Like any financial crisis, the story shaking the crypto markets right now is rapidly evolving. What we know so far is that on Nov. 8, 2022, Binance CEO Changpeng Zhao announced that his firm, the largest cryptocurrency exchange by trade volume, had signed a letter of intent to acquire rival exchange FTX. The next day, Binance walked away from the deal, leaving FTX customers in a lurch as cryptocurrency prices tumble.

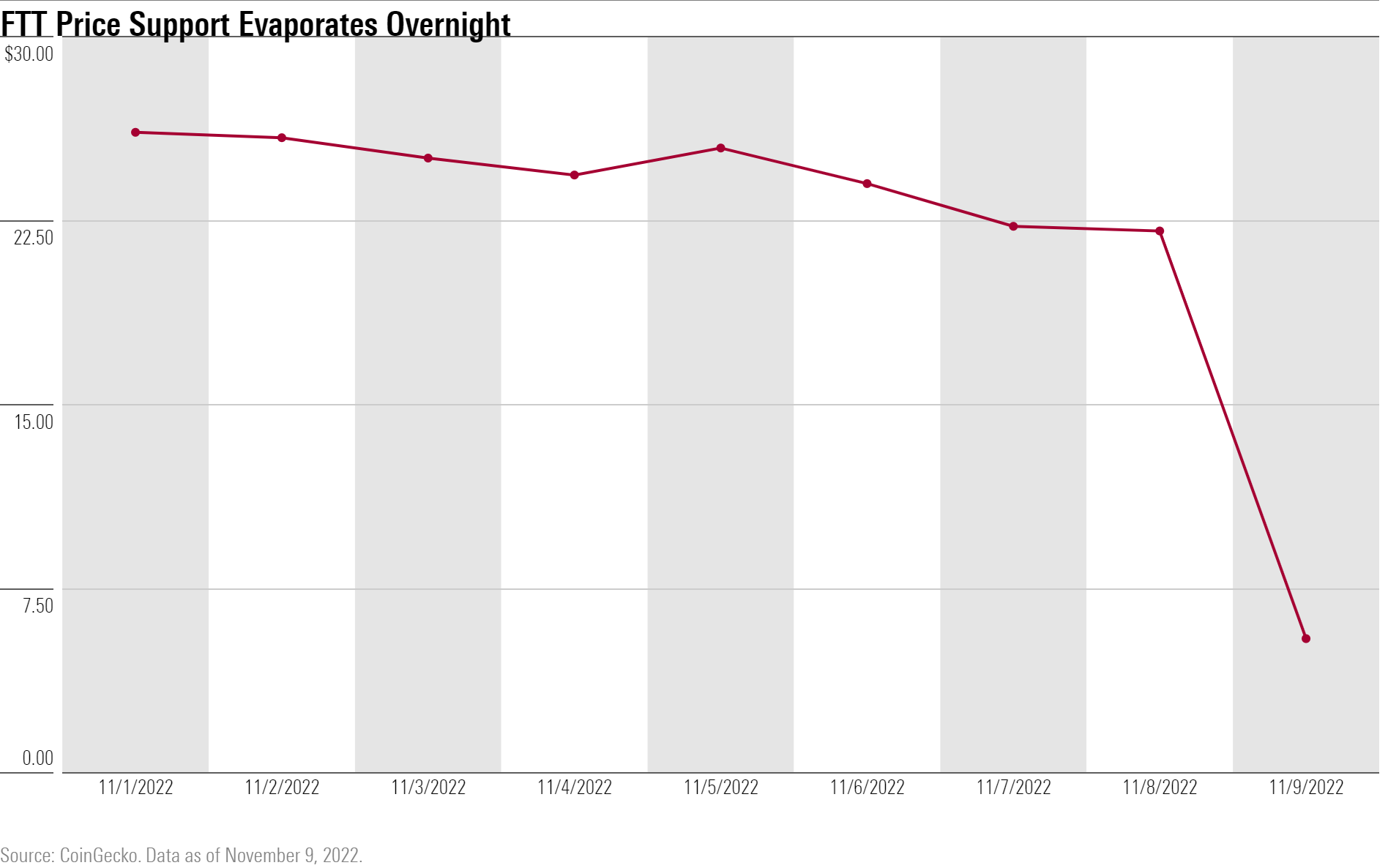

The recent developments came as a shock to many in the crypto markets amid an ongoing clash between the two titans of the industry. Zhao and FTX founder and CEO Sam Bankman-Fried had sparred long before the events of this week—Binance was an early investor in FTX—but the spat intensified in recent weeks. Critically, Zhao ratcheted up the pressure this past Sunday by announcing that his firm would be liquidating a large block of FTX’s native crypto token FTT.

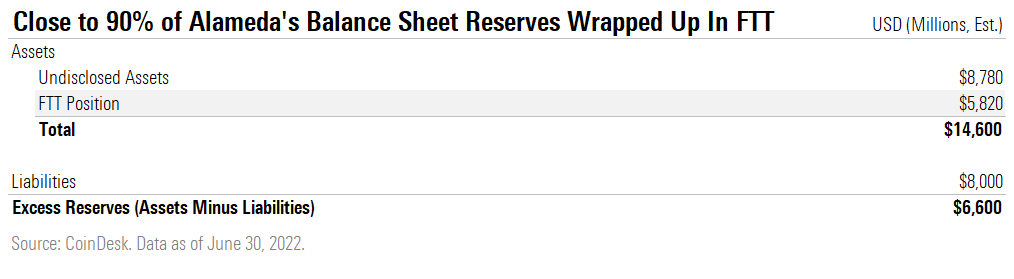

Zhao’s announcement hobbled FTX in spite of its sparkling reputation because the news followed fast on the heels of a report from CoinDesk that FTX’s sister trading firm, Alameda Research, may have relied more on FTT to stay afloat than previously known.

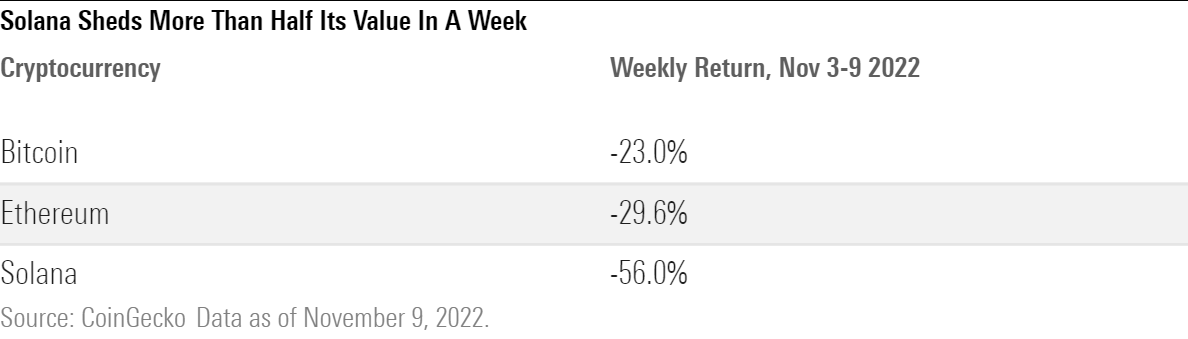

Given Bankman-Fried’s megawatt profile within crypto and his reputation as a buyer of last resort, markets quickly got spooked. Centralized exchanges also commonly serve as custodians of crypto assets, so investors became rightfully fearful that their assets on FTX and other centralized exchanges might soon evaporate. This triggered a wave of selloffs that caused even bitcoin to fall by more than 20% as people moved money out of crypto altogether.

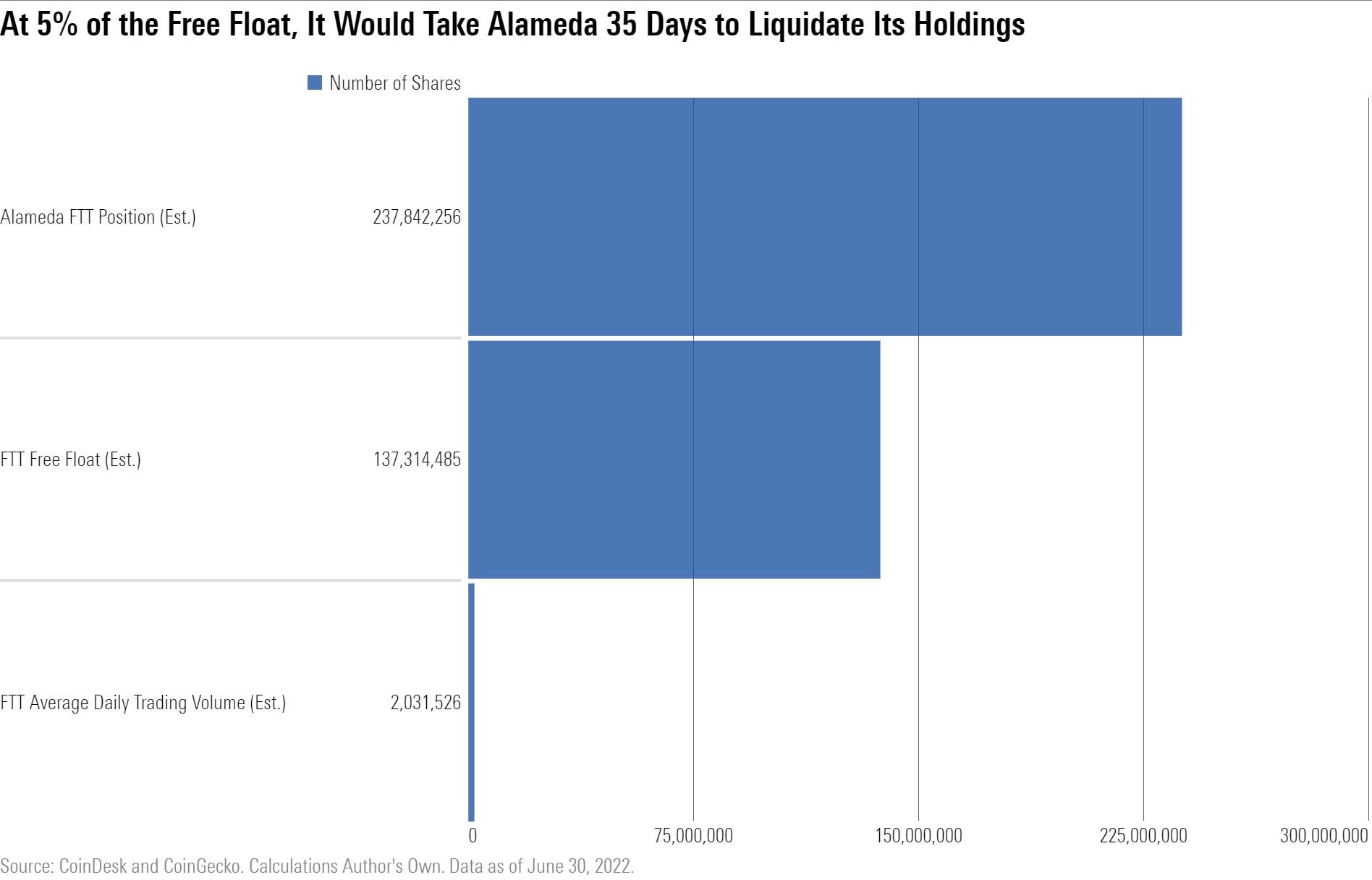

Before the imbroglio, not much was known about FTT. Even though the token was systemically important to Alameda, it was fairly small in terms of market capitalization and thinly traded. When FTX was still getting off the ground, the exchange parceled out FTT tokens to early adopters as a reward for using the exchange. As FTX grew, it expanded the utility of the token so that it operated more like a VIP membership to FTX services. In turn, FTX used a portion of its trading revenue to systematically reduce the available supply of FTT tokens through a token repurchase program, like a share repurchase of a stock.

As the biggest owner of FTT, Alameda profited handsomely off of FTX’s success, even though the two were supposed to be separate. In fact, Alameda’s very solvency depended on it. In a stunning breach of common-sense risk-management practices, FTX lent Alameda more than $10 billion. At least some of this money FTX borrowed from customers’ deposits without their knowledge or consent. In turn, Alameda gave FTX its FTT tokens—effectively shares in FTX’s own stock—as collateral, leveraging both firms to FTX’s success.

It didn’t take long for investors to lose confidence in the entire Bankman-Fried universe, and the facade crumbled swiftly. The selloff in FTT caused investors’ confidence in the FTX exchange to waver and triggered a wave of withdrawals. According to internal communications from Bankman-Fried, FTX had suffered $6 billion in redemptions from its platform in the 72 hours before the announcement on Nov. 8. These twin forces—the major selloff in FTT and the run on FTX’s exchange—likely hurt FTX’s financial position enough to cause Binance to first court and then ultimately quash the deal.

It’s important to keep in mind that this is very much a developing story, and we believe the risk of contagion in the crypto ecosystem has never been higher than it is right now. Unlike previous dustups, the culprits here are blue-chip names in the crypto world. According to CoinGecko, FTX was the fifth-biggest cryptocurrency exchange before confidence collapsed—effectively overnight. Alameda was a common counterparty to FTX and many other players in the crypto ecosystem. It was also a major holder of other tokens popularized by Bankman-Fried, especially solana, which was once the fifth-largest cryptocurrency by market cap. Solana is now down by more than 50% since Nov. 3 alone.

Given FTX’s place at the beating heart of the crypto ecosystem, its financial position is worthy of grave concern. It’s why Morningstar has often advised investors to treat any purchase of digital assets as a sunk cost; that has never been truer than it is today. Reports that FTX has paused withdrawals are evidence of this fact. We are currently monitoring the ongoing effects of this situation.