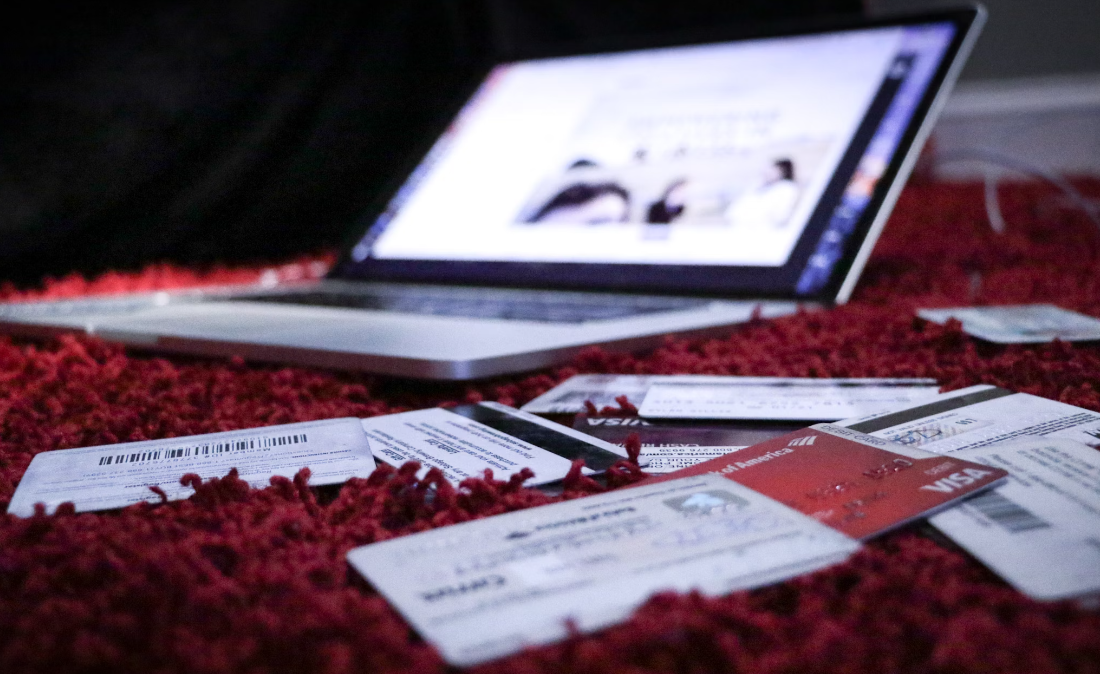

While unemployment is still very low, green #OpenToWork banners and layoff updates are popping up on LinkedIn threads, calling attention to the fact that employment isn’t a guarantee. How can we disaster-proof our lives in case of a shock like an unexpected layoff?

We all face economic shocks from time to time. Of these, involuntary job loss is one of the most traumatic and painful, its impact coursing through our emotional, social, professional, and financial lives. With high inflation, bear markets, and recession fears, the threat of a crisis like a job loss looms large over many of us.

Thankfully, we have several decades of research at our fingertips about the dos and don’ts of decision-making during and after a layoff that can help us in practical ways if we take note of the best strategies and critical resources for coping.

Two Strategies: Focus on the Problem, Focus on Emotion

Research points to two main coping strategies people employ when dealing with a negative shock:

- Problem-focused coping strategies work to remove or fix the source of the discomfort.

- Emotion-focused coping strategies work to avoid, transform, or dull emotional pain.

Both strategies are useful to some extent, but different circumstances call for different strategies to bring about the best outcome. For example, if a thorn in your foot is causing pain, a problem-focused strategy (removing the thorn) would be the best course of action. If the pain is from stitches, the best approach is to avoid, dull, or ignore it while you heal.

Emotion-focused coping includes distancing yourself psychologically from the source of discomfort, minimizing or discounting the pain or its source, distracting attention away from the pain or its source, and positive reappraisal of the situation. Investors often must use emotion-focused strategies to dull, distance, or ignore the discomfort of market volatility and investment losses. In these instances, an emotion-focused strategy can be the adaptive, optimal response because ill-timed action can lead to costly mistakes.

Reframe It Positively

Losing a job can cause intense negative emotions: anger, confusion, grief, sadness, and fear, to name a few. The research I reviewed suggests that the most effective emotional coping tool in this case is positive reappraisal—reframing the events in a positive light to reduce the pain and intensity of negative emotions.

One group of researchers noted that people who respond pessimistically to a layoff have little psychological energy left to pursue problem-focused strategies. Positive reappraisal may be especially useful because, rather than depleting mental resources through distraction and distancing efforts, reappraisal countervails negative emotions with positive ones.

How to Get Back on Your Feet After a Layoff

Positive reappraisal works by creating a more tolerable emotional response to the situation, which frees up psychological resources to put toward problem-focused strategies. Laid-off workers who favour a problem-focused approach to unemployment are more likely to be happily re-employed a few months later.

Problem-focused coping is action-oriented. In the case of job loss, it could take the form of:

- Resume building

- Proactive job searching

- Skill appraisals and training

- Professional networking

- Cash flow adjustments

A problem-focused strategy makes use of available resources to address the source of the problem. These resources, according to psychologists who study job loss, fall into three categories.

Tools for Success

The three main types of resources that people use when coping with job loss are financial resources, self-esteem, and social support. While financial resources may be the most obvious, the other two also play an important role in determining how people cope, and the path they take to re-employment.

Financial Resources—We all know that setting aside several months of living expenses is wise, and it will come as no surprise that people who have substantial savings suffer less psychological and economic pain during a period of unemployment. However, inflation has eroded many people’s savings lately, and what’s left will not go as far as it would have a year ago.

Bear markets have shrunk the estimated value of investments, higher interest rates make borrowing more expensive, and recession fears have slowed hiring and promotions for many companies. All these factors make it harder to find cash in a pinch. What’s a person to do if they lose their job and don’t have six months of living expenses on hand?

Employment Insurance (EI) is one of the benefits of risk-pooling in Canada. Benefit amounts vary by length of time worked and other factors, so it’s a good idea to check your eligibility and calculate your estimated benefit before you face job loss so that you can adequately plan.

For those with lower and middle incomes, unemployment benefits may replace a sizable portion of lost income, easing the burden and supplementing emergency savings. Those with higher incomes (or expenses) will likely need to supplement unemployment benefits with other income streams.

If savings and unemployment benefits are not enough, some illiquid assets can be tapped in an emergency. Home equity loans and lines of credit, or HELOCs, can be useful in leaner times, though borrowing to solve cash flow issues should be a last resort, not a first line of defense. As interest rates rise, we must also be cognizant of how rates affect our borrowing options, and unemployment itself, can put your ability to borrow at risk. Depending on the interest-rate environment, proactive planners may want to have an unused HELOC in place as a backup in case savings and unemployment benefits fall short.

Self-Esteem—A positive view of the self is an important psychological resource at any time, and it is critical when we face challenges. Unfortunately, being let go by an employer can severely damage people’s self-esteem, especially if their job plays a large role in their sense of identity or if they suspect their own failings to be the cause.

Everyone I spoke with on the subject reported that being laid off was a blow to their self-esteem. However, once they reappraised the situation, they were able to focus on their strengths, assets, and the value they bring to the workplace, which boosted confidence and helped them muster the energy to be proactive. This will, of course, be easier for some than others.

Social Support—The last type of coping resource is social support, which can take the form of friends, family, pets, colleagues, professional acquaintances, or any other social network. The quality of the social support is more important than the quantity.

Social support helps bolster self-esteem when it starts to wane since it can keep us connected to our sense of identity and belonging when those feel threatened. Social connections also help open doors to opportunities and partnerships. In some cases, social connection can double as financial or economic support. Spouses, roommates, partners, and friends create a kind of safety net when money is tight.

Job loss can damage our sense of social support, especially if most of our social connections are related to work. Building up a diverse set of social connections, actively networking, and maintaining professional and casual relationships in good times can help you in times of need.

Professional networks can be a major source of social support. Colleagues, LinkedIn connections, and many others can reach out with words of encouragement and leads for new opportunities.

Bounce Back Better

“Never let a good crisis go to waste.”—Winston Churchill

Forced change is difficult, and many of us would consider a layoff to be a serious personal and/or economic crisis. Still, if we must face a crisis, resilience is the goal. That means bouncing back, and if possible, bouncing back to a better situation than the one we left behind.

In the case of layoffs, many companies offer transitional services to employees and their families to help them rebound. These resources may include severance pay, resume building, job search services, skills training, and psychological support. Severance can supplement savings and unemployment insurance to help the transition be less economically painful. Knowing what your current employer offers, or has offered in the past, can help you estimate what you would be working with if laid off. Remember, too, that the terms of a severance package can be negotiated, depending on your circumstances.

Develop a Plan Before Crisis Hits

When facing involuntary job loss, we have two strategies and three resources available to help us cope. Emotion-focused coping can help repair damaged self-esteem, and positive reappraisal can reduce the pain. In the long run, we need to put our attention into problem-focused strategies such as skills training, resume building, networking, and specific job search activities.

To disaster-proof your life against the negative effects of job loss, work now to build up your resources before crisis hits so that they are available when you need them most. If you’re worried about layoffs, your financial safety net matters, but your social network and your sense of value in the marketplace are also vital. Whether or not you actually experience a layoff, strengthening these resources as safeguards against catastrophe is a worthy investment.