Even in a bear market, there will be stocks that avoid getting caught up in the downdraft. The challenge for investors is that by the time it’s clear which names those will be, it’s too late. As investors crowd into those safe harbors valuations rise, adding risks to those havens.

But not in all cases.

This year, the Morningstar US Market Index is now down 18%. But as the broad market fell from its last peak, a select number of stocks have rallied, mainly energy stocks.

While investors who got in early are enjoying their ride up, those bear market winners have potentially exhausted their fuel, soaring beyond what Morningstar analysts believe to be reasonable valuations. Take Hess (HES), an oil exploration and production firm, whose stock price has approximately doubled since the market’s last peak on Jan. 3. Hess’ stock now has a price/fair value ratio of 1.67, meaning the stock is 67% overvalued.

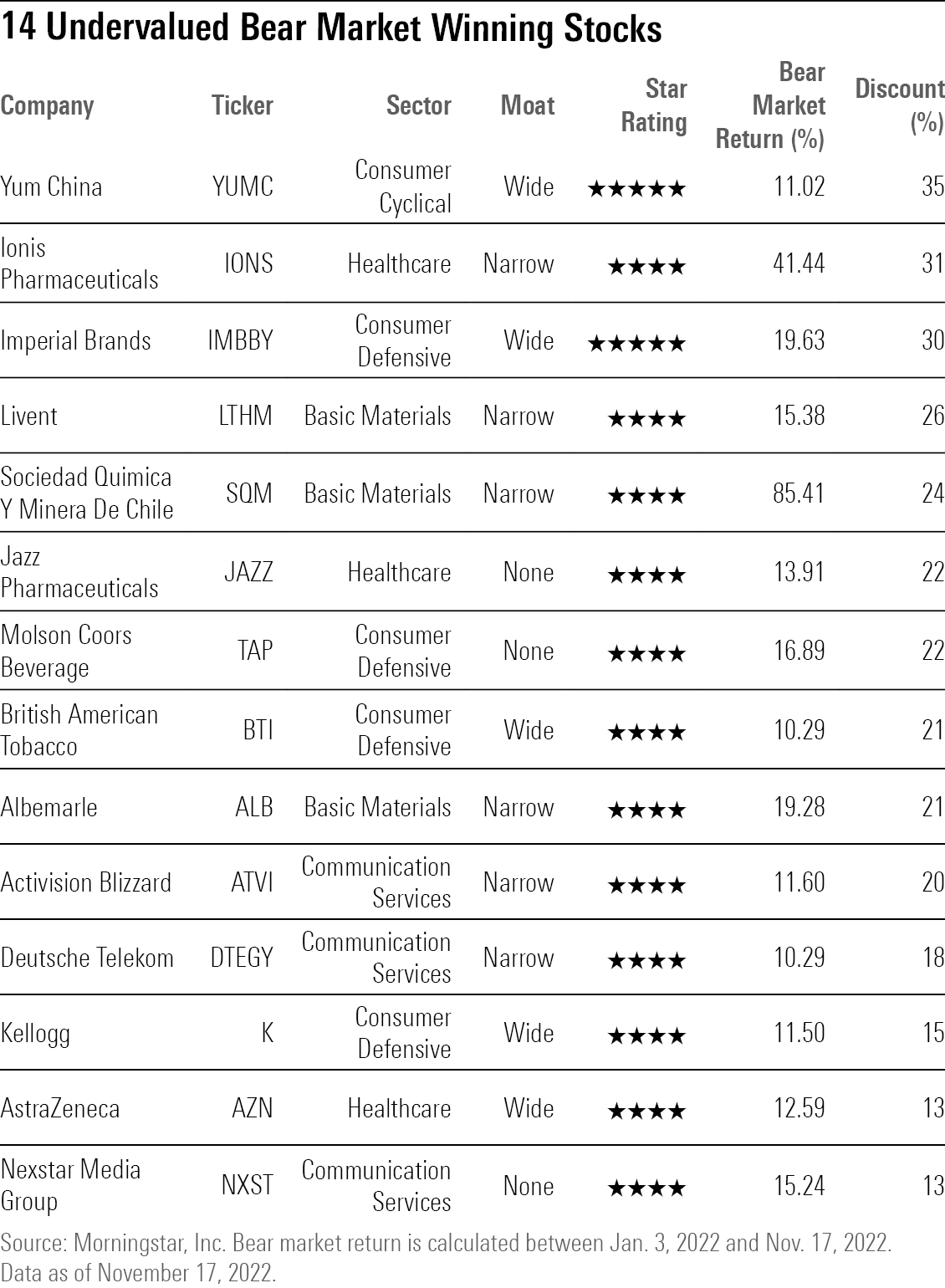

To find bear market winning stocks that have run out of steam, we ran a screen on the 843 U.S.-listed stocks covered by Morningstar analysts to locate those that are up 10% or more through Nov. 17. We found 152 stocks that met that initial hurdle, and then looked for those considered undervalued, as designated with a Morningstar Rating of 4 or 5 stars.

Our screen returned 14 stocks that not only outpaced the market by a large margin, but also are still undervalued.

To highlight opportunities that have a greater margin of safety, we listed the four stocks of companies that also have a wide Morningstar Economic Moat Rating, which means that our analysts believe these firms have a durable competitive advantage over their peers:

A full list of the results can be found at the end of this article. Here’s what Morningstar analysts have to say about them:

Yum China

- Bear Market Return: 11.02%

- Star Rating: 5 Stars

- Discount: 35%

“In China, chains account for roughly 17% of restaurant spending compared with 61% in the U.S. and 34% across the globe. Our conviction in rising fast food penetration is underpinned by three long-term secular trends: Longer working hours for urban consumers; rapidly rising disposable income; and ever smaller family sizes. Coupled with strong brand recognition and unrivaled supply chain, Yum China is set to be the prime beneficiary of growing Chinese fast-food spending. We’re also optimistic about Yum China’s various top-line drivers, including value platforms, menu innovations, new restaurant formats, enhanced digital marketing efforts (underscored by 300 million loyalty program members), unrivaled delivery capabilities, and brand expansion potential in Taco Bell, Little Sheep, Huang Ji Huang, and COFFii & Joy.

“While 2021 will still present COVID-19-related disruptions, we find management’s longer-term goals of high-single-digit system sales growth, 17% restaurant margins, and low- to mid-teens EPS growth realistic (if not slightly conservative) given favorable China consumer demographic trends and the operating leverage inherent in its business model. Coupled with Yum China’s dividend (a USD 0.12 quarterly cash dividend was reinstated in the fourth quarter of 2020) and future share repurchases, we believe Yum China offers investors above-average potential.”

— Ivan Su, senior equity analyst

Ionis Pharmaceuticals

- Bear Market Return: 41.44%

- Star Rating: 4 Stars

- Discount: 31%

“Ionis is a leader in RNA-based therapies, and its spinal muscular atrophy drug Spinraza, marketed by partner Biogen, is the first RNA-based therapy to achieve blockbuster status. The firm’s antisense oligonucleotide, or ASO, technology faces strong competition from RNA interference technology emerging from Alnylam, Arrowhead, and Dicerna, as well as gene editing and gene therapy pipelines at multiple firms. However, Ionis has built a massive pipeline of promising new drugs that are rapidly moving toward the market, securing a narrow moat.”

“Ionis relies on up-front payments and licensing fees from partners, as well as Spinraza royalties, to drive revenue today, but the pipeline should help diversify revenue by the mid-2020s. In our base case, we assume Ionis sees revenue growing to US$3.1 billion by 2030, including US$2 billion in pipeline-derived revenue at an average probability of approval of roughly 40%. We see operating margins approaching 50% by 2030, as several of the most advanced programs at Ionis are partnered and are likely to translate into higher-margin cash flows from milestones and royalty-based payments.”

— Karen Andersen, sector strategist

Kellogg

- Bear Market Return: 11.50%

- Star Rating: 4 Stars

- Discount: 15%

“Despite Kellogg’s intentions to spin off its North American cereal and plant-based alternative brands from its global snacking operations, our wide moat rating is unchanged. This rating reflects our confidence surrounding Kellogg’s ability to generate returns above its cost of capital (even under a more bearish set of assumptions) over the next two decades, stemming from its intangible assets and cost edge. We think its position as a leading packaged food manufacturer and its arsenal of resources have afforded Kellogg the ability to maintain valuable shelf space for its offerings, even in the cereal aisle, where category dynamics have languished from the onslaught of competition resulting from lower-priced private-label fare, other branded operators, and the encroachment of smaller foes from within the category and other breakfast alternatives.”

“The firm boasts four brands that generate $1 billion or more in annual sales (Pringles, Cheez-It, Frosted Flakes, and Special K) and another five that generate sales of US$500 million-US$1 billion each year (Eggo, Pop-Tarts, Corn Flakes, Rice Krispies, and Nutri-Grain) that help drive traffic into retail outlets. In our view, this position is enhanced by the resources Kellogg maintains to invest in new product launches (spending around 1% of sales, or about US$140 million, on R&D annually over the past three years) and tout those offerings in front of consumers (spending 5%-6% of sales, or approximately $750 million, each year) to drive customer traffic into stores—bolstering the stickiness of its retailer relationships (a pillar of its brand intangible asset moat source).”

— Erin Lash, consumer sector director, equity research

AstraZeneca

- Bear Market Return: 12.59%

- Star Rating: 4 Stars

- Discount: 13%

“AstraZeneca has built its leading presence in the pharma and biotech industry on patent-protected drugs and a developing pipeline that add up to a wide moat. The replenishment of new drugs is setting up industry-leading growth.

“AstraZeneca’s pipeline is emerging as one of the strongest in the drug group, and we think the company is developing several key products that hold blockbuster potential. In particular, the company’s recently launched cancer drugs Tagrisso and Imfinzi are well-positioned based on leading efficacy in hard-to-treat cancers. These drugs should also carry strong pricing power, driving the potential to expand Astra’s margins. Also, Astra is well-positioned in the respiratory and diabetes spaces, but these areas tend to have poor pricing power relative to cancer drugs.”

— Damien Conover, director of equity strategy, healthcare sector