Not one to mince his words, UN Secretary-General Antonio Guterres began proceedings at COP27 on Monday by telling delegates that we are collectively on a “highway to climate hell”. This week is as important as it gets.

There has been a lot of debate leading up to the 27th Conference of the Parties. Last year’s COP26 created a good deal of momentum around the road to net zero, but that momentum may be harder to achieve this year due to the Russian-Ukraine conflict and inflation.

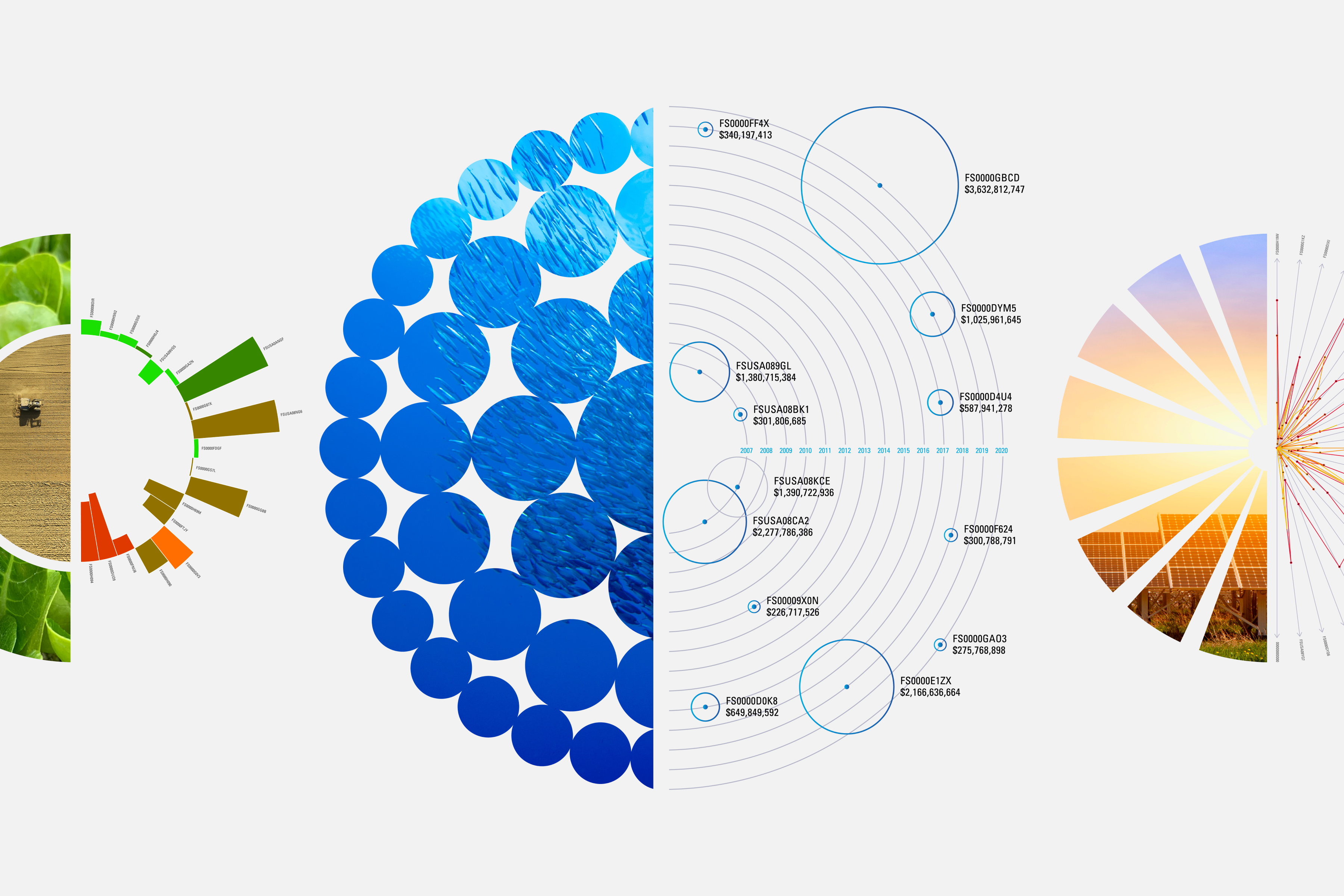

Progress has undoubtedly been made in the last 12 months. There’s been no let-up in embedding sustainability issues into the regulatory environment of collective investment products. However, there is a clear disparity between the precise pace of countries’ progress.

Word leaders and legislative bodies are taking different approaches and at different speeds, which is not ideal when we are talking about a global problem that affects the entire planet. That being said, the core aims of enhancing corporate disclosures to support investment managers’ security selection and product disclosures provides a degree of commonality – a much needed positive.

The EU Remains Ahead

When it comes to ESG product disclosures, the most advanced regime remains the EU’s Sustainable Finance Disclosure Regime, or SFDR, a key component of the wider EU Action Plan. Reporting requirements commenced this year, with the next big milestone scheduled for 1 January 2023, when firms must produce detailed SFDR templates to add to pre-contractual and periodic reports.

In the U.K., the Financial Conduct Authority has just revealed its own proposed disclosure regime. The proposals very much place consumers at their core. The FCA has undoubtedly benefitted from watching the SFDR unfold and the challenges faced along the way as the market responds to new reporting requirements.

Too Much Room for Manoeuvre

Despite the ambitions of these regimes, they highlight a key hurdle investment firms face when it comes to compliance: regulations differ across the markets in which they operate.

SFDR is intrinsically tied to the EU’s own Taxonomy of sustainable activities, to encourage taxonomy-aligned products that channel more investor capital towards sustainable investments.

This is straightforward for products domiciled or invested within Europe, but those outside of the EU are not bound by the same restrictions, making direct comparison almost impossible. These difficulties are likely to compound further as more countries develop their own taxonomies and classification frameworks, each with a unique set of requirements and deadlines.

The same issue arises when we consider disclosures. As mentioned, the U.K.’s FCA has likely observed the SFDR roll-out with an aim of avoiding the same pitfalls; the next regulator to tackle these challenges will naturally improve and build upon what’s in the market already. Refinement is of course important in this process, but it also creates a moving target for firms and end-investors in terms of the information they see.

It's important to remember that we’re all working towards the same goal. Climate change is arguably the biggest challenge mankind has ever face, and will not be solved without global alignment. COP27 provides an opportunity for different regions to come together, build bridges, and find a route toward greater consistency on the definition, measurement and reporting of goals.

Establishing Common Ground

Investment product disclosures have varied considerably from market to market long before the incorporation of ESG issues, but they did, however, benefit from a standardised way of calculating key information points. Things like past performance and expense ratios have remained consistent, which is invaluable for common understanding and comparability.

If this same international agreement was applied to key sustainability metrics and their calculation, it would matter less which type of document was used to present this information to investors – an SFDR-type disclosure, a U.K. consumer-friendly disclosure, or any other.

Take the example of temperate trajectory. We know some of the more technical jargon found in SFDR does not resonate well with retail investors, but considering temperature scenarios with easy-to-understand, graphic, and intuitive information really does. If metrics like this were consistent at the calculation level across the board, the way in which the information is presented could be adapted for different investors around the globe.

Hoping for the Best

It will be interesting to watch how discussions unfold this week and whether regulators will consider the case for aligning sustainability metrics with the seriousness it deserves.

The best outcome we can hope for at the close of COP27 is that a globalised approach to taxonomies and product disclosures has, at least, taken a step forward. Without this, we run the risk of competing against one another, creating a more complex sustainability environment for firms and investors, and tackling the global issue of climate change as individuals, not as a collective.

To understand more about the EU Taxonomy and SFDR reporting requirements, you can download one of our guidance documents: The EU Taxonomy Explained, or Morningstar’s Guide to the SFDR.