ETF providers have been busy over the last 12 months launching ESG-oriented products in a variety of asset classes. Morningstar has identified 39 new ETFs with a sustainability focus or theme launched since August 31st, 2021. That is an 88% growth since this time last year!

Although the growth has come from established ETF players such as Invesco, iShares, Horizons and BMO, we have also seen new entrants into the market such as a suite of products from Scotia and an expansion of ESG ETF offerings at Mackenzie, TD, Desjardins, CIBC, National Bank and Wealthsimple.

ESG is Here to Stay

Investors now have more options to better align their financial objectives with their environmental, social and governance values. More options can however be overwhelming, particularly in an area that is still in its infancy and where historical trends are yet to be established. Consulting once again with Morningstar’s Quantitative Ratings (MQR), investors can gain forward-looking insights into a fund’s ability to outperform its peers in the future. These ratings do not rely exclusively on performance but incorporate an assessment of the people managing the fund, the consistency and efficacy of the investment process and the parent company. On aggregate, we have found that medalist-rated funds (gold/silver/bronze) have outperformed in their respective asset classes after receiving these ratings.

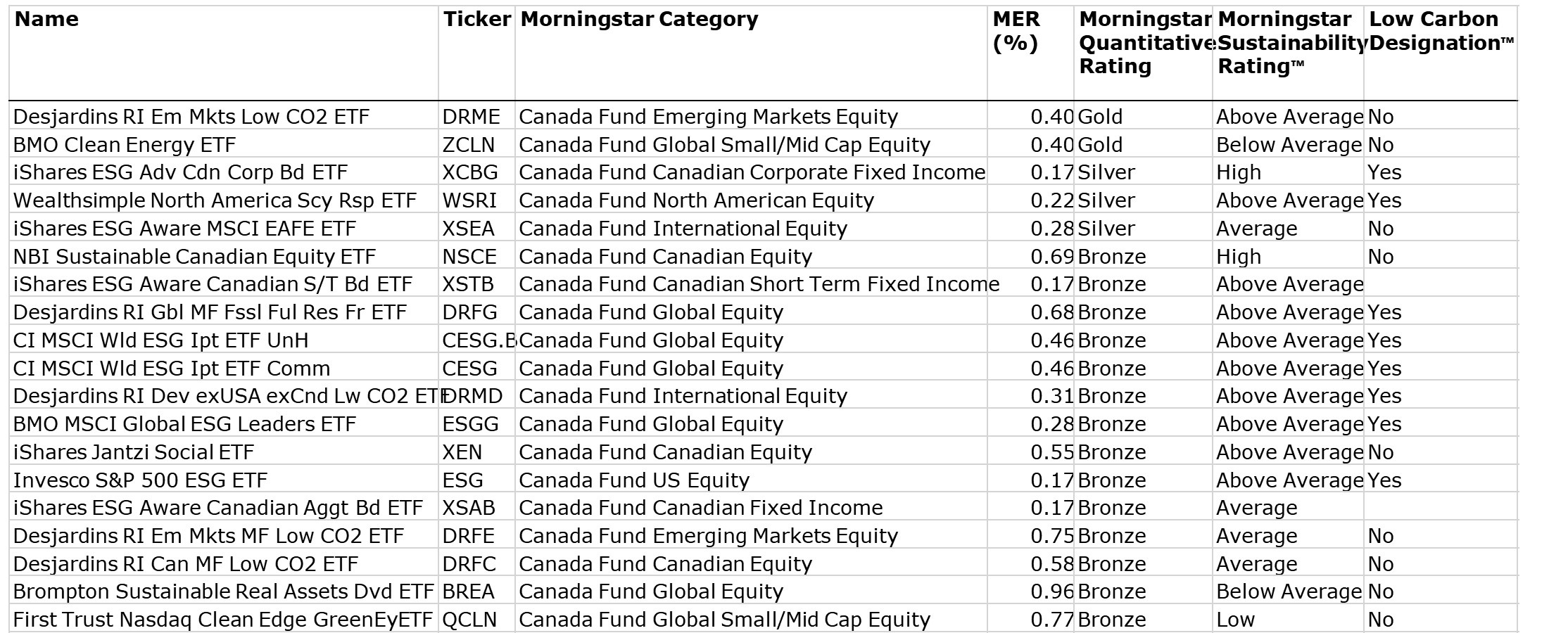

To provide investors with a well-rounded opportunity set, below I highlight those medalist funds that have outperformed their category peers over the 12 months ending August 31st, 2022 as a proxy for historical performance. I also ensured that the funds included have been identified as ESG-oriented strategies by Morningstar to ensure the intentionality of their ESG focus. The list includes:

For a larger image of the list, click here.

I’ve also included other relevant information for investors to consider. First, the Morningstar Category is the peer group of mutual funds and ETFs used to determine a fund’s relative performance ranking. The Morningstar Sustainability Rating (also known as the Globe Rating) is an assessment of the ESG risk inherent in each ETF relative to its global peer group. Lastly, for those investors looking to ensure their ESG investments are also focused on low carbon investments, I included Morningstar’s Low Carbon Designation. This rating includes consideration of the fund’s exposure to companies exposed to risks associated with a transition to a low-carbon economy as well as those directly involved in fossil fuels.