With central banks continuing to raise interest rates at a historic pace, inflation stuck at decades-high levels, and heightened volatility persisting, one thing is clear: The investing landscape is changing.

Investors are feeling this new dynamic with big losses on both the bond and stock sides of portfolios, a turn of events not seen in the markets in recent decades.

Against this shifting backdrop, says Marta Norton, chief investment officer for the Americas at Morningstar Investment Management, there’s a new key question for investors: Do better opportunities lay in stocks or bonds? It’s a question Norton’s own team is wrestling with as they weigh valuations and allocations across global markets.

Of course, the answer to that question starts with each investor’s financial goals and plan.

But for long-term investors in general, when it comes to stocks, even though valuations are more attractive than they were, it’s no longer the time to blindly “buy the dip.” Norton says the bear market can last a lot longer than many investors think. Her advice to investors is to move slowly and look for opportunities across asset classes.

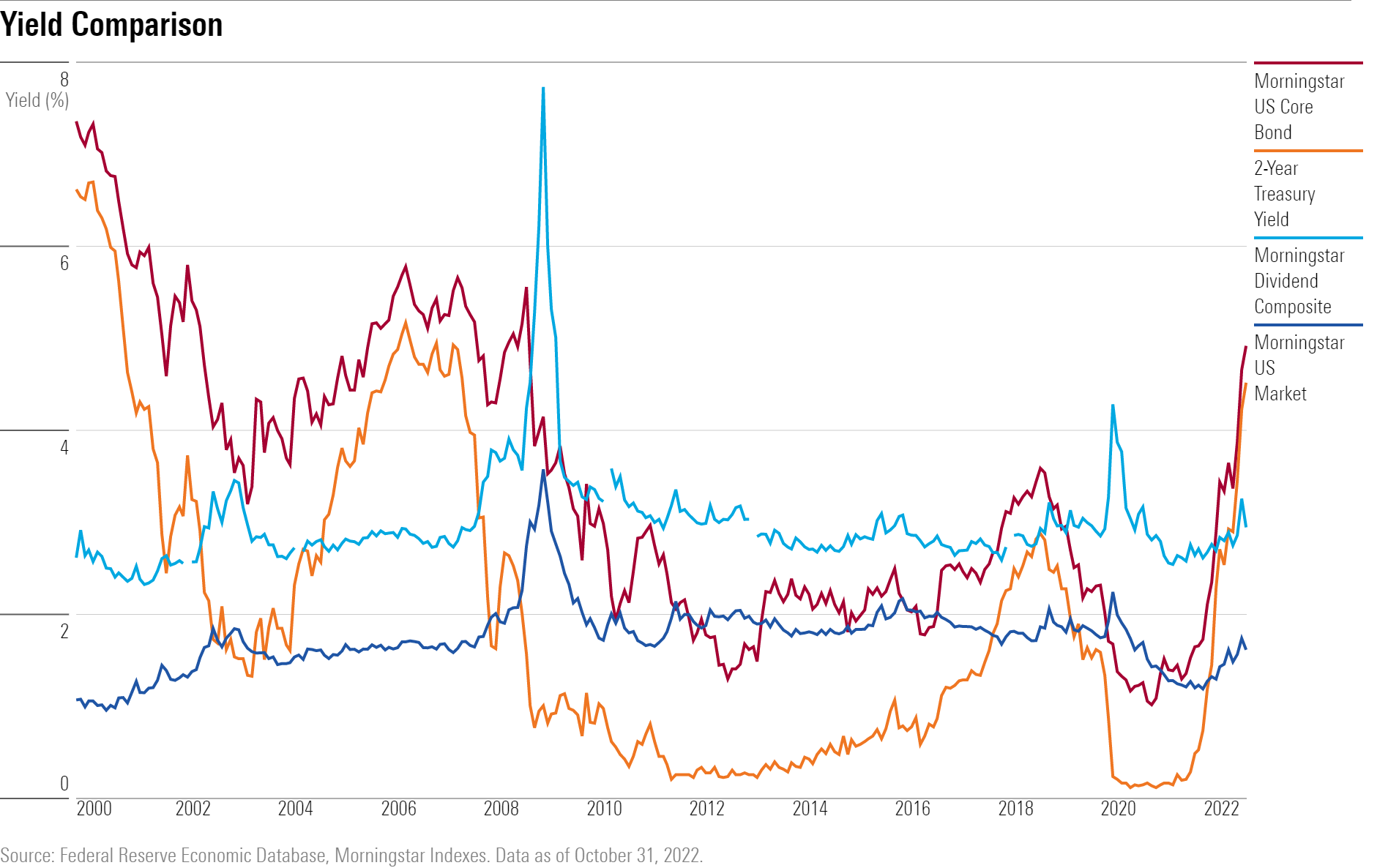

At the same time, Norton says opportunities abound in fixed income.

“When you look over the past 10 years, it’s really only been an equity story: It’s been such a good market to take on equity risk, a tremendously good time to be an equity investor,” Norton says. “But today, it’s harder to know where to invest the marginal dollar. Fixed income is looking more appealing than it has in some time.”

She points to government bonds, corporate bonds, investment-grade and high-yield debt as all representing areas of opportunity. “You don’t have to take enormous risk to earn some return, and that’s a mindset shift to the environment we had before.”

Norton adds a caveat: “Should the Fed continue to push hard on interest-rate hikes, that could mean continued selloffs in both equities and fixed income.”

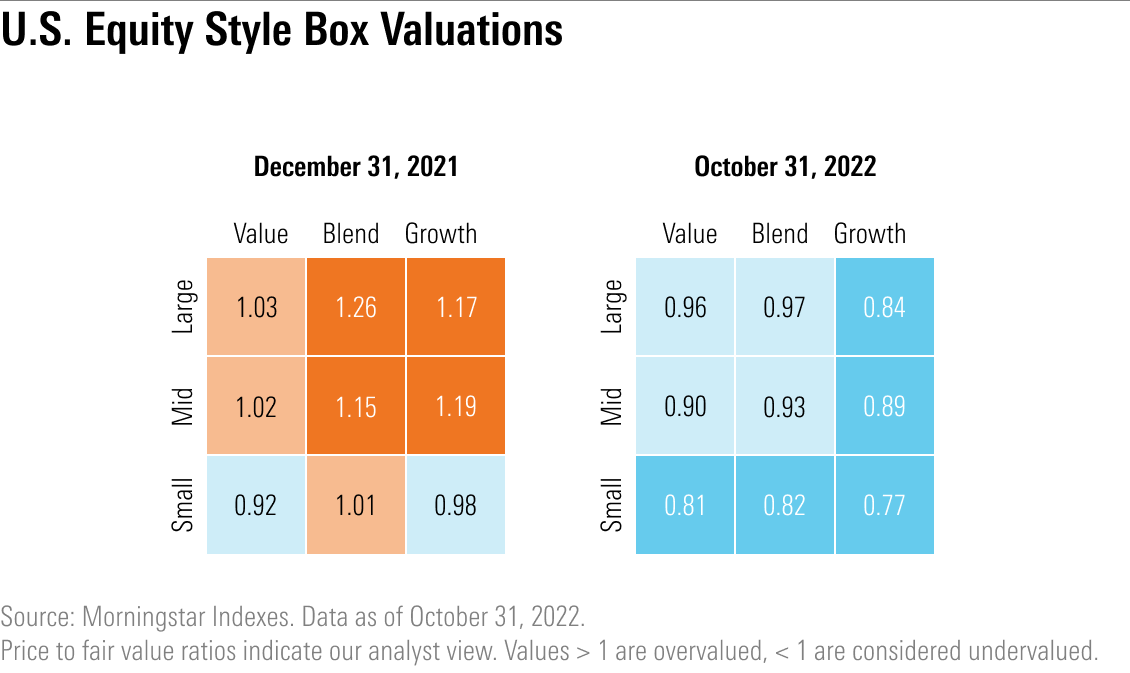

Stocks Look More Attractive Now

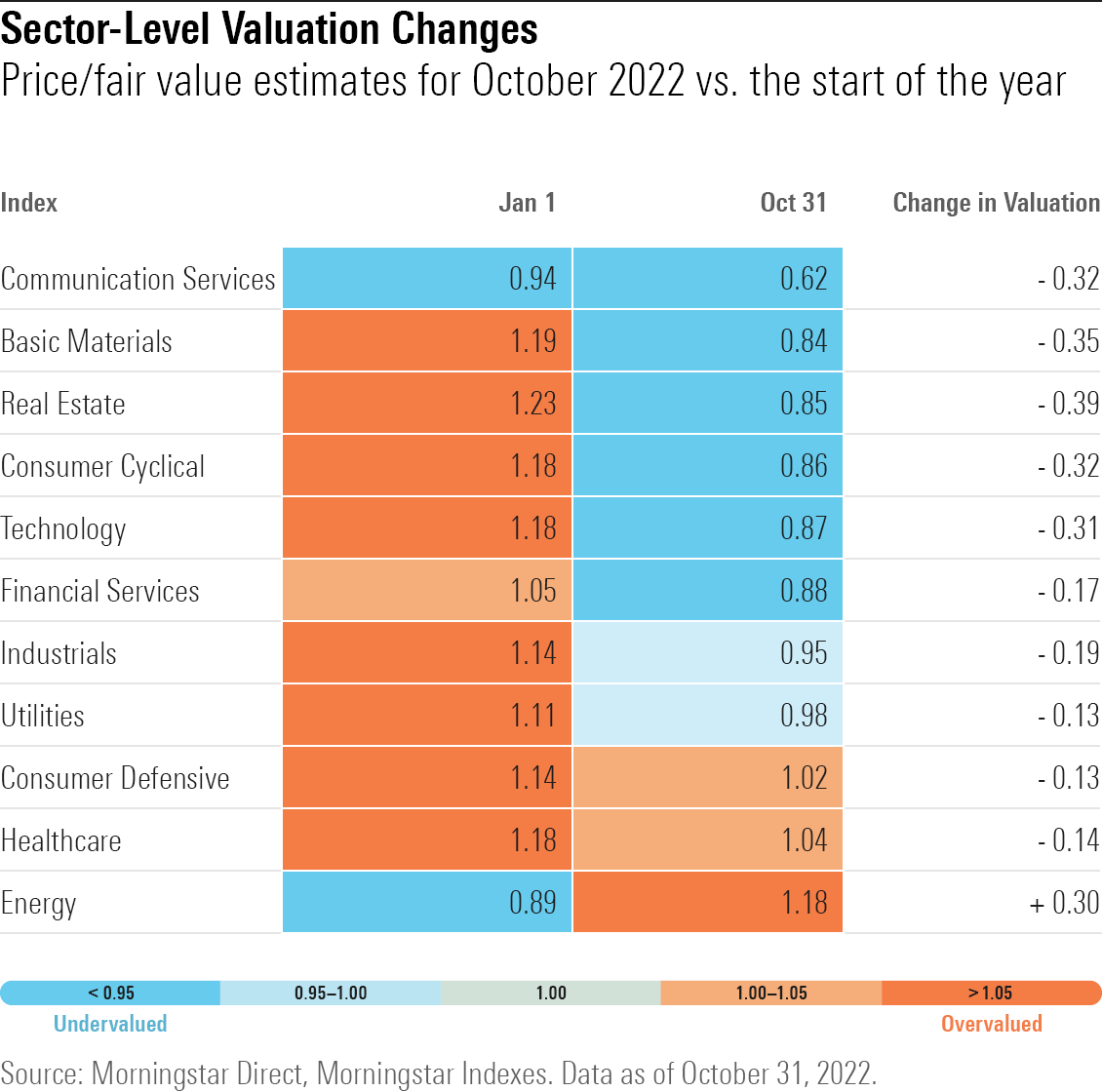

In the stock market, the good news is that valuations are more attractive at current levels than they were at the start of the year, Norton says. “The best sign that I see for the markets are today’s valuations,” she says. “Areas that were extremely overvalued last year are no longer as overpriced.”

Last year, Norton says, there was a high level of “dispersion” among valuations, where certain pockets of the market looked much more expensive than others. The consumer cyclical and technology sectors, specifically, were overpriced compared with the rest of the market, she says. “Today, there’s a lot less dispersion, so the market as a whole has gotten more attractive.” Norton says that now, investors can carry a broader exposure to the U.S. market overall than what they could before.

Now Is Not the Time for ‘Buy the Dip’

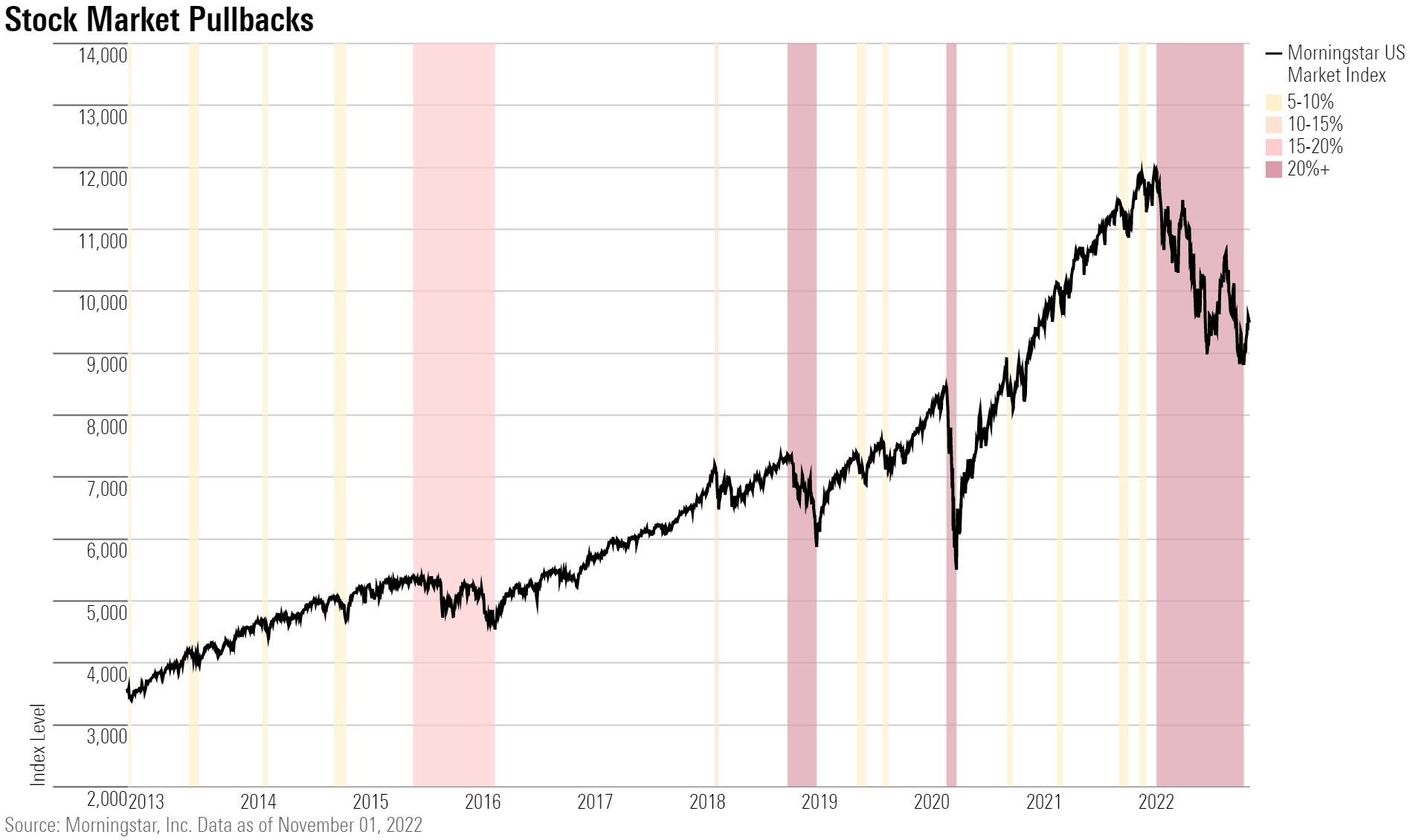

Though valuations have evened out, Norton says it’s still a time for caution.

Namely, it’s time for investors to forget about the “buy the dip” mentality where just about any time markets sold off, investors could profit from a quick rebound.

“The ‘buy the dip’ movement we’ve seen has a quick-win, lottery-ticket element,” Norton says. But “buy the dip” investors risk suffering meaningful losses by moving into a losing market, according to Norton.

The kinds of losses seen in stocks this year could continue to play out for a long time, partially because of unusual factors in the current investing environment that go beyond Fed rate hikes, Norton says. She points to the war in Ukraine and its effect on commodities markets, including the energy crisis in Europe, a looming recession with very high inflation, and geopolitical tensions with China. “There are a lot of wild cards right now.”

Despite the turbulent market that she sees ahead, Norton isn’t reducing exposure to stocks. “My net dollar is still going into the market, not coming out.”

Instead of “buy the dip,” Norton recommends dollar-cost averaging—a strategy that involves investing small amounts at consistent intervals regardless of what’s happening in the market—which should suit investors better in the current environment.

Select Sector Opportunities

When it comes to valuations, stocks can stay expensive a lot longer than investors expect. That was the case for many of the technology companies that led the big 2021 rally, which in turn led many investors to let their guard down coming into this year.

“There was a lot of complacency around big tech names,” Norton says. “In some ways, it felt silly not to own these huge, fundamentally sound tech companies, except for the fact that their price tags were so high.”

But their expensive valuations were a risk the whole time, Norton says. There was no telling when a crash would come, but with price levels so lofty, a drop at some point was highly likely.

Now, as some of these tech and communication services stocks have sold off in a meaningful fashion, they are looking more attractive. “There’s more breathing room in these stock prices and valuations now that wasn’t here before,” she says. “It gives investors a good place to be as we look out over the next 10 or so years.”

Financials are another sector that are of interest, Norton says. Normally, when there is a recession, it’s bad news for lenders as borrowers fail to pay loans and credit card debts. “But the recession, if there is one, is already priced in,” Norton says. Plus, she says, banks financially are healthier thanks to the increased regulation that followed from the global financial crisis. “So, we think that’s a decent place to be,” Norton says.

Among other sectors, “we’ve been overweight consumer staples and healthcare names heading into this environment, and that’s been a real source of protection for our portfolios,” Norton says. Utilities, even with their high dividends, don’t look attractive from a valuation standpoint, she says. And while energy stocks have put up big returns and solid earnings, “energy stocks really don’t look attractive to us any more from a valuation perspective.”

Higher Quality, Lower Risk

Within fixed income, opportunities look abundant, she says. But Norton is especially biased toward higher-quality, shorter-dated fixed income, which she says comes with the added benefit of lower risk, especially if a full-blown recession materializes.

One important bond market variable to watch are credit spreads. A credit spread is the difference in yield between two fixed income investments with the same maturity but different credit qualities. As the size of the credit spread represents the two investments’ differences in risk, widening credit spreads mean lower-quality securities get riskier and returns on those bonds lag higher-quality bonds.

“If we start to see a recession, there could be a more meaningful widening of credit spreads.”

However, the severity of the environment for credit-sensitive bonds is up for debate, Norton says.

On the one hand, “defaults aren’t necessarily priced into the market now, because there hasn’t been a large-scale corporate bankruptcy in so long.” However, “we’ve seen, as earnings come out, that companies are looking fundamentally healthy, so we may not see an uptick in defaults on a meaningful magnitude.”

Still, Norton says investors can earn higher yields without taking on much credit risk.

“In our minds, the better place to be within fixed income is higher-quality, shorter-dated fixed income, where you’re not taking on as much risk.”