Hard Times

What a difference a year makes. Twelve months ago, cryptocurrencies were all the rage. The Miami Heat had recently announced that its basketball stadium would be renamed FTX Arena, Fidelity was preparing to offer digital assets to U.S. retirement plans that it administers, and a daft internet columnist wondered what could possibly “reverse bitcoin’s present course.”

More than a few things, sir. On Nov. 13, 2021, a single bitcoin cost US$64,470. This past Friday, that same currency closed at US$16,943.

High Volatility

The first lesson is the obvious: Cryptocurrencies are extremely volatile. This statement comes as no surprise, even to investment novices, but it bears repeating. When risky assets are on the upswing, it’s easy to get caught up in the excitement. At such times, when the public discussion emphasizes possibilities rather than perils, their opportunities seem limitless. Meanwhile, as evidenced by our internet columnist, the potential problems are difficult to envision.

But those problems always exist. From a distance, bitcoin appears to have enjoyed an uninterrupted climb from 2012 through 2021, ballooning from a starting quote of US$4.25 to US$46,306 by the decade’s end. That makes for a cumulative gain of 1,089,493% (yes, really). With such astronomical growth, even very large declines make a blip on a Growth of US$10,000 chart.

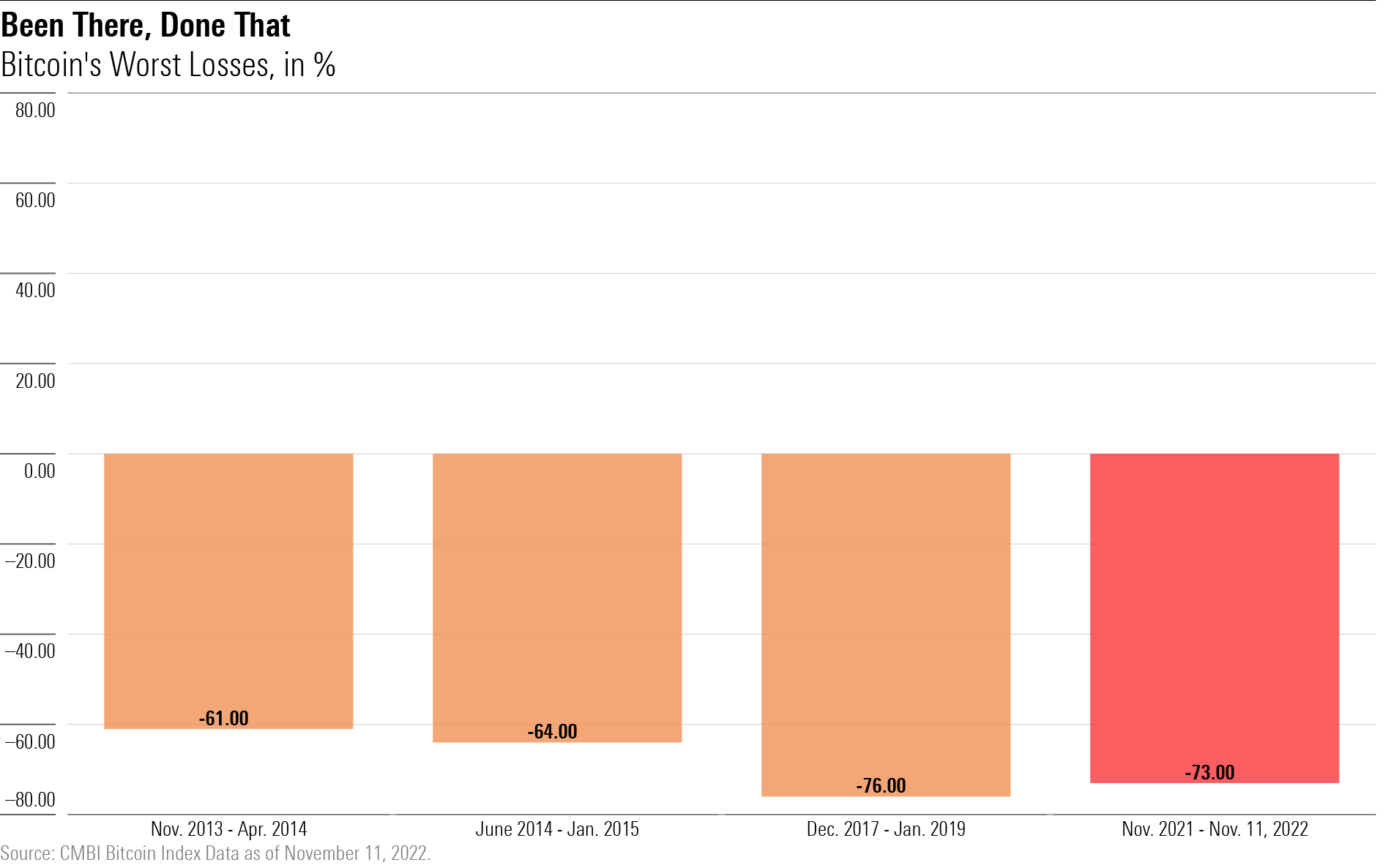

There were, however, several such slumps. On three occasions from 2012 through 2021, bitcoin’s price fell by more than 60%. The past year’s loss raises the currency’s bear-bear-bear market total to four. (If a 20% drop rates as a bear market, per the common usage, then a 60% plunge qualifies as a triple bear.)

Waning Diversification

Modern Portfolio Theory cares as much about the correlation among assets as it does volatility. If a security rises when the others fall, then even if that asset is hazardous in isolation, it can be beneficial when owned within a portfolio.

In reality, this dictum is not always practical because investor psychology intervenes. Insurance is least appealing when it is most required. It is one thing to argue that alternative assets that plummet during a bull market have behaved as expected and are therefore poised to protect the portfolio during the next downturn. It is another to faithfully hold that asset after it falls, in the hope that eventually it will earn its rent.

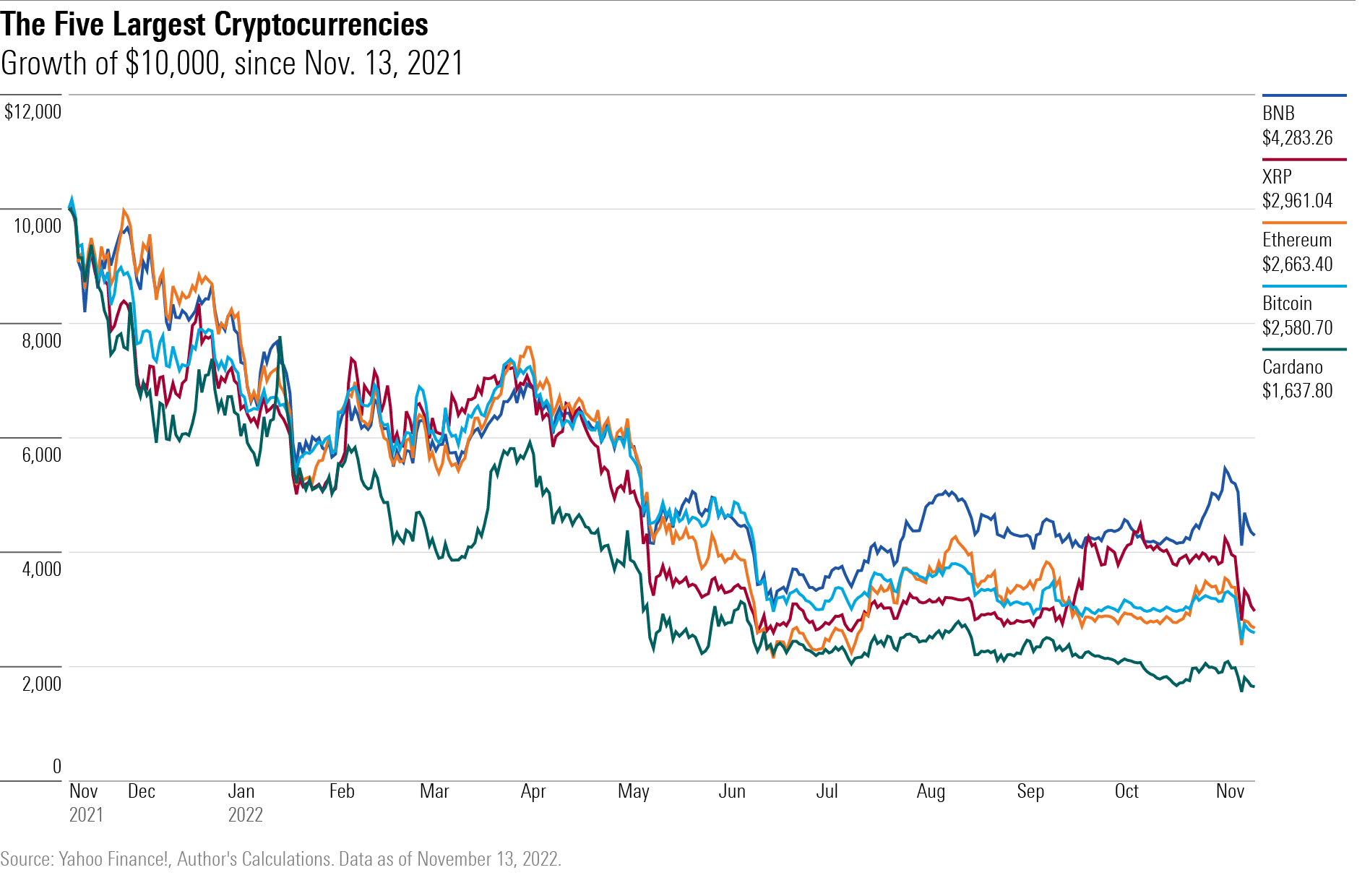

That said, if cryptocurrencies do offer diversification, then they at least deserve theoretical credit. The news here is mixed. On the bright side, the major cryptocurrencies have performed similarly. Consequently, unless things change, investors need not concern themselves with how many angels can dance on the head of each cryptocurrency pin. One digital asset looks reasonably like the next.

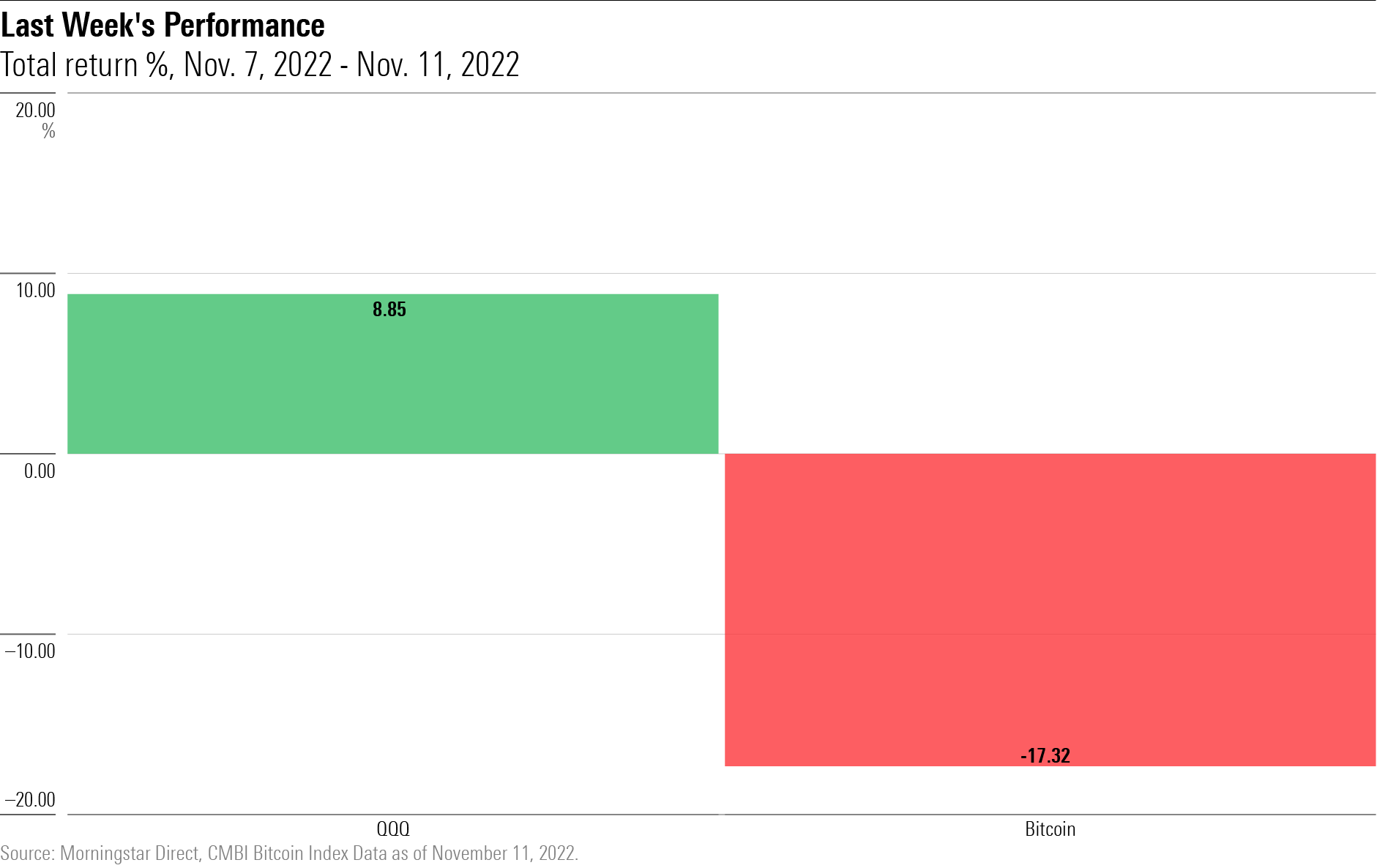

Less happily, though, cryptocurrencies are currently behaving like technology stocks. During their early days, cryptocurrencies were unicorns, seemingly oblivious to the motions of conventional investments. Since they have hit the mainstream, though, that relationship has changed. Since the new year, bitcoin has roughly tracked a 50% leveraged version of the Nasdaq-100 index (for this exercise, I leveraged the returns of Invesco QQQ Trust QQQ.)

Just because cryptocurrencies are acting like technology stocks does not mean that they will continue to do so. Nevertheless, they no longer can be assumed to deliver useful portfolio diversification. That is a hope, not an expectation.

Event Risks

The previous chart omitted last week’s trading. That is because earlier this month, the pattern abruptly changed. As technology stocks rallied following the Labor Bureau’s auspicious inflation report, cryptocurrencies tumbled. The culprit was the aforementioned cryptocurrency exchange, FTX. After a few days of heated denial, wherein corporate management assured listeners that rumors of the company’s demise were greatly exaggerated, the company promptly demised.

The news rocked cryptocurrency prices. For one, FTX’s collapse created knock-on effects. Thus, the digital lender BlockFi, which had a business partnership with FTX, disclosed that it, too, would halt customer withdrawals. For another, plunging cryptocurrency prices squeezed buyers who were leveraged, forcing many to liquidate their positions to pay their bills. Bitcoin lost 21% during the week, with (once again) the other leading cryptocurrencies following suit.

Such is the fate of a lightly monitored industry. Whereas mutual funds and major banks are tightly bound by reams of regulations, enforced by government staffers, cryptocurrency platforms often enjoy substantial freedom. Even when their activities are theoretically limited, there may be little oversight. For example, it now appears that FTX illicitly removed monies from its client accounts.

A Random Walk

The most striking lesson from this year’s events has been the futility of research. Cybercurrency buffs can list the myriad differences between the various digital assets and debate which holds the brightest future, but their familiarity proved no help when cryptocurrency’s bear market arrived. Nor, to my knowledge, did in-depth knowledge enable observers to spot FTX’s problems in advance. The authorities suffered along with the neophytes.

If this condition sounds familiar, it should. It mimics the “random walk” model of the stock market, which asserts that expertise is unhelpful because equity prices cannot be predicted. (The precept sounds extreme, but most fund shareholders believe it, as these days they predominantly buy index funds.) Those who wish to own cryptocurrencies would do well to adopt a similar mindset. Owning digital assets inevitably means enduring steep downturns and bombshell bankruptcies. Those dangers cannot be avoided.