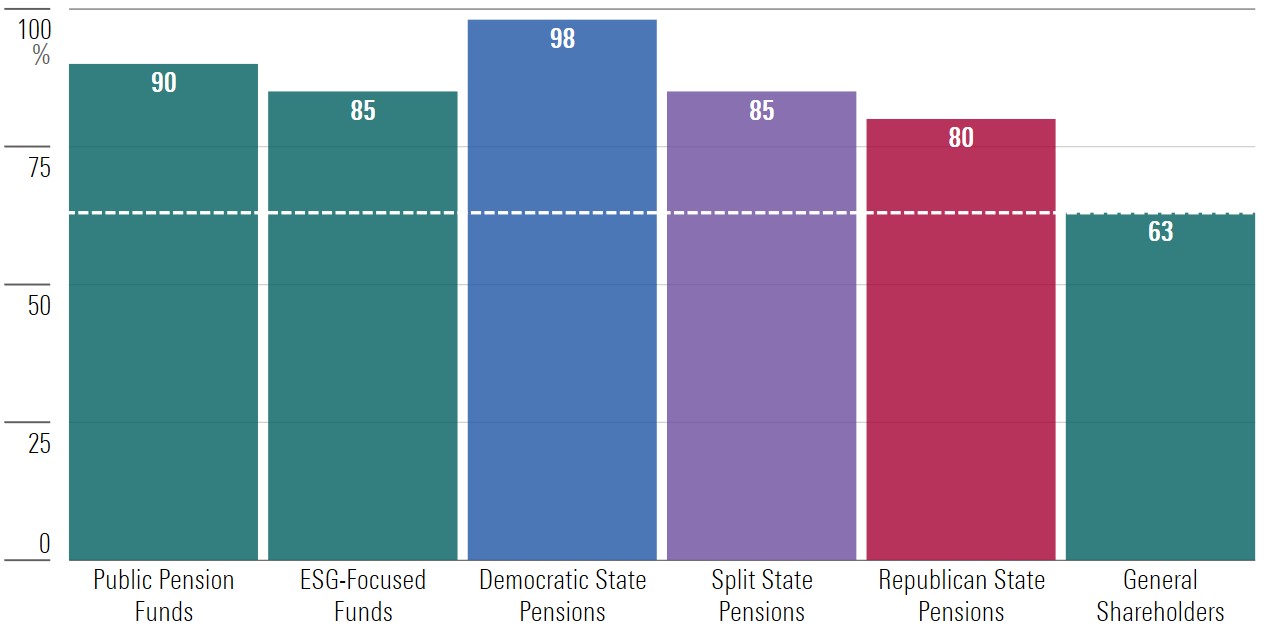

Back in the real world, I would be remiss to not take note of a study released last week by my colleague Janet Yang Rohr on how state and local pension funds voted their proxies in 2021.

She found that pension funds are keying support for ESG-related shareholder resolutions. Pension funds supported resolutions relating to climate change, political spending, worker’s rights, and pay equity at higher rates than shareholders overall.

The study was based on 72 key ESG-related resolutions from 2021 that received at least 40% support of independent shareholders and on the publicly available votes of state and local defined-benefits plans representing 14 million participants and $3.4 trillion in assets.

In 2021, public pension plans showed a higher rate of support for ESG shareholder resolutions

Public pension funds exhibited significantly greater support for ESG-related resolutions than shareholders overall. They also outpaced (by a little) the support exhibited by ESG-focused mutual funds. While Republican state pensions didn’t exhibit the near-unanimous support that Democratic state pensions did, they supported 80% of ESG-related resolutions. That’s a finding that will, no doubt, draw the ire of Republican politicians who want to interfere with pension plan administrators’ ability to vote in line with their fiduciary obligations to plan participants.

If so many professional investors are voting this way, can this really be a “social-Marxist” cabal? Only in Bizarro ESG World.